In The Long Run The Monopolist Can Earn

News Leon

Mar 17, 2025 · 5 min read

Table of Contents

In the Long Run, What Can a Monopolist Earn? An In-Depth Analysis

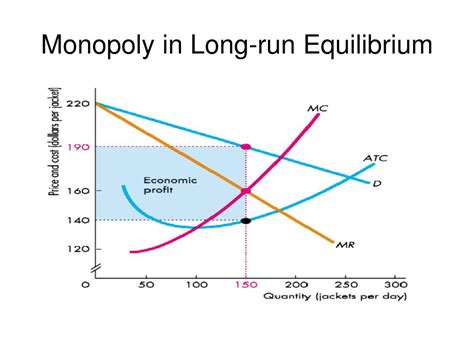

The question of a monopolist's long-run profitability is a cornerstone of economic theory. Unlike perfectly competitive firms that earn zero economic profit in the long run, monopolies possess the unique ability to restrict output and influence prices, potentially leading to sustained above-normal profits. However, the reality is far more nuanced. This article delves deep into the factors that determine a monopolist's long-run earnings, exploring various models and considering the complexities of real-world scenarios.

The Simple Model: High Barriers to Entry and Supernormal Profits

In the simplest theoretical model, a monopolist can earn supernormal profits in the long run. This stems from two crucial characteristics:

-

High Barriers to Entry: These prevent new firms from entering the market and competing away the monopolist's profits. These barriers can include patents, control of essential resources, significant economies of scale, high start-up costs, government regulations, or even aggressive anti-competitive behavior.

-

Price-Making Power: Unlike firms in perfect competition that are price takers, a monopolist is a price maker. They can choose the price-quantity combination that maximizes their profits, often setting a price higher than marginal cost. This results in a surplus of producer surplus, representing the monopolist's economic profit.

This simple model paints a picture of consistent, substantial profits for the monopolist. However, this is a simplification. Several factors can erode or even eliminate these profits in the long run.

Factors Affecting a Monopolist's Long-Run Profitability

Several critical factors can influence a monopolist's long-run earnings. Let's analyze them individually:

1. Technological Advancements and Innovation

Technological change can significantly impact a monopolist's position. A new technology might:

- Reduce costs: This allows the monopolist to lower prices, increasing market share and possibly leading to even higher profits.

- Create substitutes: The emergence of substitute goods or services can reduce demand for the monopolist's product, diminishing its market power and profits. This is a significant threat to long-term profitability.

- Disrupt the market: Radical innovation can completely overturn the existing market structure, potentially rendering the monopolist's product or service obsolete.

2. Government Regulation

Governments often intervene in monopolistic markets to protect consumers and promote competition. Regulatory actions might include:

- Antitrust laws: Designed to prevent monopolies from engaging in anti-competitive practices like price fixing or predatory pricing. Violations can lead to heavy fines and break-up of the monopoly.

- Price controls: Governments may impose price ceilings to prevent excessively high prices, reducing the monopolist's ability to extract maximum profit.

- Increased competition: Governments might promote competition through deregulation, privatization, or encouraging the development of substitute goods.

3. Changes in Consumer Preferences and Demand

Consumer tastes and preferences are dynamic. A shift in consumer demand can drastically impact a monopolist's profitability. If demand for the monopolist's product declines, profits will decrease accordingly. Adapting to changing consumer preferences is crucial for sustained profitability.

4. Potential Entry by New Competitors

Even with high barriers to entry, the possibility of new firms entering the market always exists. This can occur through:

- Technological breakthroughs: New technologies may lower the barriers to entry, making it easier for new firms to compete.

- Changes in regulations: Relaxation of regulations can open the market to new competitors.

- Innovation and differentiation: New firms might offer innovative products or services that differentiate them from the monopolist, attracting consumers and reducing the monopolist's market share.

5. Internal Inefficiencies

Monopolies are not immune to internal inefficiencies. Without the pressure of competition, there's a risk of:

- X-inefficiency: A lack of pressure to minimize costs can lead to higher production costs than necessary.

- Lack of innovation: The absence of competitive pressure might stifle innovation and reduce the monopolist's ability to adapt to changing market conditions.

- Managerial complacency: Overconfidence and a lack of responsiveness to market changes can result in declining profitability.

The Role of Dynamic Efficiency

While the static model often portrays monopolists earning consistent supernormal profits, a more dynamic view is needed. Dynamic efficiency refers to the long-run efficiency gains stemming from innovation and technological progress. Monopolists, through their potentially higher profits, can invest more in R&D, potentially leading to technological advancements that benefit consumers in the long run.

However, this is not guaranteed. The absence of competitive pressure can actually stifle innovation. Therefore, the impact of a monopolist on dynamic efficiency is highly contextual and depends on various factors such as the nature of the industry, the level of management commitment to R&D, and the strength of intellectual property protection.

Beyond Simple Models: Considering Real-World Scenarios

The simple model of a monopolist consistently earning supernormal profits rarely holds true in the real world. Many factors, including those discussed above, introduce complexities and uncertainties.

Consider the following scenarios:

- Temporary monopolies: A firm might enjoy monopoly power for a limited time due to a patent or a temporary advantage, after which competition arises, and profits decline.

- Contestable markets: Even with high barriers to entry, the threat of new entry might keep the monopolist from charging excessively high prices, limiting their profits.

- Regulation and antitrust actions: Government intervention can significantly constrain a monopolist's pricing power, reducing long-run profits.

Conclusion: A Nuanced Perspective on Monopolist Profitability

The long-run profitability of a monopolist is not a simple yes or no answer. While the potential for sustained supernormal profits exists due to barriers to entry and price-making power, numerous factors can significantly impact their earning potential. Technological advancements, government regulation, changes in consumer preferences, potential entry, and internal inefficiencies all play a crucial role. A dynamic perspective, considering innovation and long-term efficiency, is also critical for a comprehensive understanding. Therefore, while monopolies can potentially earn high profits in the long run, it's far from a guaranteed outcome, and the actual level of profitability will depend on a complex interplay of various market forces and the firm's own strategic decisions. The assumption of consistent supernormal profits should be treated with caution, and a detailed analysis of specific market conditions is necessary for a realistic assessment.

Latest Posts

Latest Posts

-

Which Of The Following Word Is Different From The Others

Mar 18, 2025

-

Reverse List Python Without Inbuilt Function

Mar 18, 2025

-

A Current Of One Ampere Is Passed Through

Mar 18, 2025

-

Difference Between Earthing And Grounding And Neutral

Mar 18, 2025

-

What Is The Molar Mass Of Calcium Carbonate Caco3

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about In The Long Run The Monopolist Can Earn . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.