Why Is The Market Demand Curve Downward Sloping

News Leon

Mar 29, 2025 · 6 min read

Table of Contents

Why is the Market Demand Curve Downward Sloping? A Comprehensive Exploration

The downward slope of the market demand curve is a fundamental concept in economics, representing the inverse relationship between the price of a good or service and the quantity demanded. This seemingly simple principle underpins countless economic models and analyses, influencing everything from pricing strategies to government policy. Understanding why the demand curve slopes downwards is crucial for anyone seeking a firm grasp of economic principles. This article delves deep into the reasons behind this fundamental relationship, exploring various factors and providing real-world examples.

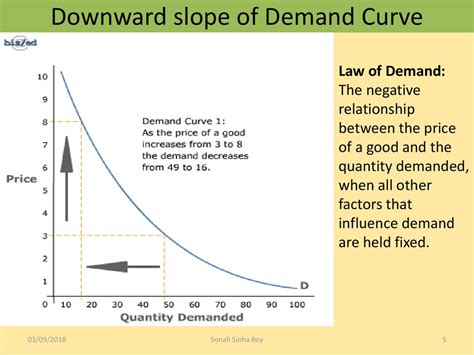

The Law of Demand: A Cornerstone of Economics

The downward-sloping demand curve is a direct consequence of the Law of Demand, which states that, all other factors remaining constant ( ceteris paribus ), the quantity demanded of a good decreases as its price increases, and vice versa. This inverse relationship isn't merely an observation; it's rooted in several key underlying factors. Let's examine them in detail.

1. The Substitution Effect

As the price of a good rises, consumers are incentivized to substitute it with cheaper alternatives. This is the substitution effect. Imagine the price of beef suddenly increases significantly. Consumers might switch to chicken, pork, or even vegetarian options, reducing the quantity demanded of beef at the higher price point. This substitution is a direct response to the change in relative prices, making the more expensive good less attractive.

Example: The rising price of gasoline often leads to increased demand for fuel-efficient vehicles or public transportation, illustrating the substitution effect in action.

2. The Income Effect

The income effect refers to the change in purchasing power caused by a price change. When the price of a good falls, consumers experience an increase in their real income—they can afford to buy more of that good and other goods. Conversely, a price increase reduces real income, limiting purchasing power and the ability to purchase as much of the good.

Example: A decrease in the price of smartphones might allow a consumer to purchase a higher-end model or to buy additional accessories, reflecting the positive income effect.

3. The Diminishing Marginal Utility

The law of diminishing marginal utility postulates that as a consumer consumes more units of a good, the additional satisfaction (utility) derived from each subsequent unit decreases. This means the first unit provides the most satisfaction, the second less, and so on. Therefore, consumers are willing to pay less for additional units, as their perceived value diminishes.

Example: Eating one slice of pizza might be highly satisfying, but eating a fifth slice might yield significantly less satisfaction. The consumer will likely be less willing to pay the same price for the fifth slice as for the first.

4. Different Consumer Preferences and Demand

Market demand is the aggregate of individual demands. Different consumers have different preferences, income levels, and willingness to pay. The downward-sloping demand curve reflects the collective behavior of these diverse consumers. At higher prices, only those with a strong preference or higher income will continue to purchase the good, while others will exit the market. As the price falls, more consumers enter the market, increasing the total quantity demanded.

5. Consumer Expectations

Future expectations about prices and income can also influence current demand. If consumers anticipate a future price increase, they might increase their current demand to stock up, creating a temporary shift in the demand curve. Conversely, if they anticipate a price decrease, they may postpone purchases, leading to reduced current demand.

Factors Affecting the Slope of the Demand Curve

While the downward slope is a general rule, the steepness of the curve can vary depending on several factors:

1. Availability of Substitutes

Goods with readily available substitutes tend to have more elastic (flatter) demand curves. A small price increase can lead to a significant shift towards the substitutes. Conversely, goods with few or no close substitutes (e.g., life-saving medications) tend to have inelastic (steeper) demand curves.

2. Necessity versus Luxury

Necessities (e.g., food, shelter) have relatively inelastic demand, meaning that demand changes less dramatically with price changes. Luxuries (e.g., yachts, designer clothing) exhibit more elastic demand, as consumers are more sensitive to price fluctuations.

3. Proportion of Income Spent on the Good

Goods that constitute a small proportion of a consumer's income will have a less elastic demand curve compared to those that represent a larger share of their budget. A price increase in a small-ticket item will have a minor impact on purchasing power compared to a price increase in a significant expenditure.

4. Time Horizon

The elasticity of demand also depends on the time frame considered. In the short run, demand might be inelastic as consumers adjust slowly to price changes. In the long run, however, consumers have more time to adapt their behavior, leading to a more elastic demand curve.

Exceptions and Caveats: When the Demand Curve Might Not Slope Downwards

While the downward-sloping demand curve is the norm, some situations can create exceptions:

1. Giffen Goods

Giffen goods are a rare exception where demand increases as price increases. These are typically inferior goods (goods for which demand falls as income rises) that constitute a significant portion of a consumer's budget. As the price rises, the income effect outweighs the substitution effect, leading consumers to buy even more of the good to compensate for the reduced purchasing power. This is a theoretical exception and difficult to observe in real-world markets.

2. Veblen Goods

Veblen goods are luxury goods where demand increases with price. The high price itself becomes a status symbol, increasing desirability and demand. This is driven by prestige and exclusivity rather than fundamental utility.

3. Bandwagon Effect

The bandwagon effect describes situations where increased demand is driven by the popularity of a product, leading to a non-traditional upward sloping demand curve for a certain price range, before falling down again as the price increases further. This can temporarily override the traditional downward slope, and is less of an exception to the rule and more of a short-term market phenomenon.

Conclusion: The Enduring Significance of the Downward-Sloping Demand Curve

The downward-sloping market demand curve remains a cornerstone of economic analysis, providing a valuable framework for understanding consumer behavior and market dynamics. While exceptions exist, the general principle of an inverse relationship between price and quantity demanded holds true across a vast range of goods and services. Understanding the underlying factors—substitution effect, income effect, diminishing marginal utility, diverse consumer preferences, and consumer expectations—is critical for interpreting market trends, making informed business decisions, and developing effective economic policies. The complexities surrounding the slope, including variations in elasticity and the exceptional cases of Giffen and Veblen goods, further enhance our understanding of the intricate relationship between supply, demand, and pricing in a dynamic market environment.

Latest Posts

Latest Posts

-

E Banking Is Also Known As

Mar 31, 2025

-

Which Of The Following Is True Of The Nucleus

Mar 31, 2025

-

Ground State Energy Of Hydrogen Atom

Mar 31, 2025

-

What Do The Conductors Have In Common

Mar 31, 2025

-

Is Carbon Monoxide A Compound Or Element

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Why Is The Market Demand Curve Downward Sloping . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.