What Happens When The Price Of A Complementary Good Increases

News Leon

Apr 06, 2025 · 6 min read

Table of Contents

What Happens When the Price of a Complementary Good Increases?

Understanding the dynamics of supply and demand is crucial for businesses and consumers alike. While the law of supply and demand focuses on the relationship between the price of a good and its quantity demanded or supplied, the real world is far more nuanced. The interplay between goods, particularly complementary goods, significantly impacts market equilibrium. This article delves deep into the consequences of a price increase in a complementary good, examining its ripple effects across various aspects of the economy.

Defining Complementary Goods

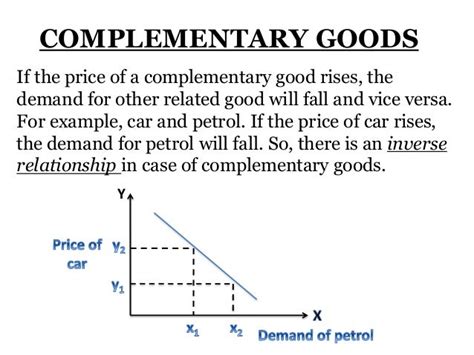

Before dissecting the implications of a price hike, let's establish a clear definition. Complementary goods are products or services that are consumed together. The consumption of one enhances the enjoyment or utility derived from the other. Think of peanut butter and jelly, cars and gasoline, or printers and ink cartridges. The demand for one is directly linked to the demand for the other. A decline in the demand for one typically leads to a similar decline in the demand for its complement.

This relationship is crucial to understanding how price changes in one good directly impact the demand for its counterpart. The relationship isn't necessarily symmetrical; the degree of complementarity can vary. For example, while gasoline is a strong complement to cars, the relationship between cars and car washes might be weaker.

The Impact of a Price Increase in a Complementary Good

When the price of a complementary good increases, several interconnected effects manifest themselves across the market:

1. Decreased Demand for the Complementary Good: The Obvious Effect

The most immediate consequence is a reduction in the quantity demanded for the complementary good itself. This is a simple application of the law of demand. As the price goes up, consumers, facing higher costs, will naturally reduce their consumption. This is particularly true if the price increase is significant or if the good is a substantial portion of the consumer's budget.

Example: If the price of gasoline significantly increases, consumers might reduce their driving, leading to a decrease in the quantity of gasoline demanded. This is a direct response to the higher cost.

2. Decreased Demand for the Primary Good: The Ripple Effect

This is where things get interesting. The decreased demand for the complementary good directly impacts the demand for the good it complements. Since the two goods are consumed together, a reduction in the consumption of one automatically leads to a decrease in the demand for the other.

Example: Continuing with the gasoline example, the reduced driving (decreased demand for gasoline) will likely lead to a decrease in the demand for new and used cars. People might postpone purchasing a new car or opt for more fuel-efficient models. The reduced demand for gasoline directly translates into reduced demand for cars.

3. Potential Shift in Consumer Behavior: Substitution and Alternatives

Consumers are rarely passive in the face of price increases. They actively seek alternatives and substitutes to mitigate the impact of higher costs. This often involves:

- Substituting goods: Consumers might switch to substitute goods that provide similar utility at a lower cost. For example, if the price of beef increases, consumers might switch to chicken or pork. Similarly, if the price of a particular brand of printer ink rises sharply, consumers might opt for cheaper alternatives or consider refillable cartridges.

- Reducing overall consumption: Faced with higher prices for complementary goods, consumers might simply reduce their overall consumption of both goods. Instead of buying a new car and filling its tank with expensive gasoline, they might postpone the purchase or opt for public transportation.

4. Impact on Businesses: Reduced Sales and Profits

The reduced demand for both the complementary good and the primary good significantly impacts businesses. Companies producing both goods will experience lower sales and consequently, reduced profits. This necessitates adjustments in their business strategies, such as:

- Price adjustments: Businesses might try to counter the decline in demand by adjusting their prices. However, aggressive price reductions can lead to lower profit margins.

- Cost-cutting measures: They might explore ways to reduce production costs to maintain profitability.

- Marketing strategies: Enhanced marketing campaigns, focusing on value propositions and highlighting features, could help attract customers.

- Product diversification: Businesses might explore diversification into related products or services to reduce dependence on the affected complementary goods.

5. Market Equilibrium Shifts: A New Balance

The combined effect of decreased demand and potential shifts in consumer behavior leads to a new market equilibrium. The equilibrium price and quantity of both the primary and complementary good will adjust to reflect the altered dynamics of supply and demand. This adjustment period might involve price fluctuations and shifts in market share as businesses react to the new market conditions.

6. Long-term Implications: Innovation and Technological Advancements

Higher prices for complementary goods can act as a catalyst for innovation and technological advancements. Businesses might invest in research and development to find more efficient and cost-effective alternatives. For instance, the high price of gasoline spurred research and development in electric vehicles and alternative fuel technologies. This long-term response can reshape the market landscape significantly.

Case Studies: Real-World Examples

Let's examine real-world examples to illustrate these concepts further.

Case Study 1: The Price of Gasoline and the Automotive Industry

A sharp increase in gasoline prices significantly impacts the automotive industry. Consumers, faced with higher fuel costs, reduce their driving and may postpone purchasing new vehicles, especially gas-guzzlers. This decrease in demand leads to lower sales for automakers and related industries like tire manufacturers and auto repair shops. In response, automakers might invest more in fuel-efficient vehicles or explore alternative energy sources.

Case Study 2: The Price of Printer Ink and Printer Sales

The high cost of printer ink cartridges is a classic example of complementary goods affecting demand. Consumers often find the cost of ink disproportionate to the cost of the printer itself. This can lead to a decrease in the demand for printers, as consumers might postpone purchases or switch to alternative printing methods. Printer manufacturers might respond by offering bundled deals, introducing more cost-effective ink options, or focusing on marketing the longevity of their printers.

Case Study 3: Smartphones and Mobile Data Plans

Smartphones and mobile data plans are strongly complementary goods. An increase in mobile data plan prices might lead to decreased consumption of mobile data, potentially affecting smartphone sales (consumers might delay upgrading) and impacting the profitability of both mobile carriers and smartphone manufacturers. This might trigger innovations in data compression or the development of more data-efficient apps and software.

Conclusion: Navigating the Interdependencies of Complementary Goods

The relationship between complementary goods is a dynamic one. A price increase in one good has cascading effects on the demand for its counterpart and the broader market. Businesses need to proactively monitor these dynamics, adapt their strategies, and leverage the situation as an opportunity for innovation. Understanding the complex interplay between complementary goods is crucial for both businesses seeking sustainable growth and consumers making informed purchasing decisions. The impact of a price increase isn't simply about a single product; it's about understanding the intricate network of economic relationships. By carefully analyzing these dynamics, businesses can effectively manage risks and capitalize on opportunities to thrive in a competitive market environment. The ability to anticipate and respond to these shifts is essential for success in the ever-evolving landscape of modern commerce.

Latest Posts

Latest Posts

-

Calcium Chloride Sodium Carbonate Balanced Equation

Apr 08, 2025

-

Why Is Melting Ice Not A Chemical Reaction

Apr 08, 2025

-

Sodium Is A Metal Or Nonmetal

Apr 08, 2025

-

What Organelle Is The Site Of Cellular Respiration

Apr 08, 2025

-

Are Lysosomes Only In Animal Cells

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Happens When The Price Of A Complementary Good Increases . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.