In Perfectly Competitive Long Run Equilibrium

News Leon

Mar 18, 2025 · 6 min read

Table of Contents

In Perfectly Competitive Long-Run Equilibrium: A Deep Dive

The concept of perfect competition is a cornerstone of microeconomic theory, providing a benchmark against which real-world market structures can be compared. While perfectly competitive markets are rarely, if ever, observed in their pure form, understanding their long-run equilibrium is crucial for grasping fundamental economic principles and analyzing market dynamics. This article will delve into the characteristics of perfectly competitive markets, explain the journey towards long-run equilibrium, and explore its implications.

Characteristics of Perfect Competition

Before examining long-run equilibrium, it's essential to understand the defining characteristics of perfect competition:

-

Many buyers and sellers: A large number of buyers and sellers participate in the market, ensuring no single participant can influence the market price. Each firm is too small to affect the overall supply.

-

Homogenous products: All firms produce identical products, making them perfect substitutes for one another. Consumers are indifferent between the products of different firms.

-

Free entry and exit: Firms can easily enter or exit the market without facing significant barriers, such as high start-up costs or government regulations. This ensures that the number of firms adjusts to market conditions.

-

Perfect information: All buyers and sellers have complete and equal access to information regarding prices, technology, and quality of products. This eliminates information asymmetry.

-

No externalities: The production or consumption of the good does not impose costs or benefits on third parties. The market price fully reflects the social cost and benefit.

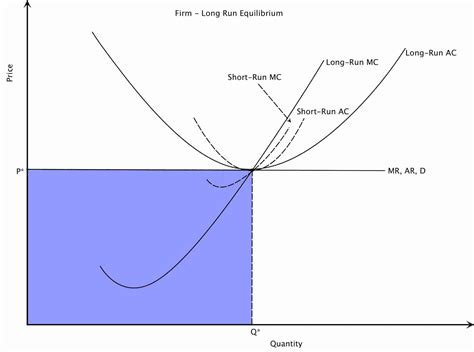

The Short Run vs. The Long Run in Perfect Competition

Understanding the difference between the short run and the long run is crucial for analyzing market equilibrium. In the short run, at least one input (typically capital) is fixed, while others (like labor) are variable. Firms can adjust their output by changing variable inputs but cannot alter their fixed inputs. This leads to potential short-run profits or losses.

In the long run, all inputs are variable. Firms can adjust their scale of operation, enter, or exit the market freely. This flexibility leads to a different equilibrium outcome compared to the short run.

The Path to Long-Run Equilibrium

Let's trace the journey to long-run equilibrium in a perfectly competitive market:

-

Short-Run Profits: Suppose the market starts with a price that allows firms to earn economic profits. These profits attract new firms to enter the market.

-

Increased Supply: The entry of new firms increases the market supply, shifting the supply curve to the right.

-

Price Decrease: The increased supply leads to a decrease in the market price. This reduces the profits of existing firms and discourages further entry.

-

Short-Run Losses: Conversely, if the market price is initially below the average total cost (ATC), firms experience economic losses. This encourages some firms to exit the market.

-

Decreased Supply: The exit of firms reduces the market supply, shifting the supply curve to the left.

-

Price Increase: The reduced supply leads to an increase in the market price. This reduces the losses of remaining firms and discourages further exit.

This process of entry and exit continues until the market reaches long-run equilibrium.

Long-Run Equilibrium: A State of Zero Economic Profit

The long-run equilibrium in a perfectly competitive market is characterized by the following:

-

Price equals Minimum Average Total Cost (ATC): The market price settles at a point where it equals the minimum point of the average total cost curve. This means firms are producing at the most efficient scale. Any deviation from this point would lead to either profits (attracting entry) or losses (encouraging exit).

-

Zero Economic Profit: Firms earn zero economic profit in the long run. This means that their revenue covers all their explicit and implicit costs (including the opportunity cost of capital). While accounting profits might be positive, they only reflect a normal return on investment and do not represent above-normal gains.

-

Optimal Allocation of Resources: The market produces the socially optimal quantity of the good, where the marginal cost (MC) equals the market price. This is Pareto efficient; no one can be made better off without making someone else worse off.

The Role of Technology and Demand Shifts

The long-run equilibrium is not static. Changes in technology or demand can disrupt the equilibrium and set off another round of entry and exit.

-

Technological Advancements: If a technological advancement reduces the cost of production for all firms, the ATC curve shifts downwards. This leads to a temporary increase in profits, attracting new firms, and ultimately settling at a new long-run equilibrium with a lower price and potentially higher quantity.

-

Changes in Demand: An increase in demand shifts the demand curve to the right. This leads to a temporary increase in price and profits. The higher profits attract new firms, increasing supply and eventually bringing the price back down to the minimum ATC, but at a higher quantity than before. A decrease in demand would have the opposite effect.

Implications of Long-Run Equilibrium in Perfectly Competitive Markets

The long-run equilibrium in perfectly competitive markets has several significant implications:

-

Efficiency: The market achieves allocative efficiency (price equals marginal cost) and productive efficiency (production at minimum average total cost). Resources are allocated to their most valuable uses.

-

Innovation: While firms earn zero economic profit in the long run, the pressure of competition incentivizes innovation and efficiency improvements to gain a temporary competitive advantage. This drives technological progress.

-

Consumer Surplus: Consumers benefit from low prices and a wide variety of goods and services. Competition ensures that consumers get the most value for their money.

-

Dynamic Adjustment: The market constantly adjusts to changing conditions, ensuring that resources are always allocated efficiently. The process of entry and exit provides a mechanism for adapting to changes in technology, consumer preferences, and market conditions.

Deviations from Perfect Competition

It is important to remember that perfect competition is a theoretical model. Real-world markets rarely, if ever, perfectly fit this model. Many markets exhibit features of imperfect competition, such as:

- Monopoly: A single firm controls the market.

- Oligopoly: A few firms dominate the market.

- Monopolistic competition: Many firms offer differentiated products.

These deviations from perfect competition can lead to inefficiencies, higher prices, and less consumer choice. Understanding the characteristics and consequences of perfect competition provides a valuable benchmark for analyzing and understanding these more realistic market structures.

Conclusion

The long-run equilibrium in a perfectly competitive market is a dynamic state characterized by zero economic profit, efficient resource allocation, and continuous adjustment to changing conditions. While a perfectly competitive market is an idealization, its theoretical implications offer crucial insights into market behavior and the forces that drive efficiency and innovation. Studying this model provides a foundational understanding of microeconomic principles and how markets function under ideal conditions, offering a baseline for understanding more complex market structures in the real world. By analyzing the journey to this equilibrium, we gain a deeper appreciation for the interplay of supply, demand, and firm behavior in determining market outcomes. The concepts explored here – from the characteristics of perfect competition to the impact of technological change – are essential tools for understanding economic dynamics and policy implications.

Latest Posts

Latest Posts

-

Find The Surface Area Of The Square Pyramid Shown Below

Mar 19, 2025

-

A Cell In A Hypertonic Solution Will

Mar 19, 2025

-

What Is 25 Percent Of 25

Mar 19, 2025

-

How Do You Make A Magnet At Home

Mar 19, 2025

-

A Decrease In Demand And An Increase In Supply Will

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about In Perfectly Competitive Long Run Equilibrium . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.