Which Of The Following Is Not A Transfer Payment

News Leon

Mar 15, 2025 · 6 min read

Table of Contents

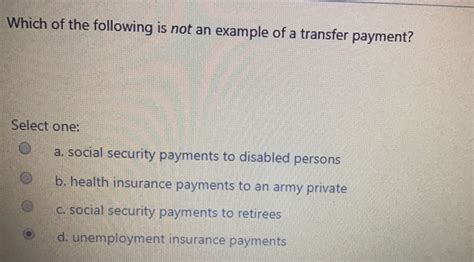

Which of the following is not a transfer payment? Understanding the nuances of government spending

Transfer payments, a cornerstone of many governments' fiscal policies, represent a significant portion of national budgets. Understanding what constitutes a transfer payment, and more importantly, what doesn't, is crucial for grasping the complexities of government finance and economic policy. This article delves deep into the definition of transfer payments, provides examples of what qualifies and, crucially, what doesn't, and explores the economic implications of these payments.

Defining Transfer Payments: A Critical Look

A transfer payment, in its simplest form, is a payment made by a government to an individual or household for which no goods or services are rendered in return. The key distinction lies in the absence of a direct quid pro quo transaction. These payments redistribute income within the economy rather than contributing directly to the production of goods and services. They are a fundamental mechanism for social welfare programs, income redistribution, and economic stabilization.

Think of it this way: when you buy a loaf of bread from a bakery, that's a market transaction. The bakery provides a good (bread), and you provide payment in return. Transfer payments, conversely, involve a payment without any such reciprocal exchange of goods or services.

Examples of Transfer Payments: A Closer Examination

Many familiar government programs represent classic examples of transfer payments. These include:

1. Social Security Benefits:

These payments are made to retirees, disabled individuals, and survivors of deceased workers. No goods or services are exchanged for these payments. They are based on prior contributions and designed to provide financial support during retirement or disability.

2. Unemployment Insurance Benefits:

Provided to individuals who have lost their jobs through no fault of their own, these benefits aim to provide temporary financial assistance while job searching. No goods or services are exchanged for receiving these benefits.

3. Welfare Payments (e.g., Temporary Assistance for Needy Families - TANF):

These programs offer financial assistance to low-income families with children, designed to help them meet basic needs. The payments themselves don't represent a direct exchange for goods or services.

4. Subsidies for Housing:

Government programs that provide financial assistance for housing, such as housing vouchers or rental subsidies, are also transfer payments. Recipients don't provide goods or services in direct exchange for these payments.

5. Medicare and Medicaid Payments:

While the healthcare services themselves aren't transfer payments, the government's payments to healthcare providers on behalf of beneficiaries are considered transfer payments. The recipient (the patient) doesn't directly provide services or goods in return. The government acts as an intermediary, transferring funds to healthcare providers.

What is NOT a Transfer Payment? The Crucial Distinction

The crucial aspect of understanding transfer payments lies in recognizing what doesn't fit the definition. Several types of government spending are frequently confused with transfer payments, but they represent distinct categories of economic activity. These include:

1. Government Purchases of Goods and Services:

This is the most fundamental difference. Government purchases directly involve the government spending money to acquire goods and services for public use. This includes:

- Defense spending: Purchasing military equipment, paying salaries to military personnel.

- Infrastructure projects: Spending on roads, bridges, schools, and hospitals. These projects generate tangible outputs and employment.

- Government salaries: Payments to government employees for their services. This is an exchange of labor for wages.

- Public services: Funding for police, fire departments, and other public services. These involve the provision of services in exchange for taxpayer funds.

These are fundamentally different from transfer payments because they directly contribute to the production of goods and services within the economy. There's a direct exchange – labor for wages, for example – or the creation of public assets.

2. Government Investment Spending:

Government investment in infrastructure (roads, bridges), research and development, and education is not a transfer payment. These investments aim to enhance future productivity and economic growth. Unlike transfer payments, they contribute directly to capital formation and economic output. The returns may not be immediate, but they are expected in the future.

3. Grants to Businesses for Specific Projects:

Government grants to businesses for specific projects (e.g., research and development, infrastructure improvements) are not transfer payments. These grants are conditional upon the business undertaking specific activities or achieving certain outcomes. There is an implicit exchange: government funding in return for a specific project or activity that benefits the broader economy. While they might involve some indirect redistribution of wealth, the core function is to stimulate economic activity and not purely redistribute existing income.

4. Interest Payments on Government Debt:

These are payments made by the government to holders of government bonds. While they might seem like a transfer payment because they don't involve a direct exchange of goods or services at that moment, they represent the cost of borrowing. The government received funds in the past in exchange for a promise to make future interest payments. Therefore, they are not strictly considered transfer payments in the purest sense, though some economists may have nuanced views on this.

The Economic Implications of Transfer Payments

Transfer payments play a vital role in shaping the economy. They influence:

- Income distribution: Transfer payments redistribute income from higher-income earners (through taxes) to lower-income earners, aiming to reduce income inequality.

- Aggregate demand: Transfer payments can stimulate aggregate demand during economic downturns by boosting disposable income among recipients.

- Economic stability: They act as automatic stabilizers, automatically increasing during recessions and decreasing during booms, helping to moderate economic fluctuations.

- Social welfare: They provide a safety net, supporting vulnerable populations and reducing poverty.

However, there are potential drawbacks:

- Fiscal burden: Large transfer payment programs can place a significant burden on government finances, potentially leading to higher taxes or increased government debt.

- Disincentives to work: Some argue that generous transfer payments can disincentivize work, potentially reducing labor supply. This is a complex issue with differing viewpoints and requires careful consideration of specific program design and labor market conditions.

- Inflationary pressures: Increased transfer payments can lead to inflationary pressures if they increase aggregate demand significantly without a corresponding increase in productive capacity.

Conclusion: Navigating the Nuances of Government Spending

Differentiating between transfer payments and other forms of government spending is paramount for understanding the government's role in the economy. Transfer payments represent a vital tool for social welfare, income redistribution, and economic stabilization, but they also carry potential economic consequences. A balanced approach that considers both the benefits and potential drawbacks is essential for effective economic policymaking. By carefully defining and analyzing transfer payments, policymakers can better design and implement programs that achieve their intended goals while minimizing unintended side effects. The distinction between what is and isn't a transfer payment helps us understand the intricate dynamics of government spending and its impact on individuals, businesses, and the overall economy. Further research into the specifics of individual government programs and their economic impact is crucial for a complete understanding of this complex area of public finance.

Latest Posts

Latest Posts

-

What Is The Least Common Multiple Of 4 And 9

Mar 15, 2025

-

Iodine Is Essential For The Synthesis Of

Mar 15, 2025

-

Is Osmosis High To Low Or Low To High

Mar 15, 2025

-

Concave Mirror And Convex Mirror Difference

Mar 15, 2025

-

Which Is Not A Cranial Bone Of The Skull

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Transfer Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.