Who Is The Maker In A Promissory Note

News Leon

Mar 22, 2025 · 6 min read

Table of Contents

Who is the Maker in a Promissory Note? A Comprehensive Guide

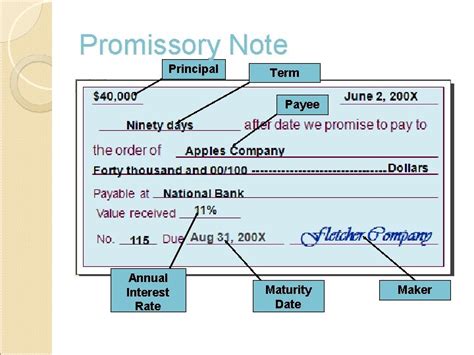

A promissory note, a written promise to repay a debt, contains several key parties. Understanding the roles of each is crucial, especially for those involved in lending, borrowing, or legal proceedings involving these instruments. This comprehensive guide delves into the pivotal role of the maker in a promissory note, exploring their responsibilities, liabilities, and the implications of their involvement. We'll also discuss the differences between the maker and other parties, like the payee and the guarantor, to ensure a complete understanding of this crucial financial document.

Defining the Maker in a Promissory Note

The maker of a promissory note is the individual or entity who unconditionally promises to pay a specific sum of money to another party, the payee, on or before a specified date. They are the primary obligor, bearing the sole responsibility for repayment unless other parties, such as guarantors or co-signers, are also involved. Think of the maker as the person or entity making the promise to pay. This promise is legally binding and enforceable.

The maker's identity is clearly stated within the promissory note itself. This information is essential for legal purposes and for tracking the debt. The maker’s legal name and address must be accurate and unambiguous to avoid potential disputes and complications down the line. Inaccurate or misleading information can significantly weaken the legal standing of the note.

Responsibilities and Liabilities of the Maker

The maker's primary responsibility is to repay the principal amount of the debt as outlined in the promissory note. This includes adherence to the repayment schedule, whether it's a lump sum payment or installment payments over a period of time. Failure to meet these obligations constitutes a breach of contract and exposes the maker to significant legal repercussions.

Beyond the principal, the maker is also responsible for paying any accrued interest. The promissory note will typically specify the interest rate, the calculation method, and the frequency of interest payments. Interest is considered part of the debt and is legally enforceable. Late payments often incur additional penalties and fees, which the maker is also liable for.

Furthermore, the maker is typically responsible for covering collection costs if they default on their obligations. These costs can encompass legal fees, attorney fees, and expenses incurred by the payee in recovering the debt. The inclusion of these clauses in the note varies based on jurisdiction and specific agreements. Understanding these potential additional costs is critical before signing.

Examples of Maker Responsibilities:

- Prompt Payment: Making all payments on time, according to the terms stipulated in the promissory note.

- Accurate Information: Ensuring that all personal information provided on the note is correct and up-to-date.

- Understanding the Terms: Fully comprehending the terms and conditions outlined in the promissory note before signing.

- Disclosure of Relevant Information: Disclosing any relevant financial circumstances that might impact repayment capability.

Differentiating the Maker from Other Parties

While the maker is the central figure in a promissory note, it's crucial to differentiate their role from other parties who might be involved.

Payee

The payee is the individual or entity to whom the payment is owed. They are the recipient of the funds promised by the maker. The payee's role is relatively passive, mainly involving the collection of payments and potentially initiating legal action in case of default. While the payee doesn’t assume the debt, they hold the rights to enforce the agreement laid out in the promissory note.

Guarantor

A guarantor is a third party who agrees to be responsible for the debt if the maker defaults. Unlike the maker, the guarantor isn't directly obligated to pay the debt. However, if the maker fails to meet their obligations, the guarantor becomes liable for the outstanding amount. A guarantor often provides collateral, thus strengthening the security of the loan. The terms of the guarantor’s responsibility are clearly defined in the promissory note.

Co-Maker

A co-maker is similar to a guarantor, but holds a stronger liability. Both the maker and the co-maker are equally responsible for the full amount of the debt. If the maker defaults, the payee can pursue the co-maker for the entire debt. This shared responsibility reflects a higher level of risk for both parties, typically seen in situations where one party lacks sufficient creditworthiness.

Legal Implications of Being a Maker

The legal implications of being a maker are significant. As the primary obligor, you are legally bound to fulfill the terms of the promissory note. Failure to do so can result in several legal consequences:

- Lawsuits: The payee can file a lawsuit to recover the outstanding debt and associated costs.

- Wage Garnishment: A court order can be issued to garnish a portion of the maker’s wages to satisfy the debt.

- Bankruptcy: Repeated defaults can lead to bankruptcy proceedings.

- Damage to Credit Score: Defaulting on a promissory note will severely damage the maker's credit score, making it difficult to obtain future loans or credit.

- Repossession of Collateral: If the promissory note involves collateral, such as a car or property, default can lead to repossession.

Understanding these potential legal consequences is vital for responsible borrowing and financial management.

Best Practices for Makers

To minimize risks and ensure smooth transactions, makers should adhere to these best practices:

- Read the Promissory Note Carefully: Thoroughly review the document before signing, understanding all terms and conditions, including interest rates, repayment schedules, and penalty clauses.

- Seek Professional Advice: Consult with a lawyer or financial advisor if any aspects of the promissory note are unclear or raise concerns.

- Maintain Open Communication: If facing financial difficulties, communicate proactively with the payee to explore potential solutions, such as restructuring the repayment plan.

- Keep Accurate Records: Maintain detailed records of all payments made, along with copies of the promissory note and any supporting documentation.

- Understand Your Rights and Obligations: Be fully aware of your legal responsibilities as a maker and your rights as a borrower.

Conclusion: The Maker's Crucial Role

The maker plays a pivotal role in a promissory note, bearing the primary responsibility for repayment. Understanding their responsibilities, liabilities, and the legal implications of their involvement is crucial for both makers and payees. By understanding the nuances of this critical financial document and following best practices, individuals and entities can navigate the intricacies of promissory notes with greater confidence and minimize potential risks. Remember that a promissory note is a legally binding contract, and adherence to its terms is paramount to avoid potentially severe financial and legal repercussions. Always seek professional advice when uncertainty arises regarding the specifics of a promissory note.

Latest Posts

Latest Posts

-

What Is The Relationship Between Marginal Product And Average Product

Mar 22, 2025

-

At What Rate Must The Potential Difference Between The Plates

Mar 22, 2025

-

125 To The Power Of 2 3

Mar 22, 2025

-

Analysis Of Daffodils By William Wordsworth

Mar 22, 2025

-

Correct The Following Sentences And Rewrite Them

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Who Is The Maker In A Promissory Note . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.