Which Of The Following Is True About Bookkeeping

News Leon

Mar 19, 2025 · 6 min read

Table of Contents

Which of the Following is True About Bookkeeping? A Deep Dive into Accounting Fundamentals

Bookkeeping. The word itself might conjure images of dusty ledgers and meticulous penmanship. While those images hold a grain of historical truth, modern bookkeeping is a dynamic and crucial process for any successful business, regardless of size or industry. Understanding bookkeeping is key to financial health, and this comprehensive guide will delve into its core principles, dispelling common misconceptions and clarifying its vital role in the world of finance.

What is Bookkeeping?

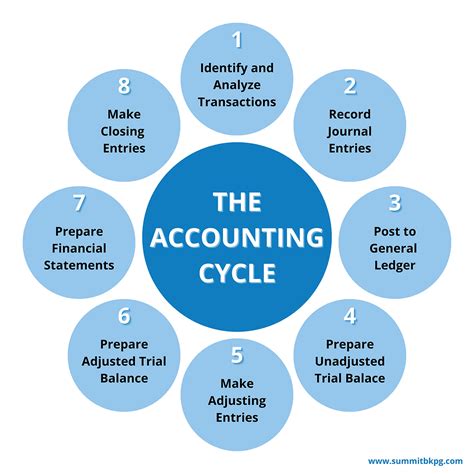

Bookkeeping is the systematic recording of financial transactions. It's the foundation upon which a company's financial statements are built. Think of it as the meticulous record-keeping of a business's financial life, documenting every incoming and outgoing penny. This includes recording sales, purchases, expenses, and payments received. While often conflated with accounting, bookkeeping is a distinct, yet essential, component.

Bookkeeping vs. Accounting: A Key Distinction

Many people use the terms "bookkeeping" and "accounting" interchangeably, but there's a crucial difference. Bookkeeping focuses on the recording of financial data—the day-to-day transactions. Accounting, on the other hand, involves the interpretation and analysis of that data. Accountants use the information gathered by bookkeepers to create financial statements (balance sheets, income statements, cash flow statements), analyze trends, and provide valuable insights for strategic decision-making. Essentially, bookkeepers collect the raw data, while accountants process and interpret it.

Key Aspects of Bookkeeping: A Detailed Look

Effective bookkeeping involves several key aspects that, when implemented correctly, ensure accurate financial reporting and sound financial management.

1. Source Documents: The Foundation of Accurate Records

Every financial transaction must be supported by a source document. These are the primary evidence of a transaction and form the basis of bookkeeping entries. Common source documents include:

- Invoices: Bills issued to clients for goods or services provided.

- Receipts: Proof of payment received.

- Bank statements: Records of all transactions in a business's bank account.

- Credit card statements: Detailed account of credit card transactions.

- Payroll records: Documentation of employee wages and deductions.

- Purchase orders: Formal requests for goods or services.

The accuracy and completeness of source documents are paramount. Missing or inaccurate source documents can lead to errors in the bookkeeping process, resulting in unreliable financial reports.

2. Chart of Accounts: Organizing Financial Data

A chart of accounts is a structured list of all the accounts used by a business to record its financial transactions. It acts as a framework for organizing financial information, ensuring consistency and facilitating accurate reporting. A well-designed chart of accounts categorizes accounts according to their nature (assets, liabilities, equity, revenues, and expenses). A typical chart of accounts might include accounts like:

- Assets: Cash, Accounts Receivable, Inventory, Equipment.

- Liabilities: Accounts Payable, Loans Payable.

- Equity: Owner's Equity, Retained Earnings.

- Revenues: Sales Revenue, Service Revenue.

- Expenses: Rent Expense, Salaries Expense, Utilities Expense.

The chart of accounts ensures that all transactions are categorized appropriately, making it easier to generate financial reports and analyze financial performance.

3. Double-Entry Bookkeeping: Maintaining Balance

Double-entry bookkeeping is a fundamental principle in bookkeeping. Every transaction affects at least two accounts. This ensures that the accounting equation (Assets = Liabilities + Equity) always remains balanced. For example, if a business purchases equipment with cash, the cash account decreases (debit), and the equipment account increases (credit). This system of debits and credits helps detect errors and maintain the integrity of financial records.

4. Journal Entries: Recording Transactions

A journal entry is a formal record of a financial transaction. It includes the date of the transaction, the accounts affected, the debit and credit amounts, and a brief description. Journal entries are chronologically recorded in a general journal, providing a detailed history of all financial activities. Accurate and timely journal entries are crucial for generating reliable financial reports.

5. Ledger: Summarizing Accounts

The ledger is a collection of accounts that summarizes the activity in each account. It shows the beginning balance, all transactions during a period, and the ending balance for each account. The ledger provides a consolidated view of the financial activity for each specific account, allowing for easy tracking and analysis of individual account balances.

6. Trial Balance: Verifying Accuracy

A trial balance is a summary report that lists the balances of all accounts in the ledger. It's used to verify the accuracy of the double-entry bookkeeping system. If the total debits equal the total credits, it suggests that the bookkeeping process has been performed correctly. However, a balanced trial balance does not guarantee the absence of errors, as some errors may not affect the overall balance.

7. Financial Statements: Communicating Financial Performance

Bookkeeping provides the raw data for generating financial statements. These statements communicate a company's financial performance and position to stakeholders, including owners, investors, creditors, and government agencies. Key financial statements include:

- Income Statement: Shows the company's revenues and expenses over a period of time.

- Balance Sheet: Shows the company's assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Shows the movement of cash in and out of the company over a period of time.

Choosing a Bookkeeping Method: Manual vs. Software

Bookkeeping can be done manually using ledgers and journals or with accounting software. Manual bookkeeping is suitable for very small businesses with few transactions, but it's time-consuming and prone to errors. Accounting software offers automation, improved accuracy, and enhanced reporting capabilities. Modern accounting software packages, available at various price points, often integrate with other business tools, streamlining the entire financial process.

The Importance of Accurate Bookkeeping

Accurate bookkeeping is not just a matter of following rules; it’s the lifeblood of a financially healthy business. The consequences of poor bookkeeping can be severe, including:

- Inaccurate Financial Reporting: Leading to poor decision-making and missed opportunities.

- Tax Problems: Incorrect tax filings can result in penalties and legal issues.

- Difficulty Securing Loans: Lenders rely on accurate financial records to assess risk.

- Loss of Investor Confidence: Investors are less likely to invest in a company with questionable financial practices.

- Operational Inefficiencies: Poor bookkeeping can hinder efficient management of resources.

Common Bookkeeping Mistakes to Avoid

Even seasoned bookkeepers can make mistakes. Here are some common errors to watch out for:

- Inconsistent Recording Practices: Maintaining a consistent method of recording transactions is critical for accuracy.

- Ignoring Reconciliations: Regularly reconciling bank and credit card statements is essential to detect errors and discrepancies.

- Failing to Categorize Transactions Correctly: Improper categorization leads to inaccuracies in financial reports.

- Missing Source Documents: Always ensure that every transaction is supported by a source document.

- Lack of Regular Backups: Regular data backups are crucial to protect against data loss.

Conclusion: The Indispensable Role of Bookkeeping

Bookkeeping is not merely a tedious chore; it's the bedrock of sound financial management. From small startups to large corporations, every business relies on accurate bookkeeping to understand its financial health, make informed decisions, and achieve sustainable growth. By understanding the principles of bookkeeping, implementing best practices, and utilizing appropriate tools, businesses can ensure financial stability and pave the way for lasting success. Investing time and resources in accurate bookkeeping is an investment in the future of your business – an investment that will undoubtedly pay significant dividends.

Latest Posts

Latest Posts

-

How Many Valence Electrons Does Cr Have

Mar 19, 2025

-

Area Of An 8 Inch Circle

Mar 19, 2025

-

Which Of The Following Is True Of Iron

Mar 19, 2025

-

Python Check If A String Is A Number

Mar 19, 2025

-

What Is The Length Of Line Segment Pq

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is True About Bookkeeping . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.