A Short-term Unsecured Promissory Note Issued By A Company Is

News Leon

Apr 01, 2025 · 6 min read

Table of Contents

A Short-Term Unsecured Promissory Note Issued by a Company Is… a Powerful (and Risky) Financing Tool

A short-term unsecured promissory note issued by a company is essentially a short-term loan where the borrower (the company) promises to repay the lender a specific amount of money by a certain date. The term "unsecured" is crucial – it means the loan isn't backed by any collateral. This lack of collateral increases the risk for the lender, resulting in potentially higher interest rates for the borrower. Understanding the intricacies of these notes is vital for both companies seeking financing and investors considering lending.

What is a Promissory Note?

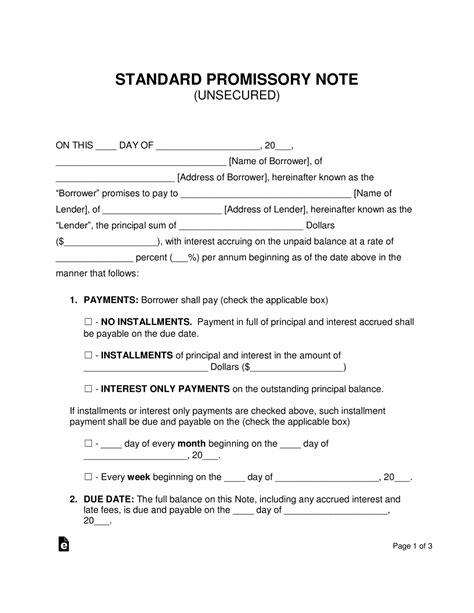

At its core, a promissory note is a formal legal document that acts as a written promise to repay a debt. It details the terms of the loan agreement, including:

- Principal amount: The total sum of money borrowed.

- Interest rate: The percentage charged on the principal amount.

- Maturity date: The date when the principal and accrued interest must be repaid.

- Payment schedule: How and when payments will be made (e.g., lump sum, installments).

- Borrower and lender information: Full legal names and addresses of both parties.

While many promissory notes are secured (backed by assets), unsecured promissory notes rely solely on the borrower's creditworthiness and promise to repay.

Short-Term vs. Long-Term Promissory Notes

The "short-term" aspect of the note is critical. This typically refers to a loan with a maturity date of less than one year. This contrasts with long-term promissory notes, which can extend for several years. The shorter timeframe impacts several factors, including:

- Interest rate: Short-term notes generally carry lower interest rates than long-term notes, reflecting the reduced risk for the lender due to the shorter repayment period.

- Risk assessment: Lenders typically conduct a more thorough credit assessment for long-term loans, while short-term notes might rely on a less extensive evaluation.

- Flexibility: Short-term notes offer more flexibility, allowing companies to meet immediate needs without committing to long-term debt obligations.

Why Companies Issue Short-Term Unsecured Promissory Notes

Companies utilize short-term unsecured promissory notes for various reasons:

- Bridge financing: To cover temporary cash flow gaps until longer-term financing is secured or revenue is received. This is particularly useful during periods of seasonal fluctuations or unexpected expenses.

- Working capital: To fund day-to-day operations, such as purchasing inventory, paying suppliers, or meeting payroll.

- Expansion opportunities: To finance short-term expansion projects or capitalize on unexpected market opportunities.

- Emergency funding: To address unexpected financial emergencies or crises.

The Risks Involved with Unsecured Promissory Notes

While convenient, unsecured promissory notes carry significant risks for both borrowers and lenders:

Risks for the Borrower:

- Higher interest rates: The lack of collateral increases the risk for the lender, leading to higher interest rates to compensate for the increased risk.

- Limited access to capital: Companies with poor creditworthiness may struggle to secure financing through unsecured promissory notes.

- Potential for default: Failure to repay the loan can severely damage the company's credit rating and reputation, making it difficult to obtain future financing.

- Strict repayment terms: Lenders might impose stringent repayment terms to mitigate risk.

Risks for the Lender:

- Credit risk: The primary risk is the borrower's potential failure to repay the loan. This is especially pronounced with unsecured notes.

- Loss of principal: If the borrower defaults, the lender may lose all or part of the principal amount.

- Collection difficulties: Recovering the debt from a defaulting borrower can be time-consuming and expensive.

- Legal costs: Lenders may incur significant legal costs pursuing recovery through court action.

Due Diligence: A Crucial Step for Both Parties

Thorough due diligence is paramount for both borrowers and lenders involved in unsecured promissory notes.

Due Diligence for Borrowers:

- Compare interest rates: Shop around and compare interest rates from multiple lenders to secure the most favorable terms.

- Understand the repayment terms: Carefully review the repayment schedule and ensure it aligns with the company's cash flow projections.

- Assess creditworthiness: Understand your company's credit rating and how it impacts the terms offered by lenders.

Due Diligence for Lenders:

- Credit check: Conduct a thorough credit check on the borrower to assess their creditworthiness and repayment history.

- Financial analysis: Review the borrower's financial statements to evaluate their financial health and ability to repay the loan.

- Legal review: Seek legal counsel to ensure the promissory note is properly drafted and legally enforceable.

- Market research: Understand the borrower's industry and market conditions to assess the viability of their business.

The Role of Creditworthiness in Securing a Loan

Creditworthiness is the cornerstone of obtaining an unsecured promissory note. Lenders will scrutinize various factors:

- Credit score: A higher credit score indicates lower risk and often leads to more favorable terms.

- Financial history: A strong track record of on-time payments and responsible financial management increases the likelihood of loan approval.

- Cash flow: Lenders want to ensure the borrower has sufficient cash flow to meet the repayment obligations.

- Debt-to-income ratio: A lower debt-to-income ratio demonstrates the borrower's ability to manage debt.

- Collateral (even though the note is unsecured): While the note itself is unsecured, lenders may assess the borrower's overall assets to gauge their ability to repay the loan, even if those assets aren't directly pledged as collateral.

Negotiating the Terms of the Promissory Note

Negotiation is key to securing favorable terms. Both borrowers and lenders should strive for an agreement that protects their interests. Key areas for negotiation include:

- Interest rate: Negotiate a competitive interest rate that reflects the level of risk.

- Maturity date: Agree on a maturity date that aligns with the borrower's cash flow projections.

- Prepayment penalties: Negotiate terms related to prepayment penalties if the borrower anticipates repaying the loan early.

- Default provisions: Clearly define the consequences of default and the steps for resolving any disputes.

Legal Considerations for Promissory Notes

Promissory notes are legally binding contracts. Careful consideration of legal aspects is crucial:

- Compliance with regulations: Ensure the promissory note complies with all applicable federal and state regulations.

- Clear and unambiguous language: The note should be written in clear and concise language to avoid ambiguity.

- Proper execution: The note should be properly signed and witnessed by both parties.

- Legal advice: Both parties should seek independent legal advice before signing the note.

Alternatives to Unsecured Promissory Notes

Companies seeking short-term financing should explore alternatives to unsecured promissory notes, which might offer better terms or reduced risks:

- Secured loans: Loans backed by collateral, offering lower interest rates but requiring the borrower to pledge assets.

- Lines of credit: A pre-approved borrowing limit that allows the company to borrow funds as needed.

- Invoice financing: Financing based on outstanding invoices, offering a quicker source of funds.

- Merchant cash advances: Advancements based on future credit and debit card sales.

Conclusion: Weighing the Risks and Rewards

A short-term unsecured promissory note issued by a company can be a valuable financing tool for bridging short-term cash flow gaps or funding specific projects. However, it's crucial to understand the inherent risks involved. Both borrowers and lenders must conduct thorough due diligence, negotiate terms carefully, and seek legal advice to ensure a mutually beneficial and legally sound agreement. The decision to utilize an unsecured promissory note should be made only after careful consideration of alternative financing options and a comprehensive assessment of the potential risks and rewards. Remember, a well-structured and carefully negotiated promissory note can be a powerful tool, but a poorly managed one can lead to significant financial difficulties.

Latest Posts

Latest Posts

-

Is Dissolving Sugar In Water A Physical Or Chemical Change

Apr 02, 2025

-

What Is The Area Of The Shaded Figure

Apr 02, 2025

-

Calculate The Molecular Mass Of Koh

Apr 02, 2025

-

A Long And Branched Chain Of Glucose Molecules Is

Apr 02, 2025

-

What Phase Does The Cytoplasm Divide

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about A Short-term Unsecured Promissory Note Issued By A Company Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.