Increases To Owner's Equity May Be From

News Leon

Mar 23, 2025 · 6 min read

Table of Contents

Increases to Owner's Equity: A Comprehensive Guide

Owner's equity, also known as shareholders' equity for corporations, represents the residual interest in the assets of an entity after deducting its liabilities. It essentially signifies the owners' stake in the business. Understanding how owner's equity increases is crucial for business owners, investors, and anyone analyzing financial statements. This comprehensive guide delves into the various ways owner's equity can be boosted, providing a detailed explanation of each method and its implications.

Key Contributors to Increased Owner's Equity

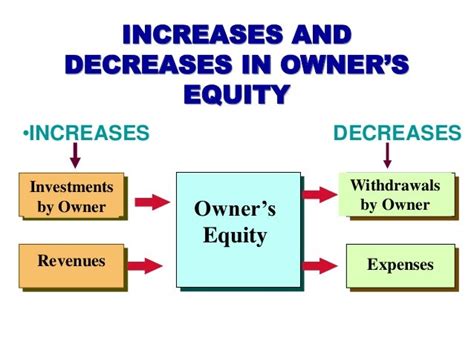

Increases in owner's equity primarily stem from two sources: profitable operations and external investments. Let's explore each in detail:

1. Profitable Operations: The Engine of Growth

The most organic and sustainable way to increase owner's equity is through profitable operations. Profits earned by a business directly contribute to retained earnings, a significant component of owner's equity.

a) Net Income: The Foundation of Growth

Net income, the bottom line of the income statement, represents the profit earned after deducting all expenses from revenues. This net income is then added to retained earnings, thereby increasing owner's equity. A consistently profitable business will see a steady and substantial growth in owner's equity over time. This growth reflects the accumulated wealth generated through the core business activities.

Example: If a business generates a net income of $100,000 in a year, and it doesn't distribute any dividends, its retained earnings and owner's equity increase by $100,000.

b) Revenue Generation Strategies: Driving Profitability

Boosting net income requires a multi-faceted approach focusing on revenue generation and cost management. Several strategies can be employed to achieve this:

- Increasing Sales Volume: Expanding market reach, targeting new customer segments, and implementing effective marketing campaigns can drive sales volume growth.

- Raising Prices: Strategically increasing prices, particularly if the business offers a unique value proposition or operates in a market with inelastic demand, can significantly boost revenue. However, careful consideration of market competition and customer sensitivity is essential.

- Improving Sales Efficiency: Streamlining the sales process, enhancing customer relationship management, and offering excellent customer service can increase sales conversion rates and revenue per customer.

- Diversifying Revenue Streams: Exploring new product lines or service offerings can reduce reliance on a single revenue stream and enhance overall profitability.

- Upselling and Cross-selling: Encouraging existing customers to purchase higher-priced products or complementary services can generate additional revenue.

c) Cost Management: Maximizing Profitability

While revenue generation is crucial, effective cost management is equally important in maximizing profitability and consequently, increasing owner's equity. Strategies for cost control include:

- Optimizing Inventory Management: Reducing inventory holding costs through efficient inventory tracking and forecasting minimizes waste and frees up capital.

- Negotiating Better Supplier Contracts: Securing favorable terms from suppliers can reduce the cost of goods sold.

- Improving Operational Efficiency: Streamlining workflows, automating processes, and adopting lean manufacturing principles can significantly reduce operational expenses.

- Reducing Waste: Identifying and eliminating waste in all areas of the business, from materials to energy consumption, contributes to substantial cost savings.

- Effective Employee Management: Optimizing staffing levels, providing appropriate training, and fostering a productive work environment can enhance productivity and reduce labor costs.

2. External Investments: Injecting Capital

External investments introduce capital from outside sources, directly boosting owner's equity. Several ways to achieve this include:

a) Additional Capital Contributions: Owner's Investments

Owners can directly increase owner's equity by injecting additional capital into the business. This is a common method for small businesses and startups needing funding for expansion or covering operating expenses. This capital infusion is recorded as an increase in the owner's capital account.

Example: If an owner invests an additional $50,000 into their business, the owner's equity increases by $50,000.

b) Debt Financing: Loans and Borrowing

While not a direct increase to owner's equity, borrowing money from external sources, such as banks or investors, can indirectly contribute to growth. The borrowed funds can be used to invest in the business, increasing its assets and, if used profitably, leading to higher net income and increased retained earnings. However, remember that debt financing increases liabilities as well, so the net effect on owner's equity depends on how profitably the borrowed funds are utilized.

c) Equity Financing: Issuing Shares (Corporations)

For corporations, issuing additional shares of stock is a significant method of raising capital. This dilutes the existing shareholders' ownership percentage but increases the overall equity of the company. The proceeds from the sale of new shares directly increase owner's equity. This is a common strategy for expanding businesses or funding large projects.

d) Investment from External Investors: Venture Capital and Angel Investors

Seeking investment from external parties like venture capitalists or angel investors is particularly common for startups and high-growth businesses. These investors provide capital in exchange for equity in the company, increasing the overall owner's equity. However, this also results in a dilution of the existing owners' ownership stake.

Understanding the Impact on Financial Statements

Increases in owner's equity are reflected in the balance sheet, specifically within the equity section. The balance sheet adheres to the fundamental accounting equation:

Assets = Liabilities + Owner's Equity

Any increase in owner's equity will require a corresponding increase in assets or a decrease in liabilities, maintaining the balance of the equation. For instance, an increase in retained earnings (due to net income) will increase assets (e.g., cash or accounts receivable) or decrease liabilities (e.g., accounts payable). Similarly, additional capital contributions increase the owner's capital account directly while simultaneously increasing assets.

The income statement also plays a vital role in influencing owner's equity changes. Net income, the primary driver of retained earnings, is calculated on the income statement, directly impacting the owner's equity section of the balance sheet at the end of the accounting period.

Analyzing Owner's Equity Changes: Key Considerations

When analyzing changes in owner's equity, it's important to consider several factors:

- Profitability Trends: Analyze the trends in net income over time to assess the sustainability of equity growth. Consistent profitability suggests a strong foundation for long-term growth.

- Debt Levels: High levels of debt can put pressure on profitability and potentially negate the positive effects of other equity-increasing activities.

- Dividend Policy: The payout of dividends reduces retained earnings and owner's equity. Analyzing dividend payout policies is crucial for understanding the complete picture of equity changes.

- External Investments: Examine the source and terms of external investments. Equity financing dilutes existing ownership, while debt financing incurs financial obligations.

- Accounting Practices: Ensure that accounting practices are consistent and comply with relevant accounting standards to accurately reflect the changes in owner's equity.

Conclusion: Strategic Growth and Owner's Equity

Increasing owner's equity is a crucial goal for any business. It represents the accumulation of wealth and the success of the business venture. By strategically focusing on both profitable operations and effective external investments, business owners can steadily build their equity and strengthen their financial position. However, careful planning, diligent management, and a thorough understanding of financial statements are crucial for achieving sustainable and meaningful increases in owner's equity. Regular monitoring and analysis of these factors are essential to ensure the long-term financial health and growth of the business. The methods outlined in this guide provide a comprehensive understanding of how to strategically approach increasing owner's equity, leading to a stronger and more successful business. Remember that building a strong financial foundation takes time and consistent effort; patience and perseverance are key to long-term success.

Latest Posts

Latest Posts

-

How To Use Sum In Python

Mar 24, 2025

-

Difference Between Land And Sea Breeze

Mar 24, 2025

-

Which Of The Following Is Not A Microprocessor Manufacturing Company

Mar 24, 2025

-

Which Layer Of The Atmosphere Does Weather Occur In

Mar 24, 2025

-

A Gas Expands From I To F In The Figure

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Increases To Owner's Equity May Be From . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.