Which Of The Following Is Not A Capital Expenditure

News Leon

Mar 29, 2025 · 6 min read

Table of Contents

Which of the Following is NOT a Capital Expenditure? Understanding CapEx vs. OpEx

Determining whether an expense is a capital expenditure (CapEx) or an operating expenditure (OpEx) is crucial for accurate financial reporting, tax planning, and effective business management. This article will delve deep into the distinction between CapEx and OpEx, providing clear examples to help you confidently identify which expense is not a capital expenditure. We'll explore the key characteristics that define each, focusing on the nuances that often cause confusion.

Understanding Capital Expenditures (CapEx)

Capital expenditures are investments a business makes to acquire or upgrade physical assets. These assets are expected to provide benefits for more than one accounting period, typically more than a year. The core idea is that CapEx increases the value or useful life of an asset, contributing to the company's long-term growth and profitability.

Key Characteristics of CapEx:

- Tangible Assets: CapEx usually involves tangible assets, meaning physical assets you can touch and see. This includes property, plant, and equipment (PP&E).

- Long-Term Benefits: The benefit from the expenditure extends beyond a single accounting period. Think of it as an investment that yields returns over several years.

- Increases Asset Value or Useful Life: The expenditure either adds to the value of an existing asset or extends its useful life. A simple repair doesn't qualify as CapEx, but a significant overhaul that extends the life of a machine does.

- Significant Cost: CapEx generally involves a substantial amount of money compared to day-to-day operating costs. The threshold can vary depending on the company's size and industry.

Examples of Capital Expenditures:

- Purchasing land or buildings: Acquiring property for business operations represents a significant long-term investment.

- Acquiring machinery and equipment: Buying new equipment for production or other business processes is a classic example.

- Constructing a new facility: Building a factory or office building is a major capital investment.

- Major renovations or improvements: Extensive renovations that significantly improve the asset's value or useful life, such as a complete overhaul of a factory floor.

- Software with a long lifespan: While not a physical asset, specialized software purchased for long-term use and costing a substantial amount may be considered CapEx. (The line here can be blurry and often depends on accounting standards used.)

- Research and Development (R&D) costs (sometimes): In certain circumstances, R&D expenditures resulting in a tangible asset with a long useful life might be classified as CapEx. However, much of R&D is treated as OpEx.

Understanding Operating Expenditures (OpEx)

Operating expenditures are the day-to-day costs associated with running a business. Unlike CapEx, OpEx is expensed in the current accounting period because its benefits are typically consumed within that period. They are essential for maintaining operations but don't significantly increase the value or useful life of assets.

Key Characteristics of OpEx:

- Maintaining Daily Operations: These costs are directly related to the business's ongoing operations.

- Short-Term Benefits: The benefit of the expenditure is realized within the current accounting period.

- No Significant Increase in Asset Value: These expenses don't add value to assets or significantly extend their useful life.

- Recurring Costs: Many OpEx items are recurring costs, such as salaries, rent, and utilities.

Examples of Operating Expenditures:

- Salaries and wages: Paying employees for their work is an ongoing operational cost.

- Rent: Paying for office space or warehouse facilities is an operational cost.

- Utilities: Electricity, water, gas, and internet bills are essential operating expenses.

- Office supplies: The cost of paper, pens, and other office supplies.

- Marketing and advertising: Costs associated with promoting products or services.

- Repairs and maintenance (minor): Routine maintenance and minor repairs that don't extend the asset's life significantly.

- Software subscriptions: Recurring monthly or annual fees for software used for day-to-day operations.

- Professional fees (legal, accounting): Regularly recurring professional fees are usually considered OpEx.

The Gray Areas: Where the Lines Blur

The distinction between CapEx and OpEx isn't always crystal clear. Several situations can lead to ambiguity:

- Materiality: A small expenditure that would normally be OpEx might be treated as CapEx if the amount is significant for the company. Conversely, a large expenditure might be spread out over multiple years for accounting purposes.

- Industry Practices: Specific industry standards and practices might influence the classification of certain expenditures.

- Accounting Standards: Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) provide guidelines, but interpretation can sometimes be subjective.

- Software and Intangible Assets: The classification of software and other intangible assets can be particularly complex and often depends on the nature of the software and its anticipated useful life.

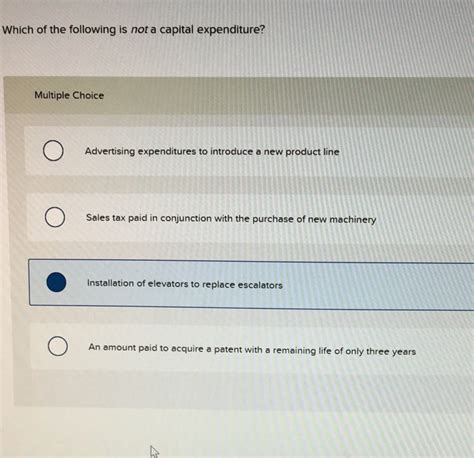

Which of the Following is NOT a Capital Expenditure? Examples and Analysis

Let's analyze several scenarios to illustrate the difference:

Scenario 1:

- Expense A: Purchasing a new delivery truck for $50,000.

- Expense B: Paying $500 for routine maintenance on an existing delivery truck.

Analysis: Expense A is a CapEx. The truck is a tangible asset with a useful life of several years, significantly increasing the company's delivery capacity. Expense B is OpEx. It's a routine maintenance cost that does not significantly increase the truck's value or useful life.

Scenario 2:

- Expense A: Spending $100,000 on a complete overhaul of the factory's production line, extending its lifespan by 5 years.

- Expense B: Paying $1,000 to repair a broken machine on the production line.

Analysis: Expense A is CapEx. The overhaul extends the production line's life, representing a significant investment. Expense B is OpEx. It's a minor repair that doesn't materially increase the production line's value or useful life.

Scenario 3:

- Expense A: Purchasing a $5,000 high-end computer for a single employee for immediate use.

- Expense B: Purchasing a $50,000 enterprise resource planning (ERP) system with a 10-year lifespan for the entire company.

Analysis: Expense A is arguably OpEx, even though it's a relatively expensive computer. Its benefit is primarily realized in the current period. Expense B is CapEx. The ERP system is a significant investment with a long-term impact on the entire company's operations.

Scenario 4:

- Expense A: Paying annual subscription fees for cloud-based software used for daily operations.

- Expense B: Purchasing a perpetual license for specialized software used for a long-term project costing $20,000.

Analysis: Expense A is OpEx. It's a recurring cost for access to a service consumed within the current period. Expense B is CapEx. It represents a substantial upfront cost with long-term benefits, resembling the purchase of a physical asset.

The Importance of Accurate CapEx vs. OpEx Classification

Accurate classification of expenses is vital for several reasons:

- Financial Reporting: Correctly categorizing expenses is crucial for preparing accurate financial statements, providing a clear picture of the company's financial health.

- Tax Planning: CapEx and OpEx are treated differently for tax purposes. Depreciation deductions are available for CapEx, impacting the company's tax liability.

- Investment Decisions: Understanding the financial implications of CapEx and OpEx informs strategic investment decisions.

- Budgeting and Forecasting: Accurate expense classification is essential for developing realistic budgets and financial forecasts.

Conclusion

Distinguishing between capital expenditures and operating expenditures requires careful consideration of the nature of the expense, its intended benefit, and its impact on the company's assets. While clear-cut examples exist, gray areas can arise. Seeking professional accounting advice can be beneficial when facing complex scenarios or significant financial implications. By understanding the principles outlined in this article, you can make more informed decisions and ensure accurate financial reporting for your business. The key takeaway is that any expenditure that primarily benefits the current period and doesn't significantly add value or extend the life of an asset is not a capital expenditure.

Latest Posts

Latest Posts

-

How Much Is 120 Hours In Days

Mar 31, 2025

-

Why Is Bone Considered Connective Tissue

Mar 31, 2025

-

One Billion Equal To How Many Crores

Mar 31, 2025

-

If The Cross Product Of Two Vectors Is Zero

Mar 31, 2025

-

How To Use Insert In Python

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Capital Expenditure . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.