At A Price Below Equilibrium Price There Is

News Leon

Mar 19, 2025 · 7 min read

Table of Contents

At a Price Below Equilibrium Price, There Is… Excess Demand!

The world of economics often feels abstract, filled with graphs and jargon. But understanding fundamental concepts like equilibrium price is crucial, not just for acing your econ exam, but also for navigating everyday life. This article dives deep into the consequences of setting a price below the equilibrium price – a scenario that creates a fascinating ripple effect within a market. We’ll explore the reasons behind this price setting, the resulting excess demand, and the various implications for consumers, producers, and the market as a whole.

Understanding Equilibrium Price: The Balancing Act

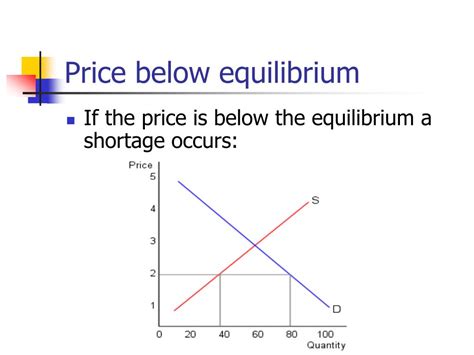

Before we delve into the complexities of below-equilibrium pricing, let's establish a firm grasp of what equilibrium price actually is. The equilibrium price, also known as the market-clearing price, is the point where the quantity demanded by consumers perfectly matches the quantity supplied by producers. Think of it as the sweet spot where the market finds its balance.

At this magical point:

- Supply = Demand: The quantity of a good or service that buyers are willing and able to purchase precisely equals the quantity sellers are willing and able to offer at a specific price.

- No Shortages or Surpluses: There are no unsatisfied buyers (shortages) or unsold goods (surpluses). The market clears efficiently.

- Market Stability (in theory): In a perfectly competitive market (a theoretical ideal), the equilibrium price remains relatively stable unless external factors like changes in consumer preferences, input costs, or government regulations intervene.

Visualize this equilibrium on a simple supply and demand graph. The point where the supply and demand curves intersect represents the equilibrium price and quantity.

Why Prices Fall Below Equilibrium: Intentional and Unintentional Factors

Prices straying below equilibrium aren’t purely accidental occurrences. Various reasons can explain why a market might find itself in this situation:

1. Government Intervention: Price Ceilings

Governments sometimes impose price ceilings, maximum prices allowed for certain goods or services. This is often done with the intention of making essential goods more affordable for low-income consumers. Examples include rent control in certain cities or price caps on essential medicines. While seemingly beneficial, price ceilings below the equilibrium price inevitably lead to significant disruptions.

2. Competitive Pressures: Price Wars

In highly competitive markets, businesses might engage in price wars, deliberately lowering prices to attract customers and gain market share. This can push prices below equilibrium, especially if multiple firms engage in this strategy simultaneously. While consumers benefit in the short term, this can be unsustainable for businesses, potentially leading to bankruptcies and market consolidation.

3. Unforeseen Market Shifts: Sudden Surplus

Sometimes, unforeseen circumstances like a sudden increase in production or a drastic shift in consumer preferences can lead to a temporary surplus of goods. To liquidate this surplus quickly, producers might be forced to lower prices below equilibrium, even if it means incurring losses in the short run.

4. Miscalculations and Inefficient Market Dynamics: Poor Forecasting

Businesses sometimes misjudge market demand, leading to an overestimation of the quantity demanded at a specific price. This can result in a surplus of goods, forcing them to lower prices to clear inventory. This highlights the challenges of accurately forecasting market trends.

The Consequences of a Price Below Equilibrium: Excess Demand and its Ramifications

When the price of a good or service is set below the equilibrium price, the inevitable consequence is excess demand, also known as a shortage. This means that the quantity demanded at the artificially low price exceeds the quantity supplied. The implications are far-reaching:

1. Queues and Waiting Lists: The Struggle for Scarce Resources

Consumers face longer queues, waiting lists, and potentially even empty shelves. The limited supply is simply not enough to satisfy the heightened demand, creating frustration and inconvenience for consumers. This is especially problematic for essential goods and services.

2. Rationing: Artificial Allocation Mechanisms

In the absence of sufficient supply, various forms of rationing might emerge. This could involve allocating goods on a first-come, first-served basis, using lottery systems, or implementing other arbitrary methods to distribute the limited supply. This can be inefficient and unfair.

3. Black Markets and Price Gouging: The Shadow Economy

The scarcity created by a price below equilibrium often fuels the emergence of black markets. Individuals or groups might acquire the goods at the artificially low price and then resell them at much higher prices, profiting from the shortage. This undermines the intention of the price control and can lead to further inequities.

4. Reduced Quality and Service: Cutting Corners to Meet Demand

Producers, facing overwhelming demand and limited resources, might compromise on the quality of their goods or services to meet the increased demand. They might use cheaper materials, cut corners in production, or reduce the level of customer service. This negatively impacts consumer satisfaction and could damage brand reputation in the long run.

5. Inefficient Resource Allocation: Missed Opportunities

Excess demand indicates that resources are not being allocated efficiently. Consumers willing to pay a higher price are prevented from accessing the good, while those who may value the good less are able to obtain it due to the artificially low price. This leads to a misallocation of resources and prevents the market from operating optimally.

6. Producer Losses: Unsustainable Business Practices

For businesses, maintaining a price below equilibrium, especially over the long term, can be financially unsustainable. They might be selling their goods or services at a loss, impacting profitability and potentially leading to business failures. This can lead to reduced supply in the future, further exacerbating the market imbalance.

Case Studies: Real-World Examples of Below-Equilibrium Pricing

Let's examine some real-world scenarios illustrating the consequences of pricing below equilibrium:

1. Rent Control: The Housing Crisis

In many cities with strict rent control measures, the rent price is kept artificially low, resulting in significant housing shortages. This leads to long waiting lists, increased competition for limited apartments, and even the emergence of black markets for rental properties.

2. Price Caps on Essential Medicines: Access and Innovation

Price caps on life-saving medications, intended to enhance accessibility, can discourage pharmaceutical companies from investing in research and development of new drugs. This can hinder innovation and ultimately limit the availability of essential medicines in the future.

3. Fuel Subsidies: Environmental Impact and Economic Inefficiency

Government subsidies that keep fuel prices artificially low often lead to increased consumption, contributing to environmental problems and inefficient resource allocation. The reduced price does not accurately reflect the true cost of fuel, including its environmental impact.

Addressing Below-Equilibrium Pricing: Finding Sustainable Solutions

While governments and businesses often have well-intentioned reasons for setting prices below equilibrium, the resulting negative consequences demand careful consideration. Rather than relying on price controls, alternative strategies might prove more effective in addressing underlying societal challenges:

- Targeted Subsidies: Instead of broadly lowering prices, governments could provide targeted subsidies to specific consumer groups who need assistance accessing essential goods and services. This allows for a more efficient allocation of resources.

- Investment in Supply: Increasing the supply of goods or services is often a more effective solution to shortages. This could involve investments in infrastructure, technological improvements, or regulatory reforms that encourage production.

- Improved Market Information: Better market information can help businesses make more accurate forecasts, reducing the likelihood of price miscalculations and resulting surpluses or shortages.

- Long-Term Policy Planning: Considering the long-term implications of price controls and other interventions is vital. Short-sighted policies can have unintended and negative consequences.

Conclusion: The Importance of Understanding Market Dynamics

Understanding the dynamics of equilibrium pricing and the consequences of deviating from it is essential for both businesses and policymakers. While setting prices below equilibrium might appear beneficial in the short term, it often leads to a cascade of negative consequences, including excess demand, shortages, inefficiencies, and market distortions. Adopting a holistic perspective, considering long-term implications and exploring alternative strategies, is crucial for fostering healthy and efficient markets that benefit both consumers and producers. The focus should be on sustainable solutions that address the root causes of market imbalances, rather than relying on short-term price interventions that often create more problems than they solve.

Latest Posts

Latest Posts

-

Example Of A Small Scale Map

Mar 19, 2025

-

The First Fully 64 Bit Compatible Version Of Android Is

Mar 19, 2025

-

If Qc Is Greater Than Kc

Mar 19, 2025

-

What Is The Difference Between Balanced Forces And Action Reaction Forces

Mar 19, 2025

-

Is Nh3 A Lewis Acid Or Base

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about At A Price Below Equilibrium Price There Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.