How To Write Letter To The Bank

News Leon

Mar 23, 2025 · 6 min read

Table of Contents

- How To Write Letter To The Bank

- Table of Contents

- How to Write a Letter to the Bank: A Comprehensive Guide

- Understanding the Purpose of Your Letter

- Essential Elements of a Bank Letter

- 1. Your Contact Information

- 2. Date

- 3. Bank's Contact Information

- 4. Subject Line

- 5. Salutation

- 6. Body Paragraphs

- 7. Closing

- 8. Enclosures

- Different Types of Bank Letters and Their Specific Needs

- A. Requesting Information

- B. Making a Complaint

- C. Requesting a Change of Service

- D. Negotiating a Debt

- E. Making a Formal Request (e.g., Letter of Good Standing)

- Tips for Writing an Effective Bank Letter

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

How to Write a Letter to the Bank: A Comprehensive Guide

Writing a letter to your bank might seem daunting, but with a clear structure and the right information, it can be straightforward and effective. Whether you're requesting a new service, disputing a charge, or addressing a more complex issue, a well-written letter demonstrates professionalism and increases your chances of a positive outcome. This comprehensive guide will equip you with the knowledge and tools to craft compelling and effective correspondence with your bank.

Understanding the Purpose of Your Letter

Before you start writing, clearly define the purpose of your letter. Are you:

- Requesting information? (e.g., account balance, transaction history, interest rates)

- Making a complaint? (e.g., unauthorized transaction, incorrect charges, poor customer service)

- Requesting a change or service? (e.g., updating your address, changing your payment method, applying for a loan)

- Negotiating a debt? (e.g., requesting a payment plan, seeking a loan modification)

- Making a formal request? (e.g., requesting a letter of good standing, closing an account)

Knowing your objective will help you structure your letter logically and include all necessary details.

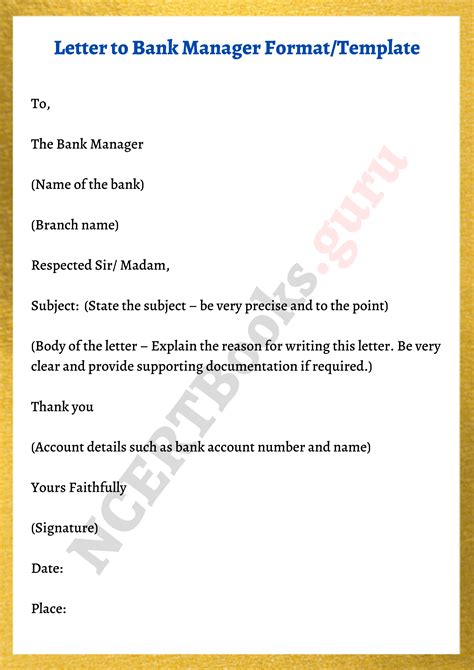

Essential Elements of a Bank Letter

A well-structured bank letter includes several key components:

1. Your Contact Information

Start with your full name, address, phone number, and email address. This allows the bank to easily contact you regarding your inquiry.

Example:

John Smith 123 Main Street Anytown, CA 91234 (555) 555-5555 john.smith@email.com

2. Date

Include the date you are writing the letter. This helps the bank track and process your correspondence efficiently.

3. Bank's Contact Information

Clearly state the bank's name, address, and the relevant department (if known). If you're unsure of the specific department, you can address it to the "Customer Service Department" or a specific individual if you have a contact person.

Example:

ABC Bank 456 Oak Avenue Anytown, CA 91234 Attention: Customer Service Department

4. Subject Line

Use a concise and informative subject line that clearly summarizes your request or complaint. This helps the bank quickly understand the purpose of your letter.

Examples:

- "Inquiry Regarding Account Number 1234567890"

- "Complaint Regarding Unauthorized Transaction on [Date]"

- "Request for Address Change on Account Number 9876543210"

5. Salutation

Use a formal salutation, such as "Dear Sir/Madam," or "Dear [Bank Representative's Name]" if you know it.

6. Body Paragraphs

This is the core of your letter. Clearly and concisely explain your reason for writing. Use short paragraphs and bullet points to improve readability. Include all relevant details, such as:

- Account number: This is crucial for the bank to identify your account quickly.

- Dates and amounts: Provide specific dates and amounts for transactions, payments, or other relevant information.

- Supporting documentation: Mention any supporting documents you are including, such as copies of receipts, statements, or photographs.

- Your desired outcome: Clearly state what you want the bank to do.

7. Closing

Use a formal closing, such as "Sincerely," or "Respectfully," followed by your signature and typed name.

8. Enclosures

If you're including any supporting documents, list them at the end of your letter. For example:

Enclosures:

- Copy of Transaction Statement

- Copy of Receipt

Different Types of Bank Letters and Their Specific Needs

Let's delve into specific scenarios and how to tailor your letter accordingly:

A. Requesting Information

This type of letter requires a clear and concise request for specific information. Include your account number and the information you need. For example:

Subject: Request for Account Statement

Dear Sir/Madam,

I am writing to request a copy of my account statement for the period of [Start Date] to [End Date]. My account number is [Account Number].

Please send the statement to my address on file. If this is not possible, please let me know alternative methods of receiving the statement.

Thank you for your time and assistance.

Sincerely,

[Your Name]

B. Making a Complaint

When making a complaint, remain calm and professional. Clearly explain the issue, provide all relevant details, and state your desired resolution. For example:

Subject: Complaint Regarding Unauthorized Transaction

Dear Sir/Madam,

I am writing to complain about an unauthorized transaction on my account, [Account Number], on [Date]. The transaction amount was [Amount], and it was made to [Recipient]. I have not authorized this transaction.

I have attached a copy of my statement showing the unauthorized transaction. I request a full investigation into this matter and a reversal of the unauthorized charge.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

C. Requesting a Change of Service

When requesting a service change, be specific about the change you need. For example:

Subject: Request for Address Change

Dear Sir/Madam,

I am writing to request a change of address on my account, [Account Number]. My new address is:

[New Address]

Please update my records accordingly.

Thank you for your assistance.

Sincerely,

[Your Name]

D. Negotiating a Debt

Negotiating a debt requires a professional and respectful approach. Clearly explain your financial situation and propose a realistic payment plan.

Subject: Request for Payment Plan

Dear Sir/Madam,

I am writing to request a payment plan for my outstanding debt on account number [Account Number]. Due to [briefly explain your financial situation], I am currently unable to make the full payment.

I propose a payment plan of [Amount] per month, starting on [Date]. I am happy to discuss this further and work with you to reach a mutually agreeable solution.

Thank you for considering my request.

Sincerely,

[Your Name]

E. Making a Formal Request (e.g., Letter of Good Standing)

For formal requests, use a more formal tone and clearly state the purpose of your request.

Subject: Request for Letter of Good Standing

Dear Sir/Madam,

I am writing to request a letter of good standing for my account, [Account Number]. I require this letter for [Explain reason for needing the letter].

Please let me know the process for obtaining this letter and any associated fees.

Thank you for your assistance.

Sincerely,

[Your Name]

Tips for Writing an Effective Bank Letter

- Keep it concise: Avoid unnecessary details or rambling. Get straight to the point.

- Proofread carefully: Ensure your letter is free of grammatical errors and typos.

- Maintain a professional tone: Avoid using emotional or aggressive language.

- Keep a copy for your records: Make a copy of your letter and any supporting documents before sending them.

- Send your letter via certified mail: This provides proof of delivery and can be useful if you need to dispute the bank's response later.

- Follow up: If you don't receive a response within a reasonable timeframe, follow up with a phone call or another letter.

Conclusion

Writing a letter to your bank doesn't have to be intimidating. By following this comprehensive guide and tailoring your letter to your specific needs, you can effectively communicate with your bank and achieve a positive outcome. Remember to be clear, concise, and professional in your communication. A well-crafted letter can significantly improve your chances of resolving your issue efficiently and amicably.

Latest Posts

Latest Posts

-

What Is The Square Root Of 1 4

Mar 26, 2025

-

A Single Celled Organism Is Called

Mar 26, 2025

-

Anything That Has Mass And Takes Up Space Is Called

Mar 26, 2025

-

How Many Protons And Electrons In Magnesium

Mar 26, 2025

-

Which Nitrogenous Base Is Not Found In Rna

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about How To Write Letter To The Bank . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.