Opportunity Cost Occurs Because Of A Producer's Need To

News Leon

Mar 21, 2025 · 6 min read

Table of Contents

- Opportunity Cost Occurs Because Of A Producer's Need To

- Table of Contents

- Opportunity Cost: A Producer's Imperative

- Understanding the Producer's Dilemma: Scarcity and Choice

- The Invisible Hand of Opportunity Cost

- Types of Opportunity Costs: Explicit and Implicit

- Explicit Costs: The Tangible Trade-offs

- Implicit Costs: The Hidden Sacrifices

- The Producer's Need to Maximize Profit: The Role of Opportunity Cost

- Marginal Analysis: Optimizing Production Decisions

- Impact of Opportunity Cost on Producer Decisions

- Production Techniques and Technology Adoption

- Input Mix Decisions

- Product Diversification and Specialization

- Investment Decisions

- Opportunity Cost in a Dynamic Market

- Technological Change

- Market Fluctuations

- Globalization and International Trade

- Conclusion: Embracing Opportunity Cost for Sustainable Growth

- Latest Posts

- Latest Posts

- Related Post

Opportunity Cost: A Producer's Imperative

Opportunity cost, a fundamental concept in economics, isn't merely an academic exercise. It's the unavoidable reality that drives every producer's decision, large or small. It stems from the producer's inherent need to allocate scarce resources effectively to maximize output and profits within a constrained environment. This article delves deep into the intricacies of opportunity cost, exploring how a producer's need for resource allocation dictates its presence and impact on production choices, market dynamics, and ultimately, economic growth.

Understanding the Producer's Dilemma: Scarcity and Choice

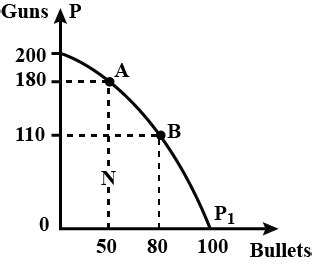

At its core, opportunity cost arises from the fundamental economic problem of scarcity. Producers, whether they are multinational corporations or small family farms, operate with limited resources: capital, labor, land, and raw materials. These resources are finite, meaning they cannot simultaneously be used to produce everything a producer might desire. This scarcity forces producers to make choices, to allocate their limited resources to the production of certain goods and services while foregoing others. This forgone opportunity represents the opportunity cost.

The Invisible Hand of Opportunity Cost

Imagine a farmer with a limited amount of fertile land. They can choose to plant wheat or corn. If they decide to plant wheat, the opportunity cost is the potential profit they could have earned from growing corn on that same land. This seemingly simple example highlights the pervasive nature of opportunity cost. Every decision involves a trade-off, a conscious or unconscious weighing of alternatives. The unseen hand of opportunity cost guides every production decision, shaping the landscape of the market.

Types of Opportunity Costs: Explicit and Implicit

Opportunity costs are not always readily apparent. They can be categorized into explicit and implicit costs:

Explicit Costs: The Tangible Trade-offs

Explicit costs are the direct, monetary payments made for the use of resources. These are the easily identifiable costs associated with production, such as wages paid to employees, rent for factory space, and the cost of raw materials. These are tangible costs that show up on a company's financial statements. While they represent a direct outflow of funds, understanding them is crucial in calculating the overall profitability of a venture.

Implicit Costs: The Hidden Sacrifices

Implicit costs, on the other hand, are the forgone opportunities that don't involve a direct monetary payment. They represent the value of the resources the producer could have used for alternative purposes. For example, the farmer who chooses to plant wheat could have used their land to start a small orchard. The potential profit from this orchard represents an implicit cost of choosing to grow wheat. These are less visible but just as critical in understanding the true cost of a decision.

Example: Let's say a talented software engineer quits their $100,000-a-year job to start their own company. Their explicit costs include office rent, marketing expenses, and salaries for employees. However, their implicit cost is the $100,000 salary they are no longer earning. This implicit cost is a significant factor in evaluating the success of their entrepreneurial venture.

The Producer's Need to Maximize Profit: The Role of Opportunity Cost

The primary goal of most producers is profit maximization. To achieve this, they must carefully consider opportunity costs in every decision. By evaluating the potential returns from different production choices, considering both explicit and implicit costs, producers can identify the combination of outputs that yields the highest profit.

Marginal Analysis: Optimizing Production Decisions

Producers often use marginal analysis to determine the optimal allocation of resources. Marginal analysis involves comparing the additional benefit (marginal benefit) of producing one more unit of a good or service to the additional cost (marginal cost) of producing that unit. Opportunity cost is intrinsic to marginal cost, as it represents the value of the resources that could have been used to produce something else. Producers will continue to produce as long as the marginal benefit exceeds the marginal cost, including the opportunity cost.

Impact of Opportunity Cost on Producer Decisions

The influence of opportunity cost extends across various facets of a producer's decisions:

Production Techniques and Technology Adoption

Opportunity cost significantly affects the choice of production techniques. If a new technology reduces labor costs but increases capital costs, the producer must weigh the cost savings from reduced labor against the cost of acquiring and maintaining the new technology. The choice depends on which option offers the greater net benefit, considering all explicit and implicit costs.

Input Mix Decisions

Producers must carefully choose the optimal mix of inputs (labor, capital, raw materials) for their production process. Opportunity cost dictates that producers should use the combination of inputs that produces the desired output at the lowest possible cost, considering the forgone opportunities associated with each input choice.

Product Diversification and Specialization

Opportunity cost influences a producer's decision to diversify their product line or specialize in a particular product. Diversification spreads risk but may result in lower efficiency than specialization. The choice depends on the relative opportunity costs associated with each strategy.

Investment Decisions

Opportunity cost plays a critical role in investment decisions. Producers must consider the potential return on investment (ROI) for different projects, weighing the expected profits against the forgone opportunities associated with investing the capital elsewhere. This involves comparing the potential returns of one investment against the potential returns of other available investment options.

Opportunity Cost in a Dynamic Market

Opportunity cost isn't static; it changes as market conditions evolve. Shifts in supply and demand, technological advancements, and changes in consumer preferences all influence the relative opportunity costs associated with different production choices.

Technological Change

Technological advancements can dramatically alter opportunity costs. The introduction of new, more efficient technologies may reduce the cost of production for certain goods while making others relatively more expensive. Producers must adapt to these changes by adjusting their production techniques and product offerings to maximize profits in the face of shifting opportunity costs.

Market Fluctuations

Market fluctuations in prices of raw materials, labor, or finished goods directly influence opportunity costs. An increase in the price of a raw material, for instance, raises the cost of production, changing the relative attractiveness of producing that good compared to other goods.

Globalization and International Trade

Globalization and international trade also impact opportunity costs. Producers can now source inputs from around the world, expanding their choices and potentially reducing costs. However, they must also consider the opportunity costs associated with sourcing inputs internationally, such as transportation costs, tariffs, and potential supply chain disruptions.

Conclusion: Embracing Opportunity Cost for Sustainable Growth

Opportunity cost is an inescapable element of production. It’s not just a theoretical concept; it's a fundamental driver of economic decision-making. By understanding and strategically managing opportunity costs, producers can make informed choices about resource allocation, production techniques, product diversification, and investment strategies. This proactive approach is crucial for maximizing profitability, fostering innovation, and ultimately, achieving sustainable growth in a competitive market. The producer who diligently assesses and minimizes opportunity cost possesses a significant advantage in the ever-evolving economic landscape. Ignoring opportunity cost is akin to navigating with a blindfold; understanding it is the key to navigating the market successfully. The constant evaluation and recalibration of opportunity cost ensure resilience and adaptability, setting the stage for long-term prosperity.

Latest Posts

Latest Posts

-

Two More Than 4 Times A Number Is 18

Mar 24, 2025

-

What Is The Bond Order Of Co

Mar 24, 2025

-

Lactose Is The Substrate Of Which Enzyme

Mar 24, 2025

-

In The Figure A Frictionless Roller Coaster Car Of Mass

Mar 24, 2025

-

Reaction Of Acetic Acid And Ethanol

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Opportunity Cost Occurs Because Of A Producer's Need To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.