Why Is The Demand For Money Downward Sloping

News Leon

Mar 15, 2025 · 7 min read

Table of Contents

Why is the Demand for Money Downward Sloping? A Comprehensive Analysis

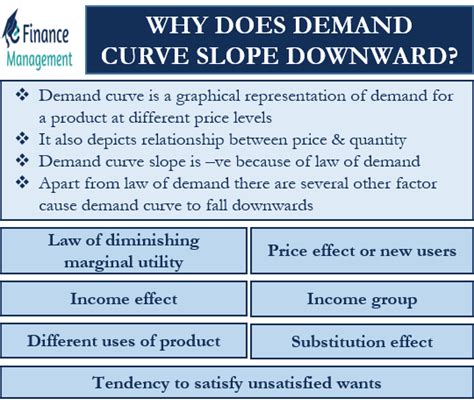

The demand for money, a fundamental concept in macroeconomics, refers to the desire to hold wealth in the form of money rather than other assets like bonds or stocks. Unlike the demand for goods and services, the demand for money is represented by a downward-sloping curve. This seemingly counterintuitive relationship – that a lower interest rate leads to a higher demand for money – stems from several key factors, which we will explore in detail.

The Three Motives Behind Money Demand

The downward slope of the money demand curve is largely explained by the three primary motives behind holding money: the transactions motive, the precautionary motive, and the speculative motive. Let's delve into each of these:

1. The Transactions Motive

This is arguably the most intuitive motive. People hold money to facilitate everyday transactions. We need cash or readily accessible funds to purchase goods and services, pay bills, and cover other expenses. The amount of money demanded for transactions is directly related to the level of income. Higher income levels typically lead to a greater volume of transactions, thus increasing the demand for transaction money.

However, the relationship between interest rates and the demand for transaction money is not as straightforward as it might seem. While a rise in interest rates doesn't directly reduce the volume of transactions, it does influence how individuals manage their money. With higher interest rates, the opportunity cost of holding money increases. Individuals might choose to keep a smaller amount of readily available cash and instead invest more in interest-bearing assets. This means that while the need for transaction money might remain the same, the amount held as cash might decrease. Hence, even the transactions motive contributes, albeit indirectly, to the downward-sloping demand curve. Efficient cash management techniques, such as optimized budgeting and regular income streams, can mitigate this effect but do not eliminate it entirely.

2. The Precautionary Motive

The precautionary motive reflects the desire to hold money for unforeseen circumstances. Unexpected expenses, such as medical emergencies or car repairs, require readily available funds. The amount of money held for precautionary purposes depends on several factors, including income stability, risk aversion, and the perceived likelihood of unexpected events.

Similar to the transactions motive, higher interest rates increase the opportunity cost of holding precautionary balances. While the need for a precautionary balance might not decrease, individuals may try to minimize the amount of money held in low-yielding assets. They may instead choose to maintain a smaller cash buffer and rely more on credit lines or other sources of emergency funding, even though this comes with associated costs and potential risks.

This highlights a crucial aspect of the money demand curve: it's not simply about the total amount of money demanded but also the form in which that money is held. Higher interest rates may encourage shifting money away from easily accessible cash accounts into more lucrative, yet less liquid, options. This shift contributes to the downward slope of the money demand curve.

3. The Speculative Motive

This motive centers on the potential returns from investing in assets versus holding money. The speculative motive is highly sensitive to interest rate changes. When interest rates are high, the return on holding bonds or other interest-bearing assets is also high. This makes holding money relatively less attractive, as it provides a zero or very low return. Therefore, individuals are more likely to reduce their money holdings and invest in these higher-yielding assets.

Conversely, when interest rates are low, the return from holding bonds is also low. The opportunity cost of holding money diminishes, making it a more attractive option. Individuals might choose to hold more money in anticipation of future investment opportunities or in case interest rates rise, allowing them to buy bonds at a lower price and benefit from capital gains. This explains why a decrease in interest rates leads to an increase in the demand for money due to the speculative motive.

Factors Influencing the Demand for Money: Beyond the Three Motives

While the three motives provide a robust foundation for understanding the downward-sloping demand for money, several other factors can influence the curve's shape and position:

-

Income Level: As previously mentioned, higher income levels generally increase the demand for money across all motives. More income translates into more transactions, a greater need for precautionary balances, and potentially more funds available for speculation.

-

Price Level: Inflation erodes the purchasing power of money. During periods of high inflation, individuals tend to demand more money to maintain their real purchasing power. This shifts the entire demand curve to the right.

-

Technological Advancements: The development of electronic payment systems, online banking, and other financial innovations can reduce the amount of money held for transactions. These advancements can flatten the money demand curve, as individuals need less physical cash for day-to-day activities.

-

Wealth: Higher levels of overall wealth can lead to a higher demand for money, particularly for speculative purposes. Wealthier individuals may have more resources available to allocate towards financial assets, including both money and interest-bearing securities. However, this relationship is not always straightforward, as wealthy individuals might diversify their holdings across a broad spectrum of assets, potentially reducing their relative reliance on liquid money balances.

-

Expected Inflation: If individuals anticipate higher inflation in the future, they may demand more money today to maintain their purchasing power. This anticipatory behavior affects the demand for money even before the actual inflation occurs.

-

Financial Regulation: Government regulations, such as reserve requirements for banks or restrictions on certain financial instruments, can influence the supply and demand for money. These regulations often impact interest rates and affect the choices individuals make in managing their assets.

The Money Demand Curve and its Implications

The downward-sloping money demand curve plays a crucial role in monetary policy. Central banks, like the Federal Reserve in the United States or the European Central Bank, use interest rates as a primary tool to influence the money supply and achieve macroeconomic goals such as price stability and full employment.

By adjusting interest rates, central banks can shift the money demand curve and impact the overall level of economic activity. For instance, if the central bank wants to stimulate economic growth, it can lower interest rates. This reduces the opportunity cost of holding money, increasing the demand for money and encouraging investment and spending. Conversely, if the central bank aims to curb inflation, it can raise interest rates, reducing the demand for money and slowing down economic activity.

However, the effectiveness of monetary policy depends on various factors, including the responsiveness of money demand to interest rate changes (the elasticity of the money demand curve), the effectiveness of the central bank’s communication with the public, and the overall state of the economy. Understanding the nuances of the money demand curve is therefore essential for designing and implementing effective monetary policy.

Conclusion: The Dynamic Nature of Money Demand

The demand for money is a dynamic concept, constantly evolving due to changes in income levels, technological advancements, inflation expectations, and the broader economic environment. While the three basic motives provide a strong framework for understanding why the demand for money slopes downward, it’s crucial to consider the interplay of other factors that can influence its shape and position. This understanding is not merely an academic exercise; it's a crucial element for policymakers seeking to manage the economy effectively and for individuals seeking to make sound financial decisions. The downward-sloping nature of the money demand curve, though not always linear or consistent in its slope, remains a central pillar of macroeconomic theory and practice. Appreciating its intricacies offers valuable insight into the functioning of modern monetary systems and their impact on individuals and the economy as a whole.

Latest Posts

Latest Posts

-

Is Osmosis High To Low Or Low To High

Mar 15, 2025

-

Concave Mirror And Convex Mirror Difference

Mar 15, 2025

-

Which Is Not A Cranial Bone Of The Skull

Mar 15, 2025

-

Mountain Range That Separates Europe And Asia

Mar 15, 2025

-

16 Out Of 40 As A Percentage

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Why Is The Demand For Money Downward Sloping . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.