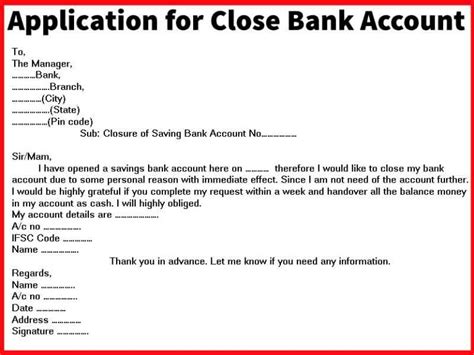

Application To Close The Bank Account

News Leon

Mar 27, 2025 · 6 min read

Table of Contents

How to Close a Bank Account: A Comprehensive Guide

Closing a bank account might seem like a simple task, but navigating the process effectively requires understanding various factors and procedures. This comprehensive guide will walk you through the entire process, from preparing your documents to ensuring a smooth and complete closure, minimizing potential issues and maximizing your financial security.

Understanding Why You Might Need to Close a Bank Account

Before diving into the mechanics of closing your account, let's explore the common reasons people choose to close their bank accounts. Understanding your motivation can help you prepare more effectively.

Common Reasons for Closing a Bank Account:

- Moving to a new bank: This is perhaps the most frequent reason. Switching banks often involves opening a new account and subsequently closing the old one. This allows you to consolidate your finances and potentially benefit from better rates, services, or location.

- Unnecessary fees: Excessive monthly maintenance fees, overdraft charges, or other hidden costs can make maintaining an account financially unsustainable. Switching to a bank with a more favorable fee structure or a fee-free account is a sensible solution.

- Poor customer service: Frustrating experiences with customer service, long wait times, or unhelpful staff can lead to a desire to switch banks. Your banking experience should be positive and efficient.

- Consolidation of accounts: Managing multiple bank accounts can be cumbersome. Closing unnecessary accounts simplifies your finances and reduces the risk of oversight.

- Account inactivity: If you haven't used an account in a while and anticipate no future use, closing it prevents accumulating unnecessary fees or potential security risks.

- Fraud or security concerns: If you suspect fraudulent activity on your account, immediate closure is crucial to prevent further losses. Report the incident to the bank and law enforcement immediately.

- Change of circumstances: Life changes like moving, starting a business, or retirement may necessitate switching banks to find services more suitable to your new situation.

Preparing to Close Your Bank Account: A Step-by-Step Guide

Once you've decided to close your account, careful preparation is key to a smooth transition.

Step 1: Check Your Account Balance and Outstanding Transactions

Before initiating the closure process, ensure you have a clear understanding of your account balance. Pay close attention to outstanding checks, pending transactions, and any scheduled automatic payments. Address these issues beforehand to avoid potential complications. Clear any outstanding debts or overdrafts.

Step 2: Gather Necessary Documents and Information

You'll typically need specific documentation to officially close your account. These may include:

- Valid Photo Identification: This is crucial for verification purposes. A driver's license, passport, or state-issued ID is generally accepted.

- Account Number: Knowing your account number will expedite the process.

- Social Security Number (SSN) or Tax Identification Number (TIN): This is needed for verification and tax reporting purposes.

- Checkbook or recent bank statements: These provide evidence of your account ownership and transaction history.

- Information on Automatic Payments: Make arrangements to update the details for all automatic payments, such as subscriptions or bill payments, to reflect your new account information.

- Direct Deposit Information: If you receive direct deposits to the account being closed, you'll need to provide updated banking information to your employer or other payers.

Step 3: Understanding the Closure Process and Potential Fees

Different banks have varying procedures for closing accounts. Some banks may allow you to close the account online, while others require an in-person visit. Inquire about any potential fees associated with account closure; some banks charge a fee for closing an account. Confirm the process with your bank to avoid unexpected charges or delays.

Step 4: Inform Relevant Parties

Ensure you inform relevant parties about your account closure. This includes:

- Employers: If you receive direct deposits, update your payroll information.

- Billers: Change your payment information for all recurring bills.

- Insurance companies: Update your banking information on file.

- Loan providers: Ensure they have your updated banking details for loan payments.

Step 5: Request Account Closure in Person or Online

Most banks offer both in-person and online methods for account closure. In-person closure provides an opportunity to ask questions and confirm the process with a bank representative. Online closure is often convenient but may require more self-sufficiency in navigating the bank's online systems. Follow your bank's specific instructions meticulously.

Step 6: Obtain Confirmation of Account Closure

Once the account is closed, obtain written confirmation from the bank. This document serves as proof that the account has been officially closed, protecting you from future liabilities associated with the account. This written confirmation often includes the date of closure.

Step 7: Monitor Your Account and Credit Report

After closing the account, monitor your account activity and credit report for any unusual activity. Any unexpected charges or discrepancies should be immediately reported to the bank and relevant authorities. Regularly checking your credit report can help ensure your financial security.

Potential Challenges and How to Address Them

While closing a bank account is usually straightforward, certain challenges might arise.

Outstanding Checks or Pending Transactions:

Ensure all outstanding checks have been cashed and all pending transactions have cleared before closing the account. Otherwise, funds might become inaccessible.

Automatic Payments and Direct Deposits:

Update all automatic payments and direct deposits well in advance of closing the account to avoid interruptions in payments or missed deposits.

Unforeseen Fees:

Inquire about potential fees associated with account closure. Some banks charge a fee for closing an account early or for specific circumstances.

Difficulties Accessing Funds:

Ensure all funds are readily accessible before initiating the closure process. You should receive the remaining funds via check or transfer to your new account.

Credit Reporting Issues:

Closing an account might affect your credit score, especially if you have a long history with the bank. Consider the impact on your credit before closing long-standing accounts.

Minimizing Risks and Ensuring a Smooth Closure

To ensure a smooth and risk-free closure, follow these best practices:

- Thoroughly review your account statements: Identify any discrepancies or unexpected charges.

- Confirm closure with a bank representative: Verify that the process has been completed correctly.

- Obtain written confirmation: Keep this document as proof of closure.

- Monitor your account and credit report: Check for any unusual activity.

- Keep copies of all relevant documents: Maintain records for future reference.

Choosing the Right Time to Close Your Account

The timing of your account closure can significantly influence the process. Avoid closing an account during peak times, as this can lead to delays and longer wait times. Closing the account at the end of the month, after automatic payments have been processed, is often advisable.

Conclusion: A Secure and Efficient Account Closure

Closing a bank account can be efficiently managed with proper preparation and understanding of the process. By following this guide, you can minimize potential risks and ensure a smooth transition to your new financial arrangements. Remember to meticulously follow your bank's specific procedures and obtain written confirmation of the closure for your records. By taking these proactive steps, you'll secure your finances and avoid potential complications.

Latest Posts

Latest Posts

-

What Physical Quantity Does The Slope Represent

Mar 31, 2025

-

An Object Becomes Positively Charged By Gaining Protons

Mar 31, 2025

-

Right Hand Rule For Angular Velocity

Mar 31, 2025

-

Read The Extract And Answer The Following Questions

Mar 31, 2025

-

Condensed Structural Formula For 1 2 Dibromoethane

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Application To Close The Bank Account . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.