Consumer Surplus Is The Area ________.

News Leon

Mar 15, 2025 · 6 min read

Table of Contents

Consumer Surplus: The Area Between Willingness to Pay and Actual Price

Consumer surplus is a fundamental concept in economics that measures the difference between the total amount that consumers are willing to pay for a good or service and the total amount they actually pay. It represents the net benefit consumers receive from participating in a market. Understanding consumer surplus is crucial for businesses to understand pricing strategies, predict market demand, and assess the overall welfare impact of their products and services. This article will delve deep into the intricacies of consumer surplus, explaining its calculation, its significance, and the factors that influence it.

Defining Consumer Surplus: The Area Below the Demand Curve

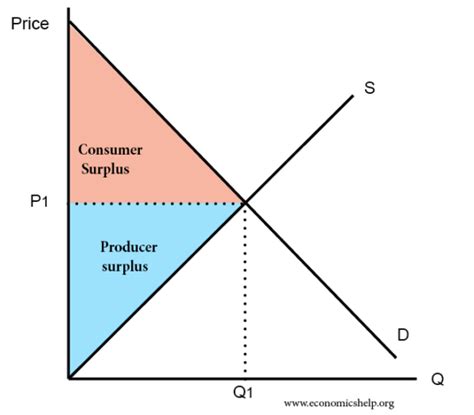

The most concise and accurate definition is: Consumer surplus is the area below the demand curve and above the market price. This graphical representation provides a powerful visual tool to comprehend the concept. The demand curve illustrates the relationship between the price of a good and the quantity demanded by consumers. Each point on the curve represents the maximum price a consumer is willing to pay for a specific quantity.

Individual vs. Market Consumer Surplus

It's important to differentiate between individual consumer surplus and market consumer surplus.

-

Individual consumer surplus: This refers to the surplus enjoyed by a single consumer for a particular good or service. It's the difference between the price a consumer is willing to pay and the actual price they pay.

-

Market consumer surplus: This is the sum of all individual consumer surpluses in a market. It represents the total net benefit enjoyed by all consumers for a particular good or service. This is the aggregate measure economists most often utilize.

Calculating Consumer Surplus: Methods and Applications

Calculating consumer surplus can be done using various methods, depending on the complexity of the demand curve.

1. Using a Linear Demand Curve: The Triangular Area

When the demand curve is linear (a straight line), the consumer surplus can be easily calculated using the formula for the area of a triangle:

Consumer Surplus = 0.5 * Base * Height

Where:

- Base: The quantity of the good or service consumed at the market price.

- Height: The difference between the maximum price consumers are willing to pay (the vertical intercept of the demand curve) and the market price.

2. Using a Non-Linear Demand Curve: Integration

For non-linear demand curves, calculating the consumer surplus requires the use of integral calculus. The consumer surplus is the definite integral of the demand function from 0 to the quantity consumed, minus the total expenditure (price multiplied by quantity). This mathematical approach provides a precise measure of consumer surplus, even for complex demand curves reflecting nuanced consumer preferences.

3. Discrete Data and Approximation: Summing Individual Surpluses

In scenarios where demand data is available only in discrete points (rather than a continuous function), consumer surplus can be approximated by summing individual consumer surpluses. This involves identifying the maximum price each consumer is willing to pay and subtracting the actual market price, then summing these individual surpluses across all consumers. This method is particularly useful when dealing with market research data or surveys.

Factors Affecting Consumer Surplus: Shifting the Demand and Supply Curves

Several factors can shift the demand curve, thus impacting the level of consumer surplus. These include:

-

Changes in Consumer Income: An increase in income typically leads to higher demand, pushing the demand curve to the right and increasing consumer surplus, assuming prices remain constant. Conversely, a decrease in income reduces consumer surplus.

-

Changes in Consumer Preferences: A shift in consumer preferences towards a particular good will increase demand, causing the demand curve to shift rightward and leading to a larger consumer surplus. Negative shifts in preferences have the opposite effect.

-

Changes in Prices of Related Goods: The price of substitute goods (goods that can be used in place of one another) and complementary goods (goods that are used together) significantly affect the demand for a particular product. For instance, a decrease in the price of a substitute good will reduce the demand for the original good, decreasing consumer surplus. Conversely, a decrease in the price of a complementary good will increase the demand and consumer surplus for the original good.

-

Changes in Consumer Expectations: Consumer expectations about future prices or availability influence present demand. If consumers anticipate a price increase in the future, current demand may surge, leading to temporarily higher consumer surplus (until the price rises).

-

Changes in the Number of Consumers: A larger consumer base increases the overall demand and usually expands the market consumer surplus.

Changes in supply also impact consumer surplus. A decrease in supply (e.g., due to production limitations or increased input costs) causes an increase in price, leading to a reduction in consumer surplus. Conversely, an increase in supply, often resulting from technological improvements or expanded production, typically lowers the price and increases consumer surplus.

The Significance of Consumer Surplus: Beyond Monetary Value

Consumer surplus holds immense significance, extending beyond its role as a purely economic metric:

-

Welfare Economics: It's a key measure of economic welfare, indicating the overall benefit consumers derive from a market. Policymakers use it to evaluate the impact of government interventions, such as taxes or subsidies, on consumer wellbeing.

-

Pricing Strategies: Businesses use consumer surplus insights to optimize their pricing strategies. By understanding the willingness to pay of different consumer segments, companies can fine-tune prices to maximize profits while maintaining a reasonable level of consumer satisfaction.

-

Market Analysis: Analyzing consumer surplus helps economists predict market demand and understand the factors driving changes in consumer behavior. This assists in formulating effective business strategies and forecasting market trends.

-

Resource Allocation: Information about consumer surplus helps in making informed decisions about resource allocation. Markets with higher consumer surplus usually represent areas where resources are utilized most efficiently in satisfying consumer needs.

Limitations of Consumer Surplus Analysis: Assumptions and Considerations

While consumer surplus is a powerful analytical tool, it has limitations:

-

Cardinal Utility Measurement: The traditional concept of consumer surplus relies on the assumption of cardinal utility—that is, the ability to quantify consumer satisfaction numerically. This assumption is debatable, as preferences are subjective and difficult to measure precisely. Ordinal utility (ranking preferences) is a more widely accepted approach today.

-

Perfect Information: Consumer surplus models assume perfect information, meaning that consumers possess complete knowledge about prices and product quality. In reality, information asymmetry is widespread, impacting consumer decisions and potentially distorting surplus calculations.

-

Income Effects: Changes in price can alter consumer purchasing power, leading to income effects that are not fully captured in basic consumer surplus models. More sophisticated models often incorporate these effects.

-

Market Power: In markets with significant market power (e.g., monopolies or oligopolies), the assumption of perfect competition is violated. Firms with significant pricing power can restrict supply and extract surplus from consumers, leading to a misrepresentation of true consumer welfare.

Conclusion: A Powerful Tool for Understanding Market Dynamics

Consumer surplus, the area below the demand curve and above the market price, serves as a vital tool in understanding market dynamics and assessing consumer welfare. Whether calculated using simple geometric formulas for linear demand curves or more complex integral calculus for non-linear curves, it provides valuable insights into consumer preferences, market efficiency, and the impact of various economic factors. While limitations exist in its application, understanding consumer surplus remains an essential skill for economists, policymakers, and businesses alike, enabling them to make more informed and impactful decisions in a complex market environment. By continuing to refine our understanding and methodologies surrounding consumer surplus, we can better evaluate the effectiveness of market mechanisms and policies aimed at maximizing overall societal well-being.

Latest Posts

Latest Posts

-

Similarities Between First And Second Great Awakening

Mar 15, 2025

-

How Many Seconds Are In 3 Days

Mar 15, 2025

-

Which Of The Following Has The Least Resistance

Mar 15, 2025

-

Cytokinesis Overlaps With Which Phase Of Mitosis

Mar 15, 2025

-

Each Of The Eight Conductors In The Figure Carries

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Consumer Surplus Is The Area ________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.