Which Of The Following Are Included In Compensation Of Employees

News Leon

Mar 24, 2025 · 6 min read

Table of Contents

Which of the Following are Included in Compensation of Employees? A Comprehensive Guide

Understanding what constitutes "compensation of employees" is crucial for various reasons, from accurate financial reporting and taxation to comprehending national economic indicators. This comprehensive guide will delve deep into the components included in this crucial economic metric, exploring the nuances and variations across different contexts. We'll clarify what's included, what's excluded, and why the precise definition is so important.

Defining Compensation of Employees: The Big Picture

Compensation of employees, in its simplest form, represents the total remuneration paid by employers to their employees for their services. This isn't simply the employee's gross salary; it encompasses a much broader range of payments and benefits. Accurately measuring compensation of employees is vital for economists tracking national income, businesses calculating their labor costs, and governments designing economic policies. It provides a critical insight into the overall health of the labor market and the distribution of income within a nation.

Key Importance: Understanding the components of compensation of employees is vital for:

- National Income Accounting: It forms a major component of GDP calculations, providing a measure of the value added by the labor force.

- Business Budgeting and Forecasting: Companies need accurate compensation figures for financial planning and profitability analysis.

- Taxation and Social Security: Various taxes and social security contributions are based on employee compensation.

- Labor Market Analysis: Understanding compensation helps analyze wage trends, income inequality, and the overall health of the labor market.

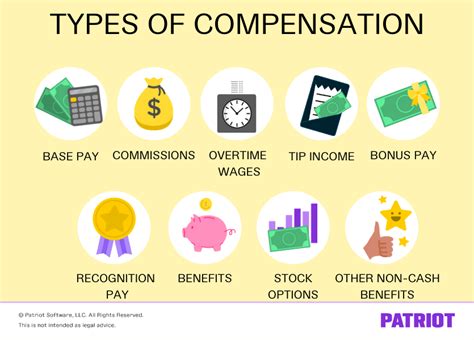

Core Components of Compensation of Employees

The core components of compensation of employees are broadly categorized into two:

1. Wages and Salaries: This is the most straightforward component and typically the largest portion of compensation. It includes:

- Gross Pay: This is the total amount earned by the employee before any deductions for taxes, insurance, or other contributions. It includes regular pay, overtime pay, bonuses, and commissions.

- Regular Pay: This is the fixed amount an employee receives for their regular work hours, usually paid weekly, bi-weekly, or monthly.

- Overtime Pay: Compensation paid for working beyond the standard working hours, typically at a higher rate than regular pay. The specific rules and rates for overtime vary by jurisdiction and industry.

- Bonuses: These are additional payments made to employees based on performance, company profits, or other criteria. Bonuses can be either fixed or variable.

- Commissions: Compensation based on a percentage of sales or other performance metrics, particularly prevalent in sales-related positions.

2. Employee Benefits: This category includes non-wage payments provided by employers to their employees. These benefits can significantly enhance the overall compensation package and represent a substantial cost for employers.

- Health Insurance: Employer-sponsored health insurance plans are a major component of employee compensation, covering medical expenses for employees and their dependents.

- Retirement Plans: This includes contributions made by employers to employee retirement accounts, such as 401(k) plans, pensions, or other defined contribution or defined benefit schemes. These are often crucial for long-term financial security.

- Paid Time Off (PTO): This encompasses paid vacation days, sick leave, holidays, and other forms of paid time off granted to employees. The amount of PTO varies significantly across industries and countries.

- Life Insurance: Employer-provided life insurance policies offer financial protection to the employee's family in case of death.

- Disability Insurance: This covers income replacement for employees who become disabled and unable to work.

- Unemployment Insurance: While paid by the employer through taxes, it directly benefits the employee in case of job loss.

- Workers' Compensation: This insurance covers medical expenses and lost wages for employees injured on the job.

- Educational Assistance: Employers might offer tuition reimbursement or other forms of educational assistance to their employees, enhancing their skills and career prospects.

- Employee Stock Options (ESOs): These provide employees the right to buy company stock at a predetermined price, often incentivizing performance and loyalty.

- Subsidized Meals: Some employers offer subsidized meals or cafeteria plans to employees.

- Transportation Assistance: This could involve subsidies for public transport or parking allowances.

- Childcare Assistance: Employer-sponsored childcare programs or subsidies are becoming increasingly common, helping employees balance work and family responsibilities.

- Wellness Programs: Employers may offer wellness programs such as gym memberships, health screenings, or smoking cessation programs.

What is NOT Included in Compensation of Employees?

It's equally important to understand what isn't included in compensation of employees. These items, while related to employment, are separately categorized in national accounts and financial statements.

- Employer's Social Security Contributions: While employers pay a portion of social security taxes, this is usually not directly included in the compensation of employees. It's a separate cost for the employer.

- Employer's Healthcare Contributions: Similar to social security, employer contributions toward health insurance are generally not considered part of the employee's compensation.

- Indirect Taxes: Taxes levied on goods and services consumed by employees are not considered part of their compensation.

- Profit Sharing: While profit sharing might enhance employee compensation indirectly, it's usually not directly included in the calculation.

- Investment Income: Returns on investments made by the employee are personal income, not part of their compensation.

- Capital Gains: Profits from the sale of assets are not included.

- Rental Income: Income generated from property rental is not part of compensation.

Variations and Considerations

The precise composition of compensation of employees can vary significantly depending on several factors:

- Industry: Some industries, like finance or technology, may offer significantly more generous compensation packages, including stock options and performance-based bonuses.

- Geographic Location: Compensation levels and benefits offerings vary significantly depending on the geographic location, reflecting differences in cost of living and labor market conditions.

- Job Level: Senior-level employees typically receive significantly higher compensation than entry-level employees, including higher salaries, more generous benefits, and performance-based incentives.

- Unionization: In unionized workplaces, collective bargaining agreements often stipulate specific compensation packages and benefits, which may differ from non-unionized settings.

- Company Size: Larger companies often have more resources available for employee compensation and benefits compared to smaller firms.

The Importance of Accurate Measurement

Accurate measurement of compensation of employees is crucial for various stakeholders:

- Employees: Accurate compensation figures are important for understanding their total compensation and negotiating salaries and benefits.

- Employers: Accurate calculation of labor costs is vital for budgeting, pricing, and strategic decision-making.

- Governments: Accurate data is essential for designing effective economic policies, including taxation, social security, and labor market regulations.

- Economists: Accurate compensation data is a cornerstone of national income accounting, helping in the analysis of economic growth, income distribution, and labor market trends.

Conclusion: A Holistic View of Compensation

Compensation of employees is a multifaceted concept that extends beyond the simple gross salary. Understanding its components, both wages and benefits, is crucial for accurate financial reporting, economic analysis, and informed policymaking. By considering the variations and factors that influence compensation across different contexts, we gain a more complete and nuanced understanding of this crucial economic indicator. Careful consideration of the inclusion and exclusion criteria ensures a more precise reflection of the true value of employee remuneration and its impact on both individual employees and the broader economy. This comprehensive guide helps clarify the complexities involved, equipping you with the knowledge to accurately interpret and analyze compensation data effectively.

Latest Posts

Latest Posts

-

What Is The Basic Unit For Distance

Mar 25, 2025

-

Cell Type Not Found In Areolar Tissue

Mar 25, 2025

-

Every Computer Has An Operating System

Mar 25, 2025

-

Which Of The Following Is A Browser

Mar 25, 2025

-

What Is The Conjugate Base Of Nh4

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Are Included In Compensation Of Employees . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.