Which Of The Following Is A Function That Money Serves

News Leon

Apr 01, 2025 · 6 min read

Table of Contents

Which of the Following is a Function That Money Serves? A Deep Dive into the Roles of Money in an Economy

Money. We use it every day, but how often do we stop to consider its fundamental role in our society and economy? More than just a means of exchange, money serves several crucial functions, impacting everything from individual transactions to global trade. Understanding these functions is crucial to grasping the complexities of economic systems and the vital role money plays in facilitating them. This article explores the key functions of money, examining each in detail and illustrating their interconnectedness.

The Primary Functions of Money

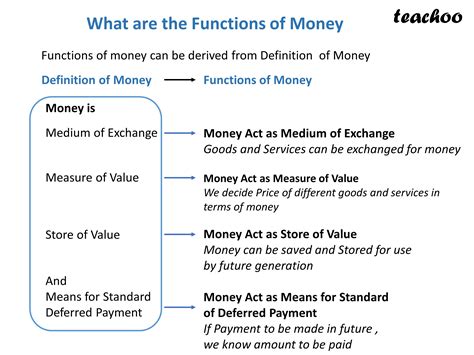

Money's functions are often categorized into three primary roles: a medium of exchange, a unit of account, and a store of value. However, it's important to note that these functions aren't mutually exclusive; they overlap and support each other in complex ways.

1. Medium of Exchange: The Facilitator of Trade

Before the widespread adoption of money, societies relied on barter systems. In a barter system, individuals exchange goods and services directly, requiring a "double coincidence of wants." This means both parties must desire what the other possesses. This system is incredibly inefficient and limits the scope of trade significantly. Imagine trying to trade your carpentry skills for groceries – you'd need to find someone who wants a new bookshelf and simultaneously needs their house repaired!

Money solves this problem. It acts as a medium of exchange, a universally accepted intermediary in transactions. Instead of directly bartering, individuals can sell their goods or services for money and then use that money to purchase other goods and services. This dramatically simplifies transactions and expands the possibilities of trade exponentially. The ease and efficiency of using money as a medium of exchange fuel economic growth and specialization.

Advantages of Money as a Medium of Exchange:

- Increased efficiency: Transactions are faster and simpler.

- Enhanced specialization: Individuals can focus on their specialized skills, knowing they can exchange their output for money to obtain other necessities.

- Expanded markets: Trade extends beyond local communities to regional, national, and even global levels.

- Reduced transaction costs: The costs associated with finding trading partners and negotiating exchanges are minimized.

2. Unit of Account: Measuring Economic Value

Money also serves as a unit of account, providing a common standard for measuring the value of goods and services. Without a unit of account, comparing the value of different items becomes incredibly difficult. How do you compare the value of a haircut to the value of a car?

Money establishes a standardized unit (like dollars, euros, or yen) to express the price of everything. This facilitates price comparisons, making informed economic decisions easier for both consumers and producers. This common measurement enables:

- Simplified price comparisons: Consumers can easily compare the prices of different products and services.

- Efficient resource allocation: Businesses can easily determine the relative costs of production and make informed choices about resource allocation.

- Clearer accounting and record-keeping: Businesses and individuals can accurately track income, expenses, and profits.

- Easier evaluation of economic performance: Economists and policymakers can better assess economic indicators, like inflation and GDP, when prices are expressed in a common unit.

3. Store of Value: Preserving Purchasing Power

Finally, money acts as a store of value, meaning it retains its purchasing power over time. This function is crucial because it allows individuals to save and defer consumption. If money didn't hold its value, there would be little incentive to save, as the purchasing power of savings would erode quickly.

However, it's important to note that money's ability to store value isn't perfect. Inflation, the general increase in prices, erodes the purchasing power of money over time. High inflation rates can severely diminish the effectiveness of money as a store of value. Similarly, deflation, a general decrease in prices, can also create problems as individuals may delay purchases anticipating further price drops. The stability of a currency's value is directly linked to its effectiveness as a store of value and confidence in the issuing monetary authority.

Secondary Functions of Money

Beyond the three primary functions, money also serves several secondary, though equally important, roles:

4. Standard of Deferred Payment: Facilitating Credit and Debt

Money serves as a standard of deferred payment, meaning it facilitates borrowing and lending. Individuals and businesses can borrow money today with the understanding that they will repay it in the future, using the same currency. This function is crucial for investment, business expansion, and consumer purchases. Credit cards, loans, and mortgages all rely on money's role as a standard of deferred payment. This aspect of money lubricates economic activity by allowing for larger-scale projects and investments that would otherwise be unattainable.

5. Means of Transferring Purchasing Power: Across Time and Space

Money efficiently transfers purchasing power across time and space. Saving money today allows individuals to make purchases in the future. Similarly, money can be easily transferred across geographical boundaries, facilitating international trade and investment. This characteristic is crucial in a globalized world where transactions often occur across vast distances. Electronic transfers, international wire transfers, and online payment systems are all examples of this function in action.

The Evolution of Money

The forms of money have evolved significantly throughout history. From bartering to commodity money (like shells or livestock), to representative money (paper money backed by a commodity), and finally to fiat money (money not backed by a commodity but declared legal tender by a government), the evolution reflects the increasing sophistication of economic systems and the growing need for efficient and reliable exchange mediums. Each stage addresses limitations of the previous form, striving for greater efficiency, stability, and ease of use. The shift to fiat currency is a testament to the trust placed in governments and the development of stable financial systems.

Challenges to Money's Functions

While money plays a vital role in the economy, several challenges can impact its effectiveness in fulfilling its functions.

- Inflation: High inflation erodes the purchasing power of money, making it a less effective store of value and potentially impacting its role as a unit of account and standard of deferred payment.

- Deflation: Similarly, deflation can discourage spending, hindering economic activity and potentially creating instability in debt markets.

- Counterfeiting: Counterfeiting undermines the integrity of money, affecting its credibility as a medium of exchange and store of value.

- Technological advancements: The rise of cryptocurrencies and digital currencies presents both opportunities and challenges to traditional monetary systems. The impact of these innovations on the functions of money is still evolving and being actively debated.

Conclusion: The Indispensable Role of Money

In conclusion, money serves multiple crucial functions in an economy, far beyond its simple role as a means of exchange. As a medium of exchange, a unit of account, a store of value, and fulfilling secondary roles like a standard of deferred payment, it underpins economic activity, promotes specialization, and facilitates global trade. While challenges exist, understanding the functions of money and the factors that affect its effectiveness is critical for both individuals and policymakers seeking to foster economic stability and growth. The continued evolution of money, driven by technological innovation and changing economic conditions, underscores its ongoing importance and adaptability in the modern world. Its versatility and capacity to adapt make it a critical component of the global economic system. The ongoing evolution of money, driven by technological advancements and changing economic landscapes, ensures its continued relevance and importance in the future of commerce and finance.

Latest Posts

Latest Posts

-

500 Rounded To The Nearest Hundred

Apr 02, 2025

-

A Feasible Solution To A Linear Programming Problem

Apr 02, 2025

-

Why Heart Is On Left Side

Apr 02, 2025

-

Molar Specific Heat At Constant Volume

Apr 02, 2025

-

Explain Why The Following Sentence Is Incorrect Es Importante

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is A Function That Money Serves . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.