Long Run Equilibrium For Perfect Competition

News Leon

Mar 18, 2025 · 7 min read

Table of Contents

Long-Run Equilibrium in Perfect Competition: A Comprehensive Guide

The concept of equilibrium is central to understanding how markets function. In economics, equilibrium represents a state of balance where opposing forces are equal. For perfectly competitive markets, this equilibrium manifests differently in the short run and the long run. While short-run equilibrium allows for potential economic profits or losses, the long run sees a powerful adjustment mechanism that drives the market towards a unique and stable equilibrium point characterized by zero economic profits. This article delves into the intricacies of long-run equilibrium in perfect competition, exploring its defining characteristics, the underlying forces that drive its establishment, and its implications for market efficiency.

Defining Perfect Competition

Before diving into long-run equilibrium, it's crucial to understand the characteristics of a perfectly competitive market. These characteristics, often idealized, provide the theoretical framework for analyzing market behavior. A perfectly competitive market is defined by:

- Many buyers and sellers: No single buyer or seller can influence the market price. They are price takers.

- Homogenous products: The products offered by different firms are identical, offering no differentiation in quality, features, or branding.

- Free entry and exit: Firms can easily enter or exit the market without facing significant barriers, such as high start-up costs or government regulations.

- Perfect information: Buyers and sellers have complete knowledge of prices, quality, and technology.

- No externalities: The production or consumption of the good doesn't impose costs or benefits on third parties.

- No government intervention: The market operates without price controls, subsidies, or taxes.

These conditions, though rarely perfectly met in the real world, serve as a useful benchmark for understanding market dynamics and comparing real-world markets to this idealized model.

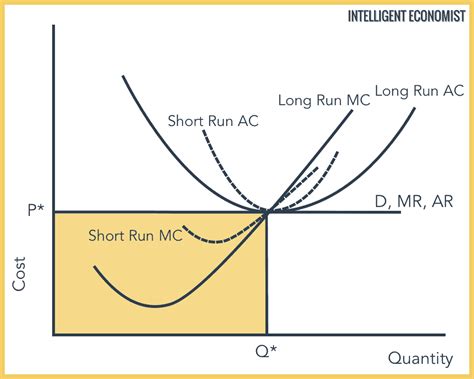

Short-Run Equilibrium vs. Long-Run Equilibrium

In the short run, firms can adjust their output levels by changing the amount of variable inputs (like labor) they employ, but they cannot change their fixed inputs (like capital). This means that firms can experience economic profits or losses. The short-run equilibrium is determined by the intersection of market demand and market supply, establishing a market price. Individual firms then choose their output level where their marginal cost (MC) equals the market price (P), maximizing their profits (or minimizing their losses).

The long run, however, allows firms to adjust all their inputs, including fixed factors. This flexibility significantly alters the market dynamics. The long-run equilibrium is a more stable and efficient state where the key difference from the short-run equilibrium is the elimination of economic profit.

The Mechanism of Long-Run Adjustment

The long-run adjustment process in perfect competition is driven by the profit motive. If firms are earning economic profits in the short run, this signals an attractive investment opportunity. New firms will be incentivized to enter the market. This entry increases market supply, shifting the supply curve to the right. This increased supply lowers the market price, squeezing the economic profits of existing firms. This process continues until economic profits are driven to zero.

Conversely, if firms are experiencing economic losses in the short run, some firms will choose to exit the market. This exit decreases market supply, shifting the supply curve to the left. The reduced supply raises the market price, reducing losses and eventually leading to zero economic profits for the remaining firms.

Zero Economic Profit: A Key Characteristic of Long-Run Equilibrium

Zero economic profit, a defining feature of long-run equilibrium in perfect competition, doesn't imply that firms are not making any money. Economic profit considers both explicit costs (e.g., wages, rent) and implicit costs (e.g., forgone salary from alternative employment). Zero economic profit means that firms are earning a normal profit—sufficient to cover all costs, including the opportunity cost of the resources used in the business. This normal profit is the minimum return necessary to keep firms in the market in the long run.

The Long-Run Supply Curve

The long-run supply curve in perfect competition is typically horizontal (perfectly elastic) at the minimum average total cost (ATC). This is because, with free entry and exit, firms will adjust their output until they reach the minimum point of their ATC curve. If the price falls below this minimum ATC, firms will exit the market, and if the price rises above it, new firms will enter, ultimately driving the price back down to the minimum ATC. This contrasts with the short-run supply curve, which is typically upward sloping.

Efficiency in Long-Run Equilibrium

Long-run equilibrium in perfect competition is characterized by allocative and productive efficiency.

-

Allocative efficiency: The market produces the quantity of goods and services that society desires at the price that reflects the marginal cost of production (P = MC). This ensures that resources are allocated to produce goods and services that society values most. No other allocation of resources could improve overall social welfare.

-

Productive efficiency: Firms produce at the lowest possible average total cost (ATC). This implies that resources are used efficiently, minimizing waste and maximizing output for a given level of inputs. Each firm operates at the minimum point of its ATC curve, minimizing the cost of producing each unit of output.

This combination of allocative and productive efficiency makes long-run equilibrium in perfect competition a benchmark for economic efficiency, although the perfectly competitive model is an idealized simplification of real-world markets.

Real-World Implications and Deviations from the Model

While perfect competition is a theoretical construct, understanding its long-run equilibrium is valuable for several reasons:

-

Benchmark for comparison: Real-world markets often deviate from perfect competition, but understanding this idealized model provides a benchmark against which to compare the efficiency and performance of actual markets. The closer a market gets to perfect competition, the more likely it is to achieve allocative and productive efficiency.

-

Policy implications: Policymakers can use the principles of perfect competition to design policies that promote competition, such as antitrust laws to prevent monopolies and regulations to reduce barriers to entry.

-

Understanding market dynamics: Even in markets that are not perfectly competitive, understanding the forces of supply and demand, entry and exit, and the pursuit of profit still helps to explain market dynamics and outcomes.

It's crucial to acknowledge that deviations from perfect competition are prevalent in the real world. These deviations include:

- Monopolistic competition: Markets with many firms selling differentiated products. This leads to some market power for individual firms and potentially higher prices than in perfect competition.

- Oligopolies: Markets dominated by a few large firms, resulting in strategic interdependence and potentially reduced efficiency.

- Monopolies: Markets controlled by a single firm with significant market power, often leading to higher prices and lower output than under perfect competition.

- Barriers to entry: High start-up costs, patents, government regulations, or control over essential resources can restrict entry and prevent the long-run equilibrium from being achieved.

- Imperfect information: Asymmetric information (where some participants know more than others), can lead to inefficient outcomes.

- Externalities: Positive or negative externalities (costs or benefits not reflected in the market price) can distort the efficient allocation of resources.

Conclusion

The long-run equilibrium in perfect competition provides a valuable theoretical framework for understanding market dynamics and the conditions required for allocative and productive efficiency. While real-world markets rarely perfectly meet the assumptions of perfect competition, the principles underlying this model offer crucial insights into the forces shaping market outcomes and the design of policies to promote economic efficiency. Understanding the interplay between entry, exit, and profit maximization highlights the dynamic nature of markets and the tendency for them to gravitate toward a state of zero economic profit in the long run, at least in the context of this idealized model. The idealized perfect competition model provides an important benchmark against which to analyze the performance of real-world markets, and to understand how deviations from this theoretical framework may lead to inefficiency.

Latest Posts

Latest Posts

-

Which Chamber Of Heart Has Thickest Wall

Mar 18, 2025

-

How Many Feet Is 1 2 Miles

Mar 18, 2025

-

How Many Valence Electrons Does Mn Have

Mar 18, 2025

-

Lines Of Symmetry On A Trapezoid

Mar 18, 2025

-

Two Same Words With Different Meanings

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Long Run Equilibrium For Perfect Competition . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.