Capital Formation Is The Process Through Which

News Leon

Mar 30, 2025 · 5 min read

Table of Contents

Capital Formation: The Engine of Economic Growth

Capital formation, the process through which savings are transformed into investment, is the bedrock of economic growth and development. It's the engine that drives progress, fueling technological advancements, infrastructure development, and improved living standards. Understanding this process is crucial for policymakers, businesses, and individuals alike, as it directly impacts the overall health and prosperity of an economy. This comprehensive article delves deep into the multifaceted nature of capital formation, exploring its key components, influencing factors, challenges, and its critical role in shaping a nation's future.

What is Capital Formation?

Capital formation, also known as investment, represents the net increase in a country's stock of capital goods. These goods, unlike consumer goods, are not consumed directly but are used to produce other goods and services. They include:

-

Physical Capital: This encompasses tangible assets like machinery, equipment, buildings, infrastructure (roads, bridges, power plants), and transportation networks. These are essential for increasing productivity and efficiency in various sectors.

-

Human Capital: This less tangible form of capital represents the knowledge, skills, education, and experience of the workforce. Investing in human capital through education and training is crucial for a nation's long-term growth potential.

-

Financial Capital: This refers to the funds available for investment, sourced from savings, loans, and other financial instruments. Efficient financial markets are essential for channeling these funds to productive investments.

-

Intellectual Capital: This encompasses intangible assets like patents, copyrights, trademarks, and brand recognition. It plays a vital role in innovation and technological advancements.

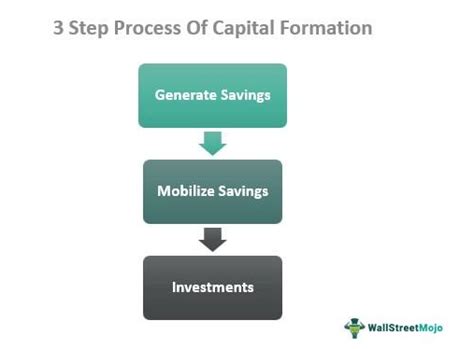

The Process of Capital Formation: A Step-by-Step Breakdown

The process of capital formation involves several interconnected steps:

-

Savings: This is the foundational element. Individuals, businesses, and governments must save a portion of their income to provide the funds for investment. A higher savings rate generally leads to greater capital formation. Factors influencing savings include income levels, interest rates, and consumer confidence.

-

Mobilization of Savings: Savings must be effectively channeled into investment opportunities. This often involves financial intermediaries like banks, insurance companies, and investment firms. These institutions collect savings from individuals and businesses and allocate them to investment projects.

-

Investment: This is the actual expenditure on capital goods. Businesses invest in new equipment, factories, and technologies to increase production capacity. Governments invest in infrastructure projects, boosting overall productivity.

-

Capital Accumulation: The result of successful investment is an increase in the stock of capital goods. This accumulation leads to higher productivity, improved efficiency, and ultimately, economic growth.

Factors Influencing Capital Formation

Several factors significantly influence the rate of capital formation in an economy:

1. Level of Income: Higher per capita income generally leads to higher savings, providing more funds for investment. A prosperous economy provides a fertile ground for capital formation.

2. Interest Rates: Low interest rates incentivize borrowing for investment purposes, boosting capital formation. Conversely, high interest rates can discourage investment, hindering the process.

3. Government Policies: Government plays a crucial role. Tax incentives for investment, infrastructure spending, and policies promoting entrepreneurship can significantly impact capital formation. Conversely, high taxes and excessive regulation can stifle investment.

4. Technological Progress: Technological advancements increase productivity and create new investment opportunities, stimulating capital formation. Innovation and adoption of new technologies are key drivers of economic progress.

5. Political Stability and Security: A stable political environment and secure property rights are essential for attracting both domestic and foreign investment. Uncertainty and political instability discourage investment, hindering capital formation.

6. Infrastructure Development: Adequate infrastructure, including transportation, communication, and energy networks, is crucial for facilitating investment and supporting economic activities. Investment in infrastructure acts as a catalyst for further capital formation.

7. Education and Human Capital: A well-educated and skilled workforce is essential for productivity enhancement. Investment in education and training improves the quality of human capital, directly contributing to higher economic growth and capital formation.

8. Foreign Direct Investment (FDI): FDI plays a vital role in supplementing domestic investment, particularly in developing economies. Attracting foreign investment requires a conducive business environment and supportive government policies.

9. Institutional Framework: A strong and transparent institutional framework, including an efficient legal system, robust regulatory environment, and low levels of corruption, is crucial for fostering trust and encouraging investment.

Challenges to Capital Formation

Despite its importance, several challenges can hinder capital formation:

1. Low Savings Rate: In many developing economies, low per capita income results in low savings, limiting the funds available for investment.

2. Inefficient Financial Markets: Poorly functioning financial markets may not effectively channel savings to productive investment projects. This leads to a misallocation of resources and reduced investment.

3. Lack of Access to Credit: Many small and medium-sized enterprises (SMEs) struggle to access credit, limiting their ability to invest and grow.

4. Macroeconomic Instability: High inflation, fluctuating exchange rates, and political instability can discourage investment and hinder capital formation.

5. Inadequate Infrastructure: A lack of adequate infrastructure can increase the cost of doing business and reduce the attractiveness of investment opportunities.

6. Corruption and Lack of Transparency: Corruption diverts resources away from productive investments, hindering economic growth and capital formation.

7. Skill Gaps: Shortages of skilled labor can limit the effectiveness of investment in physical capital, reducing overall productivity gains.

8. Regulatory Barriers: Excessive regulations and bureaucratic hurdles can discourage investment and make it difficult to start and operate businesses.

Capital Formation and Economic Growth: A Symbiotic Relationship

The relationship between capital formation and economic growth is deeply intertwined and mutually reinforcing. Higher rates of capital formation lead to increased productivity, technological advancements, and improved living standards. This, in turn, fuels further savings and investment, creating a virtuous cycle of economic growth. Conversely, a lack of capital formation can lead to stagnation and underdevelopment.

Conclusion: Fostering Capital Formation for a Brighter Future

Capital formation is not merely an economic concept; it's the engine that propels societies forward. By understanding the process, its influencing factors, and the challenges it faces, policymakers and individuals can work together to create an environment conducive to robust capital formation. Policies focused on promoting savings, improving financial market efficiency, investing in education and infrastructure, and fostering a stable and transparent business environment are crucial for achieving sustained economic growth and improving the lives of citizens. The future prosperity of nations hinges on effectively harnessing the power of capital formation. The focus should be on creating a dynamic and inclusive environment where savings are efficiently channeled into productive investment, driving innovation, creating jobs, and ultimately building a more prosperous and equitable future for all.

Latest Posts

Latest Posts

-

Does Accumulated Depreciation Have A Credit Balance

Apr 01, 2025

-

What Element Has 4 Protons And 5 Neutrons

Apr 01, 2025

-

Why Does Radius Decrease Across A Period

Apr 01, 2025

-

The Krebs Cycle Takes Place In

Apr 01, 2025

-

What Is The Following Sum In Simplest Form

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Capital Formation Is The Process Through Which . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.