The Average Propensity To Consume Refers To:

News Leon

Apr 01, 2025 · 6 min read

Table of Contents

The Average Propensity to Consume: A Deep Dive into Consumer Spending Habits

The average propensity to consume (APC) is a crucial economic concept that describes the proportion of disposable income that households typically spend on consumption. Understanding APC is vital for businesses, policymakers, and economists alike, as it offers valuable insights into consumer behavior, economic growth, and the overall health of an economy. This article will delve deep into the concept of APC, exploring its definition, calculation, factors influencing it, its relationship with other economic indicators, and its implications for economic forecasting and policymaking.

Defining the Average Propensity to Consume (APC)

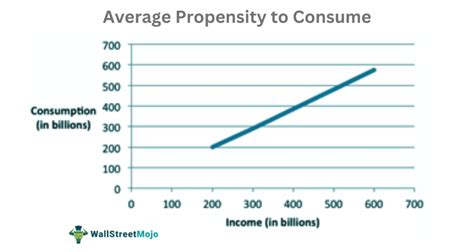

The average propensity to consume (APC) is simply the ratio of total consumption expenditure to total disposable income. In simpler terms, it represents the percentage of disposable income that a household or the entire economy spends rather than saving. The formula is straightforward:

APC = Total Consumption Expenditure / Total Disposable Income

Where:

- Total Consumption Expenditure: This encompasses all spending by households on goods and services, including durable goods (like cars and appliances), non-durable goods (like food and clothing), and services (like healthcare and education).

- Total Disposable Income: This represents the income available to households after taxes and other deductions have been made. It's the income that households can freely choose to spend or save.

A high APC indicates that a significant portion of disposable income is being spent, suggesting strong consumer confidence and a healthy economy. Conversely, a low APC suggests that households are saving a larger proportion of their income, potentially indicating economic uncertainty or caution.

Calculating the Average Propensity to Consume

Calculating the APC is relatively straightforward, requiring only two key pieces of data: total consumption expenditure and total disposable income. These data are typically obtained from national income accounts compiled by government statistical agencies. For example, if a household has a disposable income of $50,000 and spends $40,000, their APC is:

APC = $40,000 / $50,000 = 0.8 or 80%

This indicates that the household spends 80% of its disposable income and saves the remaining 20%. It is important to note that APC can be calculated for an individual household, a specific group of households, or for the entire economy. The macroeconomic APC offers a broader picture of consumer spending patterns within a nation.

Factors Influencing the Average Propensity to Consume

Several factors influence a household's or an economy's APC. These can be broadly categorized into:

1. Income Level:

The most significant factor influencing APC is the level of disposable income. Generally, households with lower disposable incomes tend to have a higher APC. This is because essential needs consume a larger portion of their income, leaving less for saving. As income increases, the APC typically decreases, as households can afford to save a larger share of their income after meeting their basic needs. This relationship is often described by Keynesian economics.

2. Consumer Confidence:

Consumer confidence plays a crucial role in determining spending habits. During periods of economic uncertainty or pessimism, consumers tend to save more and spend less, resulting in a lower APC. Conversely, periods of high consumer confidence are typically associated with increased spending and a higher APC.

3. Interest Rates:

Interest rates influence borrowing costs and saving returns. High interest rates make borrowing more expensive, potentially discouraging consumption. At the same time, high interest rates incentivize saving, as returns are higher. Conversely, low interest rates can encourage borrowing and spending, resulting in a higher APC.

4. Wealth Effects:

Changes in household wealth, including assets like real estate and stocks, also impact APC. An increase in wealth can boost consumer confidence and spending, leading to a higher APC. Conversely, a decrease in wealth can lead to reduced spending and a lower APC.

5. Government Policies:

Government policies, such as tax cuts or increases in social welfare benefits, can significantly influence disposable income and, consequently, APC. Tax cuts increase disposable income, potentially leading to higher spending and a higher APC. Conversely, tax increases can reduce disposable income and lower the APC. Similarly, government spending programs can stimulate consumption and influence the APC.

6. Inflation:

High inflation erodes the purchasing power of money, potentially leading to increased spending to maintain the same standard of living. This could result in a higher APC, but this increased spending may not be sustainable in the long run.

The Relationship between APC and Other Economic Indicators

The APC is closely related to several other important economic indicators, including:

-

Average Propensity to Save (APS): APS is the complement of APC. It represents the proportion of disposable income saved rather than spent. The sum of APC and APS always equals 1 (or 100%). APS = 1 - APC.

-

Marginal Propensity to Consume (MPC): MPC represents the change in consumption resulting from a change in disposable income. It focuses on the incremental change in spending rather than the overall proportion.

-

Marginal Propensity to Save (MPS): MPS is the complement of MPC, representing the change in savings resulting from a change in disposable income.

-

Gross Domestic Product (GDP): APC plays a vital role in determining GDP growth. Higher APC generally contributes to higher GDP growth, as increased consumption drives economic activity.

Implications for Economic Forecasting and Policymaking

Understanding APC is crucial for economic forecasting and policymaking. Economists use APC data to predict future consumer spending, which is a major component of GDP. Changes in APC can signal shifts in economic trends, allowing policymakers to take proactive measures to stabilize the economy. For instance, a declining APC might indicate a looming recession, prompting policymakers to consider fiscal stimulus or monetary easing policies to boost consumer spending.

APC and the Business Cycle

The APC fluctuates throughout the business cycle. During periods of economic expansion, consumer confidence is generally high, leading to increased spending and a higher APC. Conversely, during recessions, consumer confidence declines, leading to reduced spending and a lower APC. Businesses closely monitor APC to anticipate changes in consumer demand and adjust their production and investment strategies accordingly.

International Comparisons of APC

APC varies significantly across countries due to differences in income distribution, cultural factors, and government policies. Countries with higher levels of income inequality often exhibit a wider range of APC across different income groups. Cultural factors influencing saving habits also play a significant role in determining national APC.

Limitations of APC

While APC provides valuable insights into consumer behavior, it's essential to acknowledge its limitations:

-

Aggregation: Using aggregate APC data can mask variations in spending patterns across different income groups or demographic segments.

-

Time Lags: Changes in APC may not immediately reflect changes in disposable income or other influencing factors.

-

Other Factors: The APC model does not explicitly account for all the factors that influence consumer spending, such as consumer expectations, technological advancements, and the availability of credit.

Conclusion

The average propensity to consume is a multifaceted economic concept with significant implications for understanding consumer behavior, forecasting economic trends, and informing policy decisions. By analyzing APC, businesses and policymakers can gain valuable insights into the health of the economy and make informed decisions to stimulate economic growth and improve overall well-being. While the APC model has its limitations, it remains a crucial tool for understanding the dynamics of consumer spending and its impact on the broader economy. Continued research and refinement of the APC model, incorporating additional variables and addressing its limitations, will further enhance its value in economic analysis and forecasting.

Latest Posts

Latest Posts

-

A Long And Branched Chain Of Glucose Molecules Is

Apr 02, 2025

-

What Phase Does The Cytoplasm Divide

Apr 02, 2025

-

A Clique Is A Group Of

Apr 02, 2025

-

Determine The Quantity Of Molecules In 2 00 Moles Of P4

Apr 02, 2025

-

Which Of The Following Compounds Have The Same Empirical Formula

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about The Average Propensity To Consume Refers To: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.