Which Items Influence The Trial Balance Agreement

News Leon

Mar 17, 2025 · 6 min read

Table of Contents

Which Items Influence the Trial Balance Agreement?

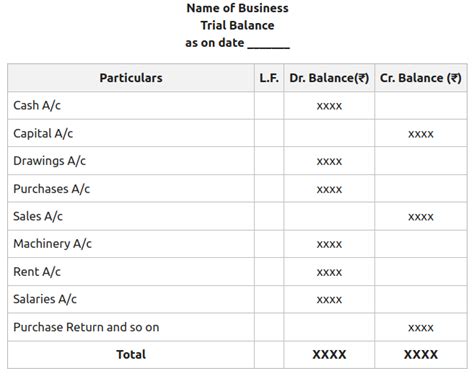

A trial balance is a crucial report in accounting, providing a snapshot of a company's financial position at a specific point in time. It lists all the debit and credit balances from the general ledger, ensuring they are equal. However, a trial balance doesn't guarantee the complete accuracy of the financial records; it only indicates that the debits and credits are in balance. Several factors can influence whether or not a trial balance agrees, and understanding these influences is crucial for maintaining accurate financial records. This comprehensive guide will delve into those influences, exploring both common causes of discrepancies and best practices to ensure agreement.

Understanding the Trial Balance: The Foundation of Financial Reporting

Before we delve into the factors influencing trial balance agreement, let's briefly recap its importance. The trial balance serves as a critical checkpoint in the accounting cycle. It's prepared after all transactions for a given period have been recorded in the general ledger. The fundamental principle behind a trial balance is the double-entry bookkeeping system. Every transaction affects at least two accounts – one debit and one credit. The total debits must always equal the total credits. If they don't, it signals an error somewhere in the recording process.

The Importance of a Balanced Trial Balance:

- Error Detection: A trial balance's primary function is to identify potential errors in the accounting process. While not foolproof, it highlights discrepancies that need further investigation.

- Basis for Financial Statements: A balanced trial balance forms the basis for preparing the financial statements – the income statement, balance sheet, and statement of cash flows. Accurate trial balances are essential for reliable financial reporting.

- Internal Control: Regularly preparing and reviewing trial balances contributes to a robust internal control system, reducing the risk of errors and fraud.

Factors Influencing Trial Balance Agreement: Common Causes of Discrepancies

Several factors can lead to a trial balance disagreement, ranging from simple data entry errors to more complex accounting issues. Let's explore some common culprits:

1. Data Entry Errors: The Most Frequent Culprit

Transposition Errors: These occur when digits are entered in the wrong order (e.g., entering 123 as 132). They are relatively easy to spot when examining individual account balances.

Slide Errors: This involves entering an extra zero or omitting a zero (e.g., entering 1000 as 100 or 100 as 1000). These errors significantly impact the overall balance.

Incorrect Account Codes: Using wrong account numbers during data entry leads to misclassification of transactions, causing imbalances in the trial balance.

Missing Entries: Failure to record a transaction entirely will result in a trial balance disagreement. This requires a thorough review of source documents to identify any missing entries.

2. Errors in Calculation and Posting: Accuracy is Key

Incorrect Calculations: Mathematical errors during the calculation of totals can lead to an imbalance. This requires careful double-checking of all calculations within each transaction and account.

Posting to Wrong Accounts: Incorrect posting of debits and credits to the wrong accounts will result in a trial balance imbalance. This necessitates careful verification of posting details against the source document.

Omission of Posting: Failure to post a transaction to the ledger will result in an imbalance. Thorough checks are crucial to ensure each transaction is posted correctly.

3. Errors in Classifying Transactions: Maintaining Categorical Accuracy

Mismatched Transaction Types: Incorrectly classifying a transaction as revenue instead of expense, or vice versa, will result in trial balance disagreement. Careful attention to the nature of each transaction is crucial.

Uncategorized Transactions: Transactions that aren't properly categorized to specific accounts will create an imbalance. A clear chart of accounts and adherence to accounting standards is crucial.

4. Accounting System Issues: The Role of Technology

Software Glitches: Software malfunctions can sometimes lead to incorrect entries or data loss. Regular software updates and backups are crucial to prevent data-related problems.

System Errors: Occasionally, systemic issues within the accounting software can cause discrepancies. It's always prudent to investigate software-related issues when discrepancies arise.

5. Errors in Adjusting Entries: Year-End Adjustments

Incorrect Adjusting Entries: Failure to record proper adjusting entries at the end of an accounting period (like depreciation, accruals, and prepayments) can lead to a trial balance disagreement.

Omission of Adjusting Entries: Failing to record necessary adjusting entries altogether will cause a trial balance to be off. Thorough review and preparation of adjusting entries are essential.

Strategies to Ensure Trial Balance Agreement

Maintaining a balanced trial balance isn't just about fixing discrepancies after they arise; it's about implementing preventative measures. Here are some key strategies:

1. Strong Internal Controls: The First Line of Defense

Establishing strong internal controls over the accounting process is paramount. This includes segregation of duties, authorization of transactions, regular reconciliation of accounts, and independent verification of financial records.

2. Regular Reconciliation: Timely Detection of Errors

Regularly reconciling bank statements and other accounts with the general ledger helps detect errors early, allowing for prompt correction.

3. Double-Checking Entries: Human Oversight is Vital

Double-checking all entries for accuracy, both in terms of amount and account classification, is critical. This may involve a peer review process.

4. Using Accounting Software Effectively: Leverage Technology

Leveraging accounting software effectively, including using appropriate validation rules and error checks, can significantly reduce errors.

5. Thorough Training for Staff: Competence is Key

Providing adequate training to accounting staff on proper recording techniques, including the use of accounting software, is crucial.

6. Documentation and Traceability: A Clear Audit Trail

Maintaining detailed documentation of all transactions, including supporting evidence, facilitates error detection and audit trail creation.

7. Regular Reviews and Audits: External Verification

Regular internal reviews and periodic external audits help identify weaknesses in internal controls and potential errors.

Beyond the Trial Balance: Accuracy of Financial Reporting

It's crucial to understand that a balanced trial balance doesn't necessarily mean that the financial statements are entirely accurate. While it detects imbalances, it doesn't identify all possible errors. For instance, errors of omission or errors where debits and credits are equally misstated will not be picked up by the trial balance. Further checks and analyses are essential to ensure the reliability and integrity of financial reporting.

Beyond the numbers, consider these:

- Accuracy of underlying data: The source documents must be accurate and reliable.

- Correct application of accounting principles: Adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) is crucial.

- Proper classification of accounts: Accounts must be properly categorized within the chart of accounts.

Conclusion: The Ongoing Pursuit of Accuracy

Ensuring trial balance agreement is a continuous process. It requires careful attention to detail, strong internal controls, and a commitment to accuracy throughout the accounting cycle. While a balanced trial balance offers confidence, it doesn't eliminate the need for ongoing vigilance. By implementing the strategies outlined above, businesses can significantly improve the accuracy of their financial records and create a strong foundation for sound financial decision-making. Remember, the trial balance is a tool; its effectiveness hinges on the diligence and competence of those who use it. The pursuit of accuracy is an ongoing journey, demanding constant vigilance and attention to detail.

Latest Posts

Latest Posts

-

Sodium Bicarbonate And Acetic Acid Reaction

Mar 17, 2025

-

What Are The Determinants Of Supply

Mar 17, 2025

-

What Percent Is 48 Out Of 60

Mar 17, 2025

-

Which Of The Following Is Are True About Natural Selection

Mar 17, 2025

-

Boiling Water Physical Or Chemical Change

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Which Items Influence The Trial Balance Agreement . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.