Does Accumulated Depreciation Have A Credit Balance

News Leon

Apr 01, 2025 · 5 min read

Table of Contents

Does Accumulated Depreciation Have a Credit Balance? A Comprehensive Guide

Accumulated depreciation, a crucial concept in accounting, often leaves many individuals and businesses puzzled. One common question revolves around its balance: Does accumulated depreciation have a credit balance? The short answer is no, accumulated depreciation typically has a debit balance. However, understanding why requires delving into the fundamental principles of accounting and the nature of depreciation itself. This comprehensive guide will illuminate this concept, explore related accounting principles, and offer practical examples to solidify your understanding.

Understanding Depreciation and its Impact on the Balance Sheet

Before we address the balance of accumulated depreciation, let's establish a firm understanding of depreciation itself. Depreciation reflects the systematic allocation of an asset's cost over its useful life. It acknowledges that assets, like machinery, buildings, or vehicles, lose value over time due to wear and tear, obsolescence, or other factors. This doesn't represent the actual cash outflow; rather, it's an accounting method to accurately reflect the asset's declining value on the balance sheet.

Several methods exist for calculating depreciation, including:

- Straight-line depreciation: This is the simplest method, allocating an equal amount of depreciation expense each year.

- Declining balance depreciation: This method accelerates depreciation, recognizing higher expenses in the early years of an asset's life.

- Units of production depreciation: This method ties depreciation expense to the actual use of the asset, resulting in variable depreciation expense depending on usage.

Regardless of the chosen method, the core principle remains: depreciation reduces the asset's book value over time.

The Accounting Equation and its Relation to Depreciation

The fundamental accounting equation—Assets = Liabilities + Equity—underpins all accounting transactions. Depreciation affects this equation indirectly. As an asset depreciates, its book value decreases. This decrease isn't represented by reducing the asset's original cost directly. Instead, a contra-asset account, called accumulated depreciation, is used.

This is where the crucial distinction lies. Accumulated depreciation is not a separate asset; it's a contra-asset account that reduces the value of the related asset. Contra-accounts have opposite balances to their corresponding accounts. Since assets typically have debit balances, their contra-accounts, like accumulated depreciation, possess credit balances.

Think of it like this: you have a machine initially valued at $10,000 (debit balance in the asset account). After three years, accumulated depreciation reaches $3,000. The net book value of the machine is now $7,000 ($10,000 - $3,000). This $3,000 is recorded as a credit in the accumulated depreciation account. The $7,000 net book value is what actually appears on the balance sheet. The original cost remains on the balance sheet but is offset by the accumulated depreciation.

Why Accumulated Depreciation Has a Credit Balance (Despite the Common Misconception)

The common misconception that accumulated depreciation has a debit balance stems from a misunderstanding of the nature of contra-accounts. While depreciation expense is debited (increasing expenses and reducing net income), the accumulated depreciation account itself, being a contra-asset account, is credited.

Here's a breakdown:

- Depreciation Expense: This is an expense account, increasing expenses with a debit.

- Accumulated Depreciation: This is a contra-asset account, reducing the asset's value with a credit.

The two are related but distinct. Depreciation expense shows the depreciation for a specific period, while accumulated depreciation reflects the cumulative depreciation since the asset's acquisition.

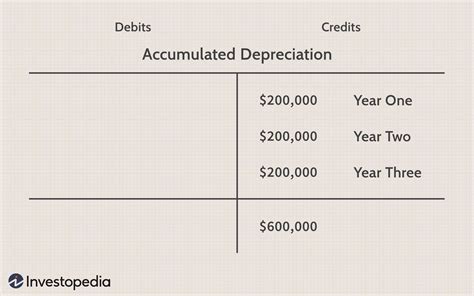

Practical Example: Illustrating Accumulated Depreciation

Let's illustrate with a numerical example:

A company purchases a machine for $20,000 on January 1, 2024, with an estimated useful life of 5 years and no salvage value. Using the straight-line method, the annual depreciation expense is $4,000 ($20,000 / 5 years).

Here's how the accounts will look at the end of each year:

Year 1 (2024):

- Debit: Depreciation Expense - $4,000

- Credit: Accumulated Depreciation - $4,000

Year 2 (2025):

- Debit: Depreciation Expense - $4,000

- Credit: Accumulated Depreciation - $4,000

Year 3 (2026):

- Debit: Depreciation Expense - $4,000

- Credit: Accumulated Depreciation - $4,000

Year 4 (2027):

- Debit: Depreciation Expense - $4,000

- Credit: Accumulated Depreciation - $4,000

Year 5 (2028):

- Debit: Depreciation Expense - $4,000

- Credit: Accumulated Depreciation - $4,000

By the end of Year 5, the accumulated depreciation balance will be $20,000 (a credit balance), completely offsetting the original cost of the machine. The net book value of the machine will be zero.

Impact on the Balance Sheet and Income Statement

The accumulated depreciation balance directly impacts both the balance sheet and income statement.

- Balance Sheet: It reduces the value of the asset reported on the balance sheet. The asset is presented at its net book value (original cost less accumulated depreciation).

- Income Statement: Depreciation expense, the annual portion of accumulated depreciation, reduces the company's net income each year.

Addressing Potential Scenarios and Clarifications

Scenario 1: Disposal of an Asset: When an asset is sold, the accumulated depreciation account is debited, and the asset account is credited. The difference between the sale price and the net book value is recorded as a gain or loss on the sale.

Scenario 2: Changes in Depreciation Estimates: If the useful life or salvage value of an asset is revised, the depreciation expense for future periods is adjusted. This adjustment may require a recalculation of the accumulated depreciation balance.

Scenario 3: Errors in Depreciation Calculation: If errors are identified in previous depreciation calculations, correcting entries are necessary to rectify the accumulated depreciation balance. This would involve adjusting the account to accurately reflect the true depreciation amount.

Conclusion: Understanding the Credit Balance in Accumulated Depreciation

In conclusion, while the terminology might seem counterintuitive at first, accumulated depreciation does indeed have a credit balance. This is due to its nature as a contra-asset account that reduces the value of its associated asset. Understanding this distinction is vital for accurately preparing financial statements and interpreting a company's financial health. By grasping the principles explained here, you can navigate the complexities of accumulated depreciation with confidence. Remember to always consult with a qualified accountant or financial professional for specific accounting advice tailored to your circumstances.

Latest Posts

Latest Posts

-

Greatest Common Factor Of 8 And 36

Apr 02, 2025

-

In Rna Adenine Always Pairs With

Apr 02, 2025

-

The Diaphragm Separates The Thoracic Cavity From The

Apr 02, 2025

-

Where Does The Majority Of Fat Digestion Take Place

Apr 02, 2025

-

Angular Distance North Or South Of The Equator

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Does Accumulated Depreciation Have A Credit Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.