An Account Is Said To Have A Debit Balance If

News Leon

Mar 31, 2025 · 7 min read

Table of Contents

An Account is Said to Have a Debit Balance If… Understanding Debits and Credits in Accounting

Understanding debit and credit balances is fundamental to mastering accounting. While the terms might sound intimidating at first, grasping their essence is surprisingly straightforward. This comprehensive guide will demystify debit balances, explaining when an account holds a debit balance, why it occurs, and its implications for financial reporting. We'll explore various account types, providing practical examples to solidify your understanding.

What is a Debit Balance?

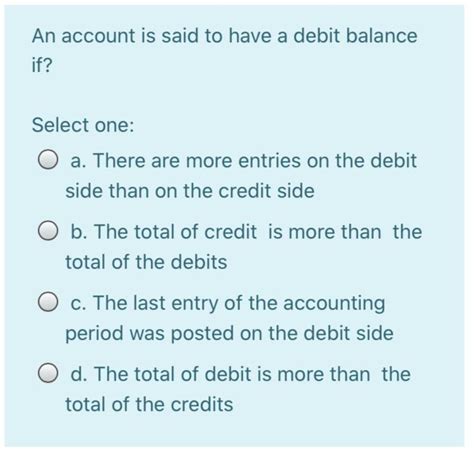

In simple terms, an account has a debit balance if the total debits exceed the total credits. Think of it like a scale: debits are on one side, and credits on the other. A debit balance means the "debit" side of the scale weighs more. This doesn't inherently imply something is "good" or "bad"; it simply reflects the nature of the account and the transactions recorded within it.

The significance of a debit balance depends heavily on the type of account. We categorize accounts into two main groups: assets, liabilities, owner's equity, revenues, and expenses. The normal balance – the side where increases are recorded – differs between these account types.

Normal Balances: The Foundation of Understanding Debit Balances

Understanding normal balances is crucial to interpreting debit balances. Here's a breakdown:

-

Assets: These represent what a company owns (cash, accounts receivable, inventory, equipment). Assets have a normal debit balance. An increase in an asset is recorded as a debit; a decrease is recorded as a credit. Therefore, a debit balance in an asset account signifies that the asset's value has increased.

-

Liabilities: These represent what a company owes (accounts payable, loans payable, salaries payable). Liabilities have a normal credit balance. An increase in a liability is recorded as a credit; a decrease is recorded as a debit. A debit balance in a liability account is unusual and generally indicates an error or an overpayment.

-

Owner's Equity: This represents the owner's stake in the business (capital, retained earnings). Owner's equity has a normal credit balance. Similar to liabilities, a debit balance here suggests a problem, potentially reflecting losses exceeding profits.

-

Revenues: These represent income generated from business operations (sales revenue, service revenue, interest revenue). Revenues have a normal credit balance. Debits to revenue accounts reduce revenue, usually due to adjustments or corrections.

-

Expenses: These represent the costs incurred in running the business (rent expense, salaries expense, utilities expense). Expenses have a normal debit balance. An increase in expenses is recorded as a debit, reflecting an outflow of resources.

When Does an Account Have a Debit Balance?

An account will typically have a debit balance under these circumstances:

-

Asset Accounts: As previously mentioned, a debit balance in an asset account is completely normal and expected. This happens whenever the increases in the asset exceed the decreases. For example:

- Cash: Receiving cash from customers, collecting on accounts receivable, and borrowing money all increase the cash account and result in a debit balance.

- Accounts Receivable: This increases whenever you provide goods or services on credit and your customers haven't yet paid you.

- Inventory: Purchasing inventory increases its balance and results in a debit.

- Prepaid Expenses: Paying for insurance or rent in advance creates a debit balance in the prepaid expense account. As these expenses are used over time, they will be credited, reducing the debit balance.

- Equipment: Purchasing new equipment creates a debit balance. The equipment's value will decrease through depreciation, requiring credit entries.

-

Expense Accounts: A debit balance is also normal and expected in expense accounts. Every time you incur a cost in running your business, it is recorded as a debit. This includes:

- Salaries Expense: Paying employee wages increases the debit balance of this account.

- Rent Expense: Paying rent increases the debit balance.

- Utilities Expense: Paying electricity or water bills increases the debit balance.

- Advertising Expense: Spending money on marketing and advertising is recorded as a debit.

- Depreciation Expense: This expense reflects the decrease in the value of assets over time and is always debited.

-

Dividend Accounts: While unusual compared to other accounts, dividends, representing distributions of profits to shareholders, have a debit balance. This is because dividends reduce retained earnings, a credit balance account.

Interpreting Debit Balances: Identifying Potential Errors

While a debit balance is expected in asset and expense accounts, it signals potential problems in other account types:

-

Liability Accounts: A debit balance in a liability account (e.g., accounts payable) is a red flag. It usually indicates an error in recording transactions. It could signify an overpayment to a creditor or a mistake in the accounting process.

-

Owner's Equity Accounts: A debit balance in owner's equity accounts suggests that the business has incurred more losses than profits. This needs investigation to identify the underlying causes.

-

Revenue Accounts: A debit balance in a revenue account (e.g., sales revenue) points to a significant error. It is uncommon and requires immediate review and correction.

Double-Entry Bookkeeping and Debit Balances

Double-entry bookkeeping is a fundamental accounting principle. Every transaction affects at least two accounts; one account will be debited, and at least one account will be credited. The total debits always equal the total credits. This system helps maintain the accounting equation:

Assets = Liabilities + Owner's Equity

This equation must always remain balanced. If a transaction increases an asset (debit), it must either increase another asset or increase a liability or owner's equity (credit). Conversely, a decrease in an asset (credit) must be balanced by a decrease in another asset or a decrease in liability or owner's equity (debit).

The proper use of debits and credits ensures that the accounting equation remains in balance, providing a reliable and accurate record of a business's financial position.

Practical Examples of Debit Balances

Let's illustrate with some concrete examples:

Example 1: Purchasing Inventory

A company buys $1,000 worth of inventory on credit.

- Debit: Inventory ($1,000) - Increases the asset.

- Credit: Accounts Payable ($1,000) - Increases the liability.

The inventory account now has a debit balance of $1,000, reflecting the increase in inventory value.

Example 2: Paying Rent

A company pays $500 in rent for the month.

- Debit: Rent Expense ($500) - Increases the expense.

- Credit: Cash ($500) - Decreases the asset.

The rent expense account now has a debit balance of $500.

Example 3: Receiving Cash from Customers

A company receives $2,000 in cash from customers who previously purchased goods or services on credit.

- Debit: Cash ($2,000) - Increases the asset.

- Credit: Accounts Receivable ($2,000) - Decreases the asset.

The cash account now has a debit balance (increased by $2,000). The accounts receivable account has a decreased debit balance (as a credit reduces its value).

Example 4: Error in Recording a Liability

A company mistakenly debits accounts payable by $300. This is an error.

- Incorrect Entry: Debit Accounts Payable ($300), Credit Cash ($300). This creates an unusual debit balance in the accounts payable.

- Correction: Debit Cash ($300), Credit Accounts Payable ($300). This corrects the error and restores the normal credit balance to accounts payable.

These examples demonstrate how debits and credits work together to maintain the balance of the accounting equation. A debit balance, in itself, is neither positive nor negative; its significance depends entirely on the type of account being considered.

The Importance of Accurate Record-Keeping

Maintaining accurate accounting records is critical for several reasons:

- Financial Reporting: Accurate records are essential for preparing financial statements (balance sheet, income statement, cash flow statement) that present a true and fair view of the company's financial health.

- Tax Compliance: The Internal Revenue Service (IRS) requires accurate records for tax filing. Inaccurate records can lead to audits and penalties.

- Decision-Making: Managers use accounting information to make informed decisions about pricing, production, and investment. Inaccurate records can lead to poor decisions.

- Investor Confidence: Investors rely on accurate financial information to assess the company's performance and make investment decisions.

Understanding debit and credit balances is fundamental to accurate record-keeping. By mastering these concepts, accountants and business owners can ensure that their financial information is reliable, facilitating sound financial management and strategic planning.

Conclusion: Mastering Debit Balances for Financial Success

Understanding when an account has a debit balance requires knowledge of normal balances and the nature of different account types. While a debit balance is expected for asset and expense accounts, it signifies potential errors in liability, owner's equity, and revenue accounts. Maintaining accurate records, through proper application of debit and credit entries, is vital for reliable financial reporting, tax compliance, informed decision-making, and investor confidence. Consistent and accurate bookkeeping practices ensure the financial health and stability of any business. Understanding the fundamentals, like debit and credit balances, is the first crucial step toward achieving financial success.

Latest Posts

Latest Posts

-

Who Has Hemophilia In The Pedigree That Is Shown

Apr 01, 2025

-

A Chord That Passes Through The Center Of A Circle

Apr 01, 2025

-

Which Of The Following Is A Fixed Cost

Apr 01, 2025

-

Determine The Area Of The Shaded Region In The Figure

Apr 01, 2025

-

A Tt Pea Plant Is A

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about An Account Is Said To Have A Debit Balance If . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.