Recording Transactions And Events Is Known As

News Leon

Mar 22, 2025 · 6 min read

Table of Contents

Recording Transactions and Events: A Comprehensive Guide to Bookkeeping and Accounting

Recording transactions and events is the bedrock of any successful business. Whether you're a sole proprietor meticulously tracking expenses in a spreadsheet or a multinational corporation managing complex financial systems, accurately and efficiently recording your financial activities is paramount. This process, broadly known as bookkeeping, forms the foundation upon which accounting rests. Understanding how to record transactions and events effectively is crucial for informed decision-making, tax compliance, securing financing, and ultimately, achieving long-term financial success.

What is Bookkeeping? The Foundation of Financial Health

Bookkeeping is the systematic and chronological recording of financial transactions. This involves documenting all financial activities, both inflows (receipts) and outflows (payments), within a business. Think of it as the meticulous record-keeping aspect of managing finances. This detailed record-keeping allows for:

- Accurate Financial Statements: The foundation of accurate balance sheets, income statements, and cash flow statements.

- Tax Compliance: Provides the necessary data for preparing accurate tax returns, preventing penalties and audits.

- Financial Planning & Forecasting: Enables informed financial planning and forecasting, helping businesses make strategic decisions.

- Investor Confidence: Demonstrates financial transparency and accountability, building trust with potential investors.

- Improved Efficiency: Streamlines the financial management process, reducing errors and saving time.

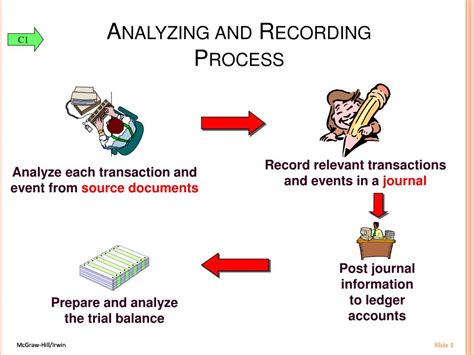

Key Aspects of Recording Transactions and Events

Effective bookkeeping involves several key aspects:

1. Source Documents: The Evidence Trail

Every transaction needs supporting documentation. These source documents serve as evidence of the financial activity and are crucial for auditing purposes. Examples include:

- Invoices: Bills issued to customers for goods or services rendered.

- Receipts: Proof of payment for expenses.

- Bank Statements: Records of all bank transactions.

- Credit Card Statements: Summary of all credit card transactions.

- Payroll Records: Documentation of employee wages and deductions.

- Contracts: Agreements that outline financial obligations.

Maintaining organized source documents is essential. A well-organized system makes the bookkeeping process significantly more efficient and reduces the risk of errors.

2. The Double-Entry Bookkeeping System: Maintaining Balance

The cornerstone of modern accounting is the double-entry bookkeeping system. This system ensures that for every transaction, there's a corresponding debit and credit entry. The fundamental accounting equation – Assets = Liabilities + Equity – always remains balanced. Understanding debits and credits is crucial:

- Debits: Increase the balance of asset accounts, expense accounts, and dividend accounts. They decrease the balance of liability accounts, equity accounts, and revenue accounts.

- Credits: Increase the balance of liability accounts, equity accounts, and revenue accounts. They decrease the balance of asset accounts, expense accounts, and dividend accounts.

This system automatically detects errors, as any imbalance signals a problem that requires immediate investigation.

3. Chart of Accounts: Organizing Financial Information

A chart of accounts is a structured list of all accounts used in a business's bookkeeping system. This acts as a financial organizational framework. Each account represents a specific category of financial activity, such as cash, accounts receivable, inventory, accounts payable, revenue, and expenses. A well-structured chart of accounts is critical for:

- Efficient Recording: Facilitates accurate and efficient recording of transactions.

- Financial Reporting: Simplifies the process of generating financial reports.

- Data Analysis: Enables effective analysis of financial data for decision-making.

4. Journal Entries: Recording Transactions in Detail

Journal entries are formal records of each transaction. They include the date, accounts affected, debits and credits, and a brief description. The journal acts as a chronological record of all financial activities.

5. Ledger: Summarizing Accounts

A ledger summarizes all transactions for each specific account in the chart of accounts. It shows the beginning balance, all transactions affecting the account, and the ending balance. The ledger provides a detailed view of the activity in each account.

6. Trial Balance: Verifying Accuracy

A trial balance is a summary of all general ledger accounts and their balances at a specific point in time. It verifies that the total debits equal the total credits, ensuring the fundamental accounting equation remains balanced. While a balanced trial balance doesn't guarantee error-free bookkeeping, it's a crucial step in identifying potential discrepancies.

Types of Transactions and Events Recorded

A wide range of transactions and events need to be recorded. These can be broadly categorized as:

1. Revenue Transactions: Sales and Income

These represent the inflow of funds from business activities. Examples include:

- Sales of Goods: Revenue generated from the sale of products.

- Service Revenue: Revenue earned from providing services.

- Interest Income: Income earned from interest-bearing accounts.

- Rental Income: Income generated from renting out property.

2. Expense Transactions: Costs of Doing Business

These represent the outflow of funds to support business operations. Examples include:

- Cost of Goods Sold (COGS): The direct costs associated with producing goods sold.

- Salaries and Wages: Compensation paid to employees.

- Rent Expense: Payment for the use of property.

- Utilities Expense: Payments for electricity, water, and other utilities.

- Marketing and Advertising Expense: Costs associated with promoting products or services.

3. Asset Transactions: Purchases and Disposals

Assets are resources controlled by a business as a result of past events and from which future economic benefits are expected to flow to the entity. Examples of asset transactions:

- Purchase of Equipment: Acquisition of equipment for business use.

- Purchase of Inventory: Acquisition of goods for resale.

- Depreciation: The systematic allocation of the cost of an asset over its useful life.

- Disposal of Assets: Sale or write-off of assets.

4. Liability Transactions: Obligations to Others

Liabilities are present obligations of an entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. Examples of liability transactions:

- Accounts Payable: Amounts owed to suppliers for goods or services.

- Loans Payable: Amounts owed to lenders.

- Salaries Payable: Amounts owed to employees for wages earned but not yet paid.

- Taxes Payable: Amounts owed to government agencies for taxes.

5. Equity Transactions: Investments and Withdrawals

Equity represents the owners' stake in the business. Examples of equity transactions:

- Owner's Investment: Capital contributed by the owner(s).

- Owner's Withdrawals: Funds withdrawn by the owner(s) from the business.

The Importance of Accurate Record Keeping

The accuracy and timeliness of recorded transactions are critical for several reasons:

- Accurate Financial Reporting: Misstatements can lead to inaccurate financial reports, impacting decision-making and investor confidence.

- Tax Compliance: Inaccurate records can result in penalties, interest, and audits from tax authorities.

- Fraud Prevention: Accurate record-keeping acts as a deterrent to fraud.

- Improved Business Management: Detailed financial data enables better management of resources and improved operational efficiency.

Modern Bookkeeping Tools and Technologies

Technology has revolutionized bookkeeping, offering a range of tools to streamline the process:

- Accounting Software: Software like QuickBooks, Xero, and FreshBooks automate many bookkeeping tasks, reducing manual effort and improving accuracy.

- Cloud-Based Solutions: Cloud-based accounting software allows access to financial data from anywhere, promoting collaboration and enhancing efficiency.

- Automated Data Entry: Some software packages can automate data entry from source documents, reducing the risk of human error.

Conclusion: The Unsung Hero of Business Success

Recording transactions and events – the essence of bookkeeping – is not merely a compliance requirement; it's a crucial element of business success. By accurately and efficiently recording financial activities, businesses gain valuable insights into their financial health, make informed decisions, attract investors, and ensure long-term sustainability. Investing in a robust bookkeeping system and leveraging available technologies are key steps in achieving this financial clarity and fostering sustainable growth. Remember, detailed, accurate bookkeeping is the foundation upon which informed business decisions are built. It’s the unsung hero that quietly powers success.

Latest Posts

Latest Posts

-

Another Name For The Matrix Structure Is The

Mar 24, 2025

-

The Cpu Consists Of Which Two Parts

Mar 24, 2025

-

How Many Electrons Does Chloride Have

Mar 24, 2025

-

Are Frogs Herbivores Carnivores Or Omnivores

Mar 24, 2025

-

Which Of The Following Statements Regarding Radioactive Decay Is True

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Recording Transactions And Events Is Known As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.