Which Of The Following Are Cash Outflows From Financing Activities

News Leon

Mar 31, 2025 · 6 min read

Table of Contents

Which of the Following are Cash Outflows from Financing Activities? A Comprehensive Guide

Understanding cash flows is crucial for businesses of all sizes. Analyzing cash flow statements helps businesses track their liquidity, make informed financial decisions, and ultimately, ensure long-term sustainability. One key section of the cash flow statement focuses on financing activities, which encompass how a company raises and manages its capital. This article will delve deep into identifying cash outflows from financing activities, explaining each type with examples and highlighting their significance in financial analysis.

What are Financing Activities?

Financing activities represent the cash inflows and outflows related to how a company obtains and manages its capital structure. This includes obtaining funds through debt or equity, repaying debt, paying dividends, and repurchasing stock. Essentially, it showcases how a company funds its operations and growth. It's important to distinguish financing activities from operating activities (day-to-day business operations) and investing activities (long-term assets like property, plant, and equipment).

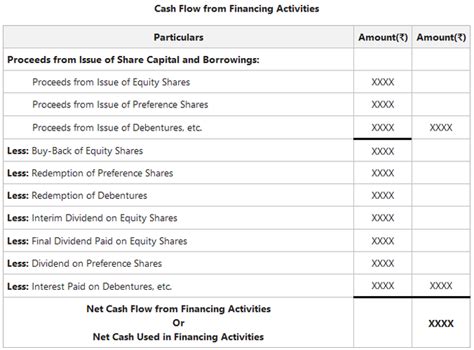

Identifying Cash Outflows from Financing Activities

Cash outflows from financing activities represent payments made by the company to external parties related to funding its operations. These outflows reduce the company's cash balance. Let's explore the key categories:

1. Repayment of Debt

This is a significant cash outflow. When a company borrows money, whether through loans, bonds, or other debt instruments, it's obligated to repay the principal amount plus any accrued interest. This repayment directly impacts the cash flow statement's financing activities section.

- Examples:

- Repayment of a bank loan.

- Redemption of bonds payable.

- Payment of lease obligations (depending on the classification of the lease).

- Paying off a mortgage.

Significance: Consistent repayment of debt demonstrates financial responsibility and strengthens a company's creditworthiness. However, excessive debt repayment can strain cash flow if not properly managed.

2. Repurchase of Stock (Share Buybacks)

Companies sometimes repurchase their own outstanding shares from the market. This reduces the number of outstanding shares, potentially increasing earnings per share (EPS) and sending a positive signal to investors. However, it also represents a cash outflow.

- Examples:

- Purchasing company shares in the open market.

- Repurchasing shares through a tender offer.

Significance: Share buybacks are strategic decisions aimed at enhancing shareholder value. However, they can deplete cash reserves, which needs to be carefully balanced against other investment opportunities.

3. Payment of Dividends

Dividends are distributions of a company's profits to its shareholders. They are a crucial aspect of shareholder return and represent a significant cash outflow, especially for companies with a long history of consistent dividend payments.

- Examples:

- Cash dividends paid to common stockholders.

- Cash dividends paid to preferred stockholders.

Significance: Dividends signal financial health and stability, attracting investors seeking regular income. However, the decision to pay dividends should consider the company's growth prospects and future investment needs. A company might choose to reinvest profits rather than distribute dividends to fund expansion or research and development.

4. Payment of Lease Liabilities

Depending on the classification of a lease (operating or finance lease), lease payments might be classified under financing activities. Finance lease payments, which transfer substantially all the risks and rewards of ownership to the lessee, are considered financing activities.

- Examples:

- Payments made under a finance lease agreement for equipment or property.

Significance: Lease payments reflect a commitment to using assets while managing capital expenditures. Properly managing lease obligations is crucial for maintaining a healthy financial position.

5. Issuance of Treasury Stock

While less common than other outflows, the purchase of treasury stock is a cash outflow from financing activities. This is different from a share buyback, where the company retires the shares. Issuing treasury stock means the company already owns these shares, and they are being sold.

Significance: This can be part of a broader compensation plan or a strategic move to manage share prices.

6. Payments to redeem preferred stock.

Preferred stock is a type of equity financing that offers shareholders preferential treatment compared to common stock holders regarding dividends. Repaying preferred stockholders constitutes a cash outflow from financing activities.

Significance: This signifies that the company is streamlining its equity structure and potentially reducing its cost of capital.

Distinguishing between Outflows and Inflows

It is crucial to differentiate between cash outflows and inflows in financing activities. While the above details outflows, it's important to understand the counterpart:

- Cash Inflows: These are increases in cash from financing activities. Examples include: issuing new equity (stock), obtaining loans, issuing bonds, receiving proceeds from convertible debt.

Analyzing Cash Outflows: Key Metrics and Considerations

Analyzing cash outflows from financing activities requires a holistic approach. Here are some key metrics and considerations:

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing relative to equity financing. A high ratio suggests higher reliance on debt, implying greater financial risk but potentially faster growth.

- Interest Coverage Ratio: This ratio measures a company's ability to meet its interest obligations. A lower ratio signifies potential difficulties in servicing debt.

- Dividend Payout Ratio: This ratio shows the percentage of earnings distributed as dividends. A high ratio indicates a greater commitment to shareholder returns but might limit reinvestment opportunities.

- Free Cash Flow: This represents the cash flow available after accounting for capital expenditures and working capital needs. It provides a clearer picture of a company's financial flexibility.

- Debt Maturity Schedule: Analyzing the maturity schedule helps understand the timing of future debt repayments and associated cash outflows.

The Importance of Analyzing Financing Activities

Analyzing cash flows from financing activities offers valuable insights into a company's financial health and strategic direction. This analysis helps:

- Assess Financial Risk: Understanding the level of debt and dividend payouts helps assess the company's financial risk profile.

- Evaluate Capital Structure: Analyzing how a company finances its operations provides insight into its capital structure strategy.

- Predict Future Cash Flows: Analyzing historical trends can help predict future cash flows from financing activities, supporting better financial planning.

- Compare to Industry Peers: Comparing a company's financing activities to industry peers allows for a relative assessment of its financial health and strategy.

- Identify Potential Problems: Analyzing unusual or significant changes in financing activities can signal potential problems that need immediate attention.

Conclusion

Cash outflows from financing activities are a critical component of a company's financial performance. Understanding the different types of outflows, their implications, and the relevant metrics allows for a comprehensive assessment of a company's financial health, strategic direction, and future prospects. By carefully analyzing these outflows, investors and business managers can make better-informed decisions, mitigate risks, and enhance the long-term success of the business. Remember that consistent monitoring and analysis are essential for effective financial management.

Latest Posts

Latest Posts

-

A Process By Which Information Is Exchanged Between Individuals

Apr 02, 2025

-

Select The Four Statements About Plasmodium That Are True

Apr 02, 2025

-

Greatest Common Factor Of 36 And 20

Apr 02, 2025

-

What Is The Antonym Of Urban

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Are Cash Outflows From Financing Activities . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.