Perfect Competition In Long Run Equilibrium

News Leon

Mar 16, 2025 · 6 min read

Table of Contents

- Perfect Competition In Long Run Equilibrium

- Table of Contents

- Perfect Competition in Long-Run Equilibrium: A Deep Dive

- Understanding the Building Blocks: Short-Run Equilibrium vs. Long-Run Equilibrium

- The Dynamics of Long-Run Equilibrium in Perfect Competition

- Characteristics of Long-Run Equilibrium

- The Role of Technology and Innovation

- Limitations and Real-World Applicability

- Implications of Long-Run Equilibrium

- Conclusion: A Valuable Theoretical Tool

- Latest Posts

- Latest Posts

- Related Post

Perfect Competition in Long-Run Equilibrium: A Deep Dive

Perfect competition, a theoretical market structure characterized by numerous buyers and sellers, homogenous products, free entry and exit, and perfect information, provides a crucial benchmark for understanding market dynamics. While rarely observed in its purest form in the real world, its analysis offers valuable insights into how markets function and how firms behave under idealized conditions. This article delves into the concept of long-run equilibrium in perfect competition, exploring its characteristics, implications, and limitations.

Understanding the Building Blocks: Short-Run Equilibrium vs. Long-Run Equilibrium

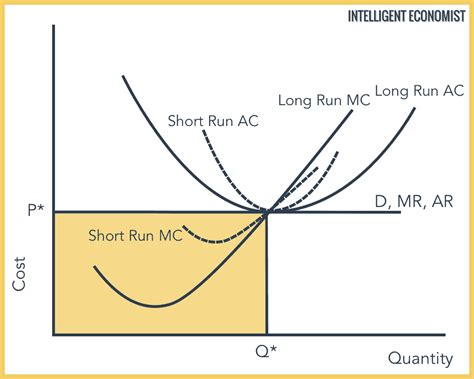

Before we delve into the intricacies of long-run equilibrium, it's crucial to grasp the concept of short-run equilibrium. In the short run, at least one factor of production is fixed, typically capital. Firms adjust their output levels based on the prevailing market price, aiming to maximize profits. The short-run equilibrium is determined where the firm's marginal cost (MC) equals its marginal revenue (MR), which in perfect competition is equivalent to the market price (P). Profit maximization occurs at this point, but it doesn't necessarily imply zero economic profit. Firms may earn positive or negative economic profits in the short run depending on the relationship between price and average total cost (ATC).

The long run, on the other hand, is characterized by the flexibility to adjust all factors of production, including capital. This allows for entry and exit of firms into and out of the market. It’s this element of entry and exit that fundamentally differentiates the long-run equilibrium from its short-run counterpart. The long-run equilibrium is a state of stability where firms earn zero economic profit, and there's no incentive for firms to enter or exit the market.

The Dynamics of Long-Run Equilibrium in Perfect Competition

The journey to long-run equilibrium is driven by the profit motive. Let's consider a scenario where firms are earning positive economic profits in the short run:

-

Short-run positive economic profits: A higher-than-normal market price allows firms to cover their costs and generate above-normal returns. This attracts new firms to enter the market.

-

Market supply increases: As new firms enter, the market supply curve shifts to the right, increasing the overall quantity supplied at each price level.

-

Price falls: The increased supply leads to a decrease in the market price, reducing the profit margins for existing firms.

-

Zero economic profit achieved: This process continues until economic profits are driven down to zero. At this point, the market price equals the minimum average total cost (ATC). Firms are still covering their explicit and implicit costs (including a normal rate of return on investment), but they are not earning any extra profit beyond that.

Conversely, if firms are incurring short-run economic losses:

-

Short-run economic losses: A market price below the average total cost (ATC) results in economic losses for firms.

-

Firms exit the market: Firms facing persistent losses will exit the market, reducing the market supply.

-

Market supply decreases: The reduced supply shifts the market supply curve to the left.

-

Price rises: The decreased supply leads to an increase in the market price.

-

Zero economic profit achieved: This process continues until the market price rises to the point where it equals the minimum average total cost (ATC). Again, economic profits are driven to zero, and there's no further incentive for firms to exit.

Characteristics of Long-Run Equilibrium

The long-run equilibrium in perfect competition exhibits several key characteristics:

-

Price equals minimum average total cost (P = min ATC): This is the most crucial characteristic. Firms are producing at the most efficient scale, minimizing their average costs.

-

Price equals marginal cost (P = MC): This condition ensures allocative efficiency, meaning resources are allocated optimally to satisfy consumer demand.

-

Zero economic profit: Firms earn normal profits, covering all their costs, including opportunity costs. There's no incentive for firms to enter or exit the market.

-

Productive efficiency: Firms produce at the lowest possible average total cost, achieving productive efficiency.

The Role of Technology and Innovation

While the model of perfect competition assumes homogenous products, in reality, innovation and technological advancements constantly introduce new products and improve existing ones. These changes can disrupt the long-run equilibrium. A technological breakthrough could lower the average total cost for firms, resulting in temporary positive economic profits. This would trigger new entry, ultimately leading to a new long-run equilibrium with a lower price and potentially increased output. Therefore, while the long-run equilibrium is a state of stability, it's not static; it's constantly susceptible to shifts due to exogenous factors like technological change.

Limitations and Real-World Applicability

While the model of perfect competition provides a valuable theoretical framework, several limitations restrict its applicability in the real world:

-

Homogenous products: In reality, product differentiation is widespread. Brands, quality variations, and consumer preferences create market imperfections.

-

Perfect information: Consumers rarely possess perfect information about all available products and prices. Information asymmetry can influence market outcomes.

-

Free entry and exit: Barriers to entry, such as high start-up costs, patents, or government regulations, can restrict the free entry and exit of firms.

-

Many buyers and sellers: Many markets are dominated by a few large firms, creating an oligopolistic or monopolistic market structure rather than perfect competition.

Despite these limitations, the perfect competition model serves as a useful benchmark against which to compare other market structures. It provides a theoretical ideal towards which markets may, to varying degrees, aspire. Analyzing deviations from this ideal allows economists to understand the implications of market imperfections and how they affect market outcomes and resource allocation.

Implications of Long-Run Equilibrium

The long-run equilibrium in perfect competition has significant implications for resource allocation and economic efficiency:

-

Allocative efficiency: Resources are allocated to produce the goods and services that consumers most value. The market price reflects the marginal cost of production, indicating that society’s willingness to pay for the last unit produced is equal to the cost of producing it.

-

Productive efficiency: Firms produce at the lowest possible average cost, maximizing the output from available resources. There’s no waste in production.

-

Consumer surplus maximization: The competitive market structure generates the maximum possible consumer surplus, reflecting consumer welfare.

-

Dynamic efficiency: While the model is often presented as static, the long-run equilibrium incorporates a dynamic element through the process of entry and exit. Technological innovation can lead to improved efficiency and lower prices over time.

Conclusion: A Valuable Theoretical Tool

The concept of long-run equilibrium in perfect competition, despite its limitations in strictly mirroring real-world markets, remains a cornerstone of economic theory. It offers a crucial framework for understanding how competitive forces drive markets towards efficiency, highlighting the interplay between supply and demand, profit motives, and the dynamic adjustments of firms in response to market signals. While real-world markets seldom perfectly embody the assumptions of perfect competition, understanding this idealized model provides invaluable insights into the forces that shape market structure, pricing, and resource allocation. Analyzing deviations from this theoretical ideal allows for a more nuanced and comprehensive understanding of real-world market dynamics and the challenges associated with achieving economic efficiency. The model continues to serve as a valuable benchmark for evaluating the performance and efficiency of various market structures.

Latest Posts

Latest Posts

-

How Many Chambers In A Frog Heart

Mar 17, 2025

-

Anticodons Are Found On What Type Of Rna

Mar 17, 2025

-

How Many Protons Does Chloride Have

Mar 17, 2025

-

Which Organelles Are Involved In Energy Conversion

Mar 17, 2025

-

Which Of The Following Compounds Is Not Aromatic

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Perfect Competition In Long Run Equilibrium . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.