Which Of The Following Is Not An Intangible Asset

News Leon

Mar 23, 2025 · 5 min read

Table of Contents

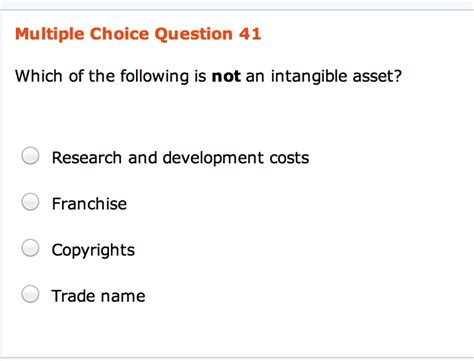

Which of the Following is NOT an Intangible Asset? A Comprehensive Guide

Understanding intangible assets is crucial for businesses of all sizes. These assets, unlike physical property, represent valuable rights and privileges that contribute significantly to a company's profitability and long-term success. However, the line between tangible and intangible assets can sometimes be blurry. This article will delve deep into the definition of intangible assets, explore common examples, and definitively answer the question: which of the following is NOT an intangible asset? We will examine various options and explain why certain items qualify while others do not.

Defining Intangible Assets: A Foundation for Understanding

Intangible assets are non-physical assets that provide future economic benefits to a company. These benefits stem from the asset's inherent value, its legal rights, or its competitive advantage. Key characteristics that define intangible assets include:

- Lack of Physical Substance: You can't touch, see, or feel them. They exist in a more abstract form.

- Future Economic Benefits: They contribute to the company's revenue generation or cost reduction over time.

- Identifiable: They can be separated or sold individually from the business.

- Control: The business must have control over the asset to benefit from it.

This is in contrast to tangible assets, which are physical items like buildings, machinery, and inventory that can be touched and seen.

Common Examples of Intangible Assets

Before we address the core question, let’s review some typical examples of intangible assets to solidify our understanding:

- Patents: Exclusive rights granted to an inventor for a specific invention. They provide a significant competitive advantage.

- Copyrights: Legal rights granted to creators of original works (books, music, software). They protect the intellectual property from unauthorized use.

- Trademarks: Brand names, logos, and symbols that distinguish a company's products or services. They build brand recognition and customer loyalty.

- Trade Secrets: Confidential information that provides a competitive advantage, such as formulas, processes, or designs. These are protected through secrecy rather than formal legal registration.

- Goodwill: The intangible value of a business beyond its identifiable net assets. This often reflects brand reputation, customer loyalty, and strong management teams.

- Brand Recognition: The public awareness and recognition of a brand, often translating to higher sales and pricing power.

- Software: Computer programs and applications that provide functionality and capabilities to users. The value resides in the code and its functionality, not a physical disc or hardware.

- Customer Lists: A valuable asset for businesses that rely on repeat customers or direct sales efforts.

Understanding What is Not an Intangible Asset

Now, let's tackle the central question, focusing on items that are often mistakenly categorized as intangible assets. To illustrate, let’s consider a few scenarios:

Scenario 1: Is a Company’s Building an Intangible Asset?

Answer: No. A company building is a tangible asset. It is a physical structure that can be seen, touched, and assessed physically. While the building might contribute to the company's overall value and provide economic benefits (such as housing operations), it’s fundamentally a tangible property.

Scenario 2: Is Cash an Intangible Asset?

Answer: No. Cash, while not directly used in production, is a current asset, a tangible asset representing readily available funds. It has physical form (even if it's electronic). Intangible assets represent future value, while cash represents immediate value.

Scenario 3: Are Accounts Receivable Intangible Assets?

Answer: No. Accounts receivable are current assets representing the money owed to the company by its customers for goods or services sold on credit. While the money itself isn't physically in hand, the right to collect those funds is a legally enforceable claim – a tangible asset right.

Scenario 4: Is Inventory an Intangible Asset?

Answer: No. Inventory – goods available for sale – is a tangible asset. It has physical form and can be seen, touched, and counted. Its value is directly tied to its physical existence and market demand.

Scenario 5: Are Employee Skills and Knowledge Intangible Assets?

Answer: Partially. While employee skills and knowledge contribute significantly to a company’s value, they are generally not considered identifiable intangible assets in the same way as patents or trademarks. They're difficult to separate from the employees themselves and to quantify their individual value. While their collective expertise may contribute to goodwill, it is not recognized as a distinct intangible asset on the balance sheet. However, some organizations might consider intellectual capital (the combined knowledge and skills of its employees) as a valuable, internal intangible asset. But this is not reported directly on financial statements according to standard accounting practices.

Scenario 6: Is a Company's Reputation an Intangible Asset?

Answer: Yes, in a way. A company’s reputation strongly contributes to its overall value and is often reflected in the concept of goodwill, which is an intangible asset. However, "reputation" itself isn't a discrete, separately identifiable asset that can be easily valued or transferred. It's an element that contributes to the broader intangible asset of goodwill.

The Importance of Accurate Intangible Asset Recognition

Properly identifying and valuing intangible assets is crucial for several reasons:

- Accurate Financial Reporting: Accurate reporting gives stakeholders a clear picture of a company's financial health and value.

- Mergers and Acquisitions: Intangible assets play a vital role in determining the value of a company during mergers and acquisitions.

- Tax Planning: Understanding the tax implications of intangible assets is essential for tax optimization.

- Investment Decisions: Investors use information about intangible assets to assess a company's long-term potential.

Conclusion: Distinguishing Tangible from Intangible

To recap, many items can be easily identified as not intangible assets because they possess a physical presence or represent immediate value rather than future economic benefits. Buildings, cash, accounts receivable, and inventory are all examples of tangible assets. While employee skills and knowledge contribute to a company’s value, they are not usually recognized separately as identifiable intangible assets under generally accepted accounting principles. Understanding this distinction is vital for accurate financial reporting, informed decision-making, and building a robust business strategy. The key to identifying an intangible asset lies in its lack of physical form and its capacity to generate future economic benefits for the owning entity. A thorough understanding of these principles is essential for any business owner, accountant, or investor.

Latest Posts

Latest Posts

-

During Which Of The Following Phases Does Dna Replication Occur

Mar 25, 2025

-

An Atomic Nucleus Has A Mass That Is

Mar 25, 2025

-

What Is The Sum 2 X 2 4 X 2

Mar 25, 2025

-

Select The Correct Iupac Name For The Following Compound

Mar 25, 2025

-

How Many Atoms Are In A Single Molecule Of Water

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not An Intangible Asset . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.