The Margin Of Safety Is The Excess Of

News Leon

Mar 25, 2025 · 6 min read

Table of Contents

The Margin of Safety: Excess of What, and Why It Matters

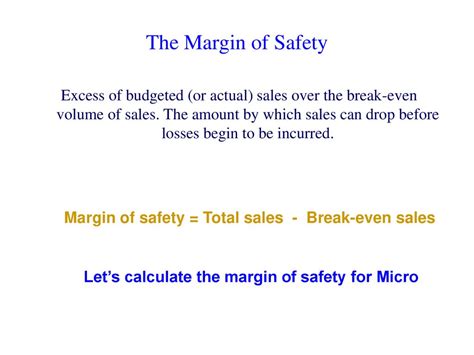

The margin of safety, a cornerstone of value investing championed by Benjamin Graham, isn't just about numbers; it's about managing risk and securing long-term returns. It's the excess of a company's intrinsic value over its market price. This "excess" acts as a buffer, protecting your investment from unforeseen circumstances and market volatility. Understanding precisely what this excess encompasses is crucial for successfully employing this powerful investing principle.

Defining the Margin of Safety: More Than Just a Price Discount

The margin of safety isn't simply buying a stock at a discount. While a low price relative to intrinsic value is a component, it's much more nuanced. It's the excess of:

1. Intrinsic Value Over Market Price: The Core Concept

This is the most fundamental aspect. Intrinsic value represents the true worth of a company, based on its assets, earnings potential, and future growth prospects. It's a subjective estimation, requiring thorough fundamental analysis. The margin of safety is the difference between this estimated intrinsic value and the current market price. A larger gap signifies a greater margin of safety.

Example: If you estimate a company's intrinsic value at $100 per share, and the market price is $70, you have a $30 margin of safety ($30/$100 = 30% margin of safety). This 30% cushion protects against potential errors in your valuation and market fluctuations.

2. Projected Earnings Over Current Earnings: A Future-Oriented Perspective

The margin of safety isn't solely focused on the present. It also considers the potential for future earnings growth. A company with a strong track record and promising future prospects offers a greater margin of safety, even if its current earnings are modest. This "excess" potential represents the upside if your estimations prove conservative.

Example: A company currently earning $1 per share might be projected to earn $1.50 per share within three years. This projected "excess" in earnings contributes to the overall margin of safety, bolstering investor confidence in future returns.

3. Asset Value Over Market Capitalization: A Net-Asset Value Focus

For value investors, particularly those following Graham's principles, the net asset value (NAV) plays a significant role. NAV represents the liquidation value of a company's assets, minus its liabilities. A significant difference between the NAV and market capitalization suggests a margin of safety. This is especially relevant for companies with significant tangible assets, like real estate or manufacturing facilities.

Example: A company with a NAV of $100 million but a market capitalization of $70 million offers a built-in margin of safety. Even if the company's operations struggle, the underlying asset value offers a floor to the share price.

4. Conservative Estimations Over Optimistic Projections: Avoiding Overconfidence

A crucial element of the margin of safety is the deliberate use of conservative estimations. Value investors are inherently skeptical, avoiding optimistic forecasts and focusing on worst-case scenarios. This cautious approach adds to the "excess" protection.

Example: Instead of projecting aggressive growth rates, a value investor might use more moderate assumptions, potentially underestimating the future earnings. This built-in conservatism strengthens the margin of safety, even if the actual results surpass expectations.

5. Diversification Over Concentration: Spreading Risk

While a large margin of safety on an individual investment offers significant protection, diversification across multiple investments further enhances the overall margin of safety for the portfolio. This "excess" protection mitigates the risk associated with individual company failures.

Example: Instead of investing heavily in a single stock with a high margin of safety, diversifying across multiple companies with varying margins of safety reduces the potential for significant portfolio losses even if some individual investments underperform.

Why is the Margin of Safety Crucial?

The margin of safety acts as a powerful safeguard against several potential pitfalls:

- Valuation Errors: No valuation is perfect. Fundamental analysis involves estimations and judgments that are inherently subjective. The margin of safety accounts for these potential errors, ensuring you're not overly exposed to valuation mistakes.

- Market Volatility: Stock markets are inherently volatile. Short-term price fluctuations can significantly impact portfolio value. The margin of safety provides a buffer, protecting against temporary drops in price.

- Unforeseen Events: Unexpected events—economic downturns, industry disruptions, or company-specific issues—can significantly affect a company's performance. The margin of safety helps weather these storms.

- Management Misconduct: Poor management decisions can severely damage a company's value. The margin of safety provides a degree of insulation against such risks.

- Uncertain Future: Predicting the future is impossible. The margin of safety acknowledges this uncertainty and accounts for potential deviations from expected outcomes.

Practical Applications and Considerations

Building a portfolio with a margin of safety requires diligent research and a long-term perspective. Here are some practical steps:

- Thorough Fundamental Analysis: Invest significant time in understanding a company's financials, competitive landscape, management team, and industry dynamics.

- Conservative Valuation Techniques: Employ valuation methods like discounted cash flow analysis (DCF), but use conservative assumptions about growth rates, discount rates, and future earnings.

- Focus on Quality Businesses: Invest in fundamentally sound businesses with a solid track record, strong competitive advantages, and sustainable business models.

- Patience and Discipline: Finding undervalued companies takes time. Don't rush into investments, and avoid emotional decision-making.

- Regular Monitoring and Re-evaluation: Continuously monitor your investments and re-evaluate your valuations periodically to adjust your positions as needed. This ongoing assessment is crucial for maintaining an adequate margin of safety.

The Margin of Safety in Different Investment Contexts

The principle of the margin of safety isn't confined to individual stocks. It applies across various investment contexts:

- Real Estate: Buying real estate at a price below its intrinsic value, considering factors like rental income, comparable property values, and potential appreciation.

- Bonds: Purchasing bonds that yield significantly above the prevailing interest rates, accounting for potential credit risk and default probabilities.

- Private Equity: Investing in private companies with significant undervaluation, leveraging due diligence and negotiations to secure a favorable price.

Beyond the Numbers: The Psychological Aspect

The margin of safety isn't just about mathematical calculations; it also involves a psychological element. It fosters a mindset of humility and caution, acknowledging the limitations of our knowledge and the inherent uncertainties of investing. By focusing on the margin of safety, investors build resilience to market fluctuations and emotional biases, leading to more rational and effective investment decisions.

Conclusion: Embracing the Excess for Long-Term Success

The margin of safety, as the "excess" of intrinsic value over market price and incorporating various forms of "excess" protection, is a powerful tool for mitigating risk and generating long-term returns. By carefully considering the multiple aspects of the margin of safety and adopting a disciplined approach, investors can significantly improve their chances of success in navigating the complexities of the financial markets. It's not about chasing high returns; it's about securing your capital and achieving consistent, sustainable growth over the long term. The "excess" you build into your investments is your shield against the inevitable storms of the market. Remember, investing is a marathon, not a sprint, and the margin of safety is your endurance training.

Latest Posts

Latest Posts

-

Genes Had Been Absent On The Chromosomes

Mar 28, 2025

-

Which Of The Following Is A Nonrenewable Source Of Energy

Mar 28, 2025

-

An Improvement In Production Technology Will

Mar 28, 2025

-

If 2 X 1 14 Then X

Mar 28, 2025

-

How Many Mm Are In 50 Cm

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about The Margin Of Safety Is The Excess Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.