Long-run Equilibrium In Perfect Competition Results In

News Leon

Mar 28, 2025 · 7 min read

Table of Contents

Long-Run Equilibrium in Perfect Competition: A Detailed Analysis of Results

The concept of long-run equilibrium in perfect competition is a cornerstone of microeconomic theory. It describes the state where firms in a perfectly competitive market are earning zero economic profit, and there's no incentive for firms to enter or exit the market. Understanding this equilibrium is crucial for comprehending market dynamics, resource allocation, and overall economic efficiency. This article delves deep into the characteristics of this equilibrium, its implications, and the factors that influence its attainment.

Defining Perfect Competition

Before exploring long-run equilibrium, it's crucial to define the characteristics of a perfectly competitive market. These characteristics, often considered idealized, serve as a benchmark against which real-world markets can be compared. They include:

- Large Number of Buyers and Sellers: No single buyer or seller can influence the market price. Their individual actions have negligible impact on the overall supply and demand.

- Homogenous Products: All firms produce identical goods or services, making them perfect substitutes. Consumers see no difference between products offered by different firms.

- Free Entry and Exit: Firms can easily enter or exit the market without significant barriers like high start-up costs, government regulations, or patents.

- Perfect Information: Buyers and sellers have complete knowledge of prices, quality, and other relevant market information.

- No Transaction Costs: There are no costs associated with buying or selling, such as search costs or transportation costs.

Short-Run Equilibrium vs. Long-Run Equilibrium

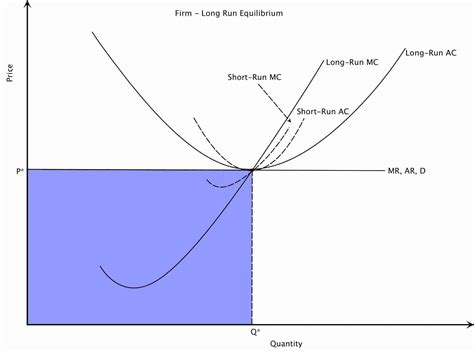

It's important to differentiate between short-run and long-run equilibrium. In the short-run, firms can adjust their output levels but not their plant size or number of firms in the market. Firms can earn economic profits or losses. In contrast, the long-run allows for adjustments in both output and the number of firms. Crucially, in perfect competition, the long run leads to a state of zero economic profit.

The Path to Long-Run Equilibrium

The journey to long-run equilibrium involves a dynamic process driven by profit signals. Let's trace the steps:

-

Positive Economic Profits (Short-Run): If firms in a perfectly competitive market are earning positive economic profits in the short run (meaning revenue exceeds total costs, including opportunity costs), this attracts new firms to enter the market. The lure of profit incentivizes entrepreneurs to invest and begin production.

-

Increased Supply: The entry of new firms increases the market supply, shifting the supply curve to the right. This leads to a decrease in the market price. This price decrease occurs because the increased supply now exceeds the existing demand at the previous price level.

-

Decreased Profits: As the market price falls, the economic profits of existing firms decline. The fall in price reduces revenue, squeezing profit margins until economic profits reach zero.

-

Zero Economic Profit (Long-Run): The process continues until economic profits are driven down to zero. At this point, there's no longer an incentive for new firms to enter the market. The market reaches long-run equilibrium. This doesn't mean that firms are not making accounting profits (revenue minus explicit costs). Zero economic profit means that the return on investment is equal to what could be earned in the next best alternative investment.

-

Negative Economic Profits (Short-Run) & Market Exit: If, instead of positive profits, firms experience negative economic profits (losses) in the short run, some firms will choose to exit the market. This reduces market supply, shifting the supply curve to the left, increasing the market price, and reducing losses until firms return to the break-even point of zero economic profit in the long run.

Characteristics of Long-Run Equilibrium in Perfect Competition

The long-run equilibrium in perfect competition exhibits several key characteristics:

- Zero Economic Profit: Firms earn zero economic profit, meaning their total revenue exactly covers their total costs, including both explicit (e.g., wages, rent) and implicit (opportunity) costs.

- Efficient Allocation of Resources: Resources are allocated efficiently because firms produce at the minimum point of their average total cost curves. This ensures that goods are produced at the lowest possible cost.

- Productive Efficiency: Firms produce at the lowest possible average total cost, minimizing waste and maximizing efficiency.

- Allocative Efficiency: The market produces the quantity of goods and services that consumers desire at a price that reflects the marginal cost of production. This aligns production with consumer preferences.

- No Incentive for Entry or Exit: With zero economic profit, there's no incentive for new firms to enter or existing firms to exit the market. The market is in a stable state.

- Price equals Marginal Cost (P=MC): In the long run, the market price equals the marginal cost of production for each firm. This is a critical condition for allocative efficiency.

- Price equals Minimum Average Total Cost (P=Min ATC): The market price also equals the minimum average total cost. This signifies productive efficiency.

Implications of Long-Run Equilibrium

The attainment of long-run equilibrium in perfect competition has several significant implications:

- Consumer Surplus Maximization: Consumers benefit from the low prices and efficient resource allocation resulting in a maximization of consumer surplus.

- Static Efficiency: The market is statically efficient because it achieves both productive and allocative efficiency. This means resources are used efficiently and the right mix of goods is produced.

- Dynamic Inefficiency (A potential caveat): While statically efficient, perfect competition might not always be dynamically efficient. This means it might not incentivize innovation and technological advancements. The lack of economic profit discourages investment in research and development.

Factors Affecting the Attainment of Long-Run Equilibrium

Several factors can influence how quickly or whether a market achieves long-run equilibrium:

- Barriers to Entry and Exit: High start-up costs or government regulations can hinder free entry and exit, delaying or preventing the attainment of long-run equilibrium.

- Technological Change: Technological advancements can shift cost curves, causing a temporary disruption before a new equilibrium is established. New technologies might lead to temporary economic profits, attracting new firms and triggering the process of adjustment again.

- Changes in Consumer Preferences: Shifts in consumer demand can affect the market price and profitability, necessitating adjustments to reach a new equilibrium.

- Government Intervention: Policies like price ceilings or subsidies can distort the market and prevent the establishment of a free-market equilibrium.

Real-World Applications and Limitations

While perfect competition is a theoretical model, some real-world markets approximate its characteristics. Agricultural markets, for instance, often exhibit features of perfect competition, particularly in the case of staple crops with numerous small farms. However, it's crucial to acknowledge the limitations of the model:

- Information Asymmetry: Perfect information is rarely attained in real-world markets. Buyers and sellers frequently possess unequal information, impacting market outcomes.

- Product Differentiation: Products are seldom perfectly homogeneous. Minor differences in quality, branding, or location lead to imperfect substitutes.

- Barriers to Entry and Exit: Significant barriers, such as high capital requirements or strong brand loyalty, often exist in real-world markets.

- Imperfect Mobility of Resources: Resources do not always move freely between industries.

Conclusion

The long-run equilibrium in perfect competition is a powerful concept that highlights the potential for efficient resource allocation and consumer surplus maximization under ideal market conditions. While real-world markets rarely perfectly match the model, understanding this equilibrium provides a valuable benchmark for analyzing market dynamics and evaluating the effects of various economic policies. The process of reaching this equilibrium involves a dynamic interaction between supply and demand, driven by profit signals that guide firm entry, exit, and adjustments in output. Despite its limitations, the model provides a critical foundation for economic analysis and understanding market efficiency. The zero economic profit condition, while seemingly negative, is indicative of a market functioning in a way that doesn't attract further competitors, signaling a state of stability and efficient allocation of resources. Studying this equilibrium further enables a better comprehension of market functioning, resource allocation, and the interaction between market forces.

Latest Posts

Latest Posts

-

Oxidation State Of O In Oh

Mar 31, 2025

-

Orbitals That Have The Same Energy Are Called

Mar 31, 2025

-

Sugar Dissolve In Water Physical Or Chemical

Mar 31, 2025

-

A Homogeneous Equation Is Always Consistent

Mar 31, 2025

-

Why Does The Sun Appear White At Noon

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Long-run Equilibrium In Perfect Competition Results In . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.