Is Insurance Premium A Capital Expenditure

News Leon

Mar 18, 2025 · 6 min read

Table of Contents

- Is Insurance Premium A Capital Expenditure

- Table of Contents

- Is Insurance Premium a Capital Expenditure? A Comprehensive Guide

- Understanding Capital Expenditures (CapEx) and Revenue Expenditures (OpEx)

- Analyzing Insurance Premiums: CapEx or OpEx?

- 1. Insurance Premiums as Revenue Expenditures (OpEx): The Most Common Scenario

- 2. Insurance Premiums as Capital Expenditures (CapEx): The Exceptions

- The Importance of Proper Classification

- Determining the Correct Classification: A Practical Approach

- Conclusion: Context is King

- Latest Posts

- Latest Posts

- Related Post

Is Insurance Premium a Capital Expenditure? A Comprehensive Guide

The question of whether insurance premiums are capital expenditures (CapEx) or revenue expenditures (OpEx) is a common point of confusion for businesses of all sizes. The answer, unfortunately, isn't a simple yes or no. The classification depends heavily on the type of insurance and the specific circumstances under which the insurance is purchased. This comprehensive guide will delve into the nuances of this accounting conundrum, providing clarity and helping you make informed decisions.

Understanding Capital Expenditures (CapEx) and Revenue Expenditures (OpEx)

Before diving into the specifics of insurance, let's establish a clear understanding of CapEx and OpEx.

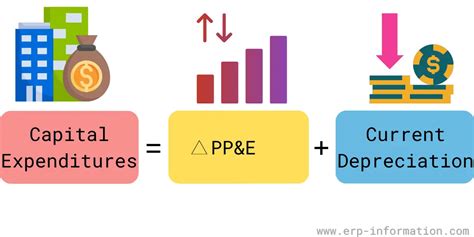

Capital Expenditures (CapEx): These are investments in assets that provide benefits over a period exceeding one year. Think of purchasing equipment, buildings, or software – these are all assets that add value to your business in the long term. CapEx is recorded on the balance sheet as an asset and depreciated over its useful life.

Revenue Expenditures (OpEx): These are expenses incurred in the normal course of business operations. They are essential for the day-to-day running of the business and do not provide long-term benefits. Examples include salaries, rent, and utilities. OpEx is recorded on the income statement and is fully expensed in the year they are incurred.

Analyzing Insurance Premiums: CapEx or OpEx?

The classification of insurance premiums hinges on the nature of the insurance policy itself. Let's break it down:

1. Insurance Premiums as Revenue Expenditures (OpEx): The Most Common Scenario

In most cases, insurance premiums are considered revenue expenditures. This applies to the majority of insurance policies, including:

- Property Insurance: This covers damage or loss to your physical assets, such as buildings, equipment, or inventory. While protecting your assets is crucial, the policy itself doesn't add value to the asset. It's a cost of maintaining your existing assets.

- Liability Insurance: This protects your business from lawsuits related to injury or property damage caused by your operations. Again, it's a cost of doing business, not an investment adding value.

- Workers' Compensation Insurance: This covers medical expenses and lost wages for employees injured on the job. This is a necessary cost for compliance and risk management, but not a capital investment.

- Business Interruption Insurance: This protects your business from financial losses due to unexpected disruptions, such as natural disasters. While vital for business continuity, this is a cost of mitigating risk, not creating an asset.

Why are these OpEx? These policies protect against risk, ensuring the business continues to operate smoothly. They are necessary costs for running a business, but they don't directly increase the value or lifespan of the business's assets. They are expensed immediately, reducing the business's net income for the current accounting period.

2. Insurance Premiums as Capital Expenditures (CapEx): The Exceptions

There are exceptions where insurance premiums might be classified as CapEx. This is less common but crucial to understand. These scenarios typically involve insurance tied to the acquisition or enhancement of a capital asset:

-

Insurance Premiums on Assets Under Construction: If you're building a new factory or acquiring significant equipment, the insurance premiums paid during the construction or acquisition phase might be considered CapEx. This is because the insurance protects the asset while it's being created. The cost is directly related to the creation of a capital asset, rather than the ongoing operation of the business. This is capitalized and amortized over the useful life of the asset.

-

Extended Warranty/Service Agreements: While not strictly insurance, extended warranties and service agreements often function similarly. If the agreement significantly extends the useful life of an asset or protects against substantial repair costs, it may be considered a capitalizable cost, similar to how insurance during construction is treated. The cost should be allocated over the extended life of the asset.

-

Insurance Premiums Linked to Specific Capital Projects: Insurance policies specifically designed to cover the risks associated with a major capital project (e.g., a new product launch, a large-scale construction project) may be capitalized. The policy directly supports the capital investment and can be amortized over the life of the project. This is highly dependent on the specific wording and intent of the policy.

Why are these potentially CapEx? The key differentiator here is that the insurance directly contributes to the acquisition or safeguarding of a capital asset. The premium isn't just a cost of operations; it's a cost directly tied to the creation or protection of a long-term asset. This directly impacts the asset's value, making it suitable for capitalization and subsequent depreciation.

The Importance of Proper Classification

The correct classification of insurance premiums is critical for several reasons:

-

Accurate Financial Reporting: Misclassifying insurance premiums can distort your company's financial statements, impacting your profitability and potentially misleading investors or lenders.

-

Tax Implications: CapEx and OpEx are treated differently for tax purposes. CapEx allows for depreciation deductions over time, while OpEx is fully deductible in the current year. Improper classification can lead to significant tax discrepancies.

-

Decision-Making: Accurate financial information is essential for making sound business decisions related to investments, expansion, and operational efficiency. Misclassified insurance premiums can skew your understanding of true costs and profitability.

-

Compliance: Accurate financial reporting is vital for compliance with accounting standards (like GAAP or IFRS), avoiding potential penalties.

Determining the Correct Classification: A Practical Approach

To determine whether an insurance premium should be classified as CapEx or OpEx, consider the following questions:

- What asset is the insurance protecting? Is it an existing operational asset, or is it a capital asset under construction or acquisition?

- Does the insurance directly contribute to the creation or enhancement of a capital asset? If yes, it's more likely to be CapEx.

- What is the duration of the insurance coverage? Longer-term policies are more likely to be considered in relation to CapEx if related to a capital asset, as they contribute to the protection of the asset over its lifetime.

- What is the materiality of the insurance cost? For smaller insurance premiums, the accounting impact of classifying them differently may be negligible.

- Consult your accountant or tax advisor: They can provide expert guidance based on your specific situation and applicable accounting standards.

Conclusion: Context is King

Whether an insurance premium is a capital expenditure or a revenue expenditure is not a straightforward answer. The classification depends entirely on the context – the type of insurance, the asset it protects, and the circumstances under which it was purchased. By carefully analyzing these factors and consulting with financial professionals, businesses can ensure accurate financial reporting, optimize tax implications, and make informed decisions. Remember that precise accounting is crucial for the health and long-term success of any business. Always prioritize thorough record-keeping and seek professional advice when in doubt. Understanding the nuances of CapEx and OpEx, specifically as they relate to insurance, is a key component of effective financial management.

Latest Posts

Latest Posts

-

Correctly Identify The Following Formed Elements

Mar 19, 2025

-

Points That Lie On The Same Line

Mar 19, 2025

-

What Are The Components Of Solution

Mar 19, 2025

-

Find The Area Of The Following Figures

Mar 19, 2025

-

What Are The Products Of The Following Reactions

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Is Insurance Premium A Capital Expenditure . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.