The Long Run Perfectly Competitive Equilibrium

News Leon

Apr 01, 2025 · 6 min read

Table of Contents

The Long Run Perfectly Competitive Equilibrium: A Deep Dive

The perfectly competitive market structure, while a theoretical ideal rarely perfectly realized in the real world, serves as a crucial benchmark for understanding market dynamics. This article delves deep into the concept of long-run perfectly competitive equilibrium, explaining its characteristics, the forces that drive it, and its implications for businesses and consumers. We'll explore how economic profits, losses, and the entry and exit of firms shape market outcomes in the long run, ultimately leading to a state of allocative and productive efficiency.

Understanding the Short Run vs. the Long Run

Before we dive into the long run, it's critical to understand the distinction between the short run and the long run in economics. The short run, in a perfectly competitive market, is defined as a period where at least one input (typically capital) is fixed. Firms can adjust their output levels by changing variable inputs like labor, but they can't alter their fixed capital. This constraint limits their ability to respond to changes in market conditions.

The long run, on the other hand, is a period where all inputs are variable. Firms have the flexibility to adjust their capital stock, plant size, and other fixed factors, allowing them to fully respond to market signals. This adaptability is crucial to understanding the long-run equilibrium.

The Short Run Equilibrium in Perfect Competition

In the short run, a perfectly competitive firm maximizes its profits by producing where its marginal cost (MC) equals its marginal revenue (MR). Since perfectly competitive firms are price takers, their marginal revenue is simply the market price (P). Therefore, the short-run profit-maximizing output is where MC = MR = P.

Key Characteristics of Short-Run Equilibrium:

- Price taking: Firms are too small to influence the market price.

- Profit maximization: Firms aim to maximize their economic profits (total revenue minus total costs).

- Potential for profits or losses: Firms can earn economic profits, break even, or incur economic losses depending on the relationship between price and average total cost (ATC).

The Dynamics of Entry and Exit

The key difference between the short run and long run in perfect competition lies in the ability of firms to enter or exit the market. In the short run, the number of firms is fixed. However, in the long run, the potential for profit attracts new firms, while losses cause existing firms to exit. This process is the driving force behind the long-run equilibrium.

The Attraction of Profit

If firms in a perfectly competitive market are earning economic profits (profits above and beyond the normal return on investment), this signals an attractive opportunity. New firms, sensing the potential for profit, will enter the market. This entry increases the market supply, which shifts the supply curve to the right.

The Pressure of Losses

Conversely, if firms are experiencing economic losses (earning less than a normal return on investment), they will start to exit the market. This exit reduces market supply, shifting the supply curve to the left.

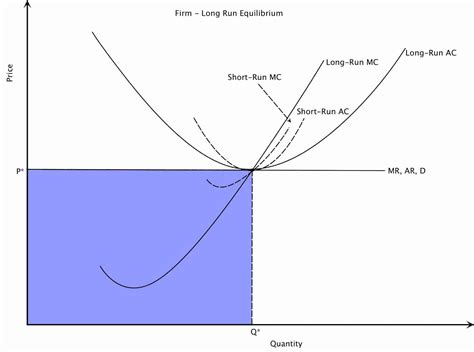

The Long Run Perfectly Competitive Equilibrium: A State of Efficiency

The long-run perfectly competitive equilibrium is a state where all firms are earning zero economic profits. This doesn't mean they are making no money; it means they are earning a normal rate of return on their investment—enough to cover all costs, including the opportunity cost of the resources used.

Characteristics of Long-Run Equilibrium:

- Zero economic profit: Firms earn a normal rate of return, but no excess profits.

- Price equals minimum average total cost (ATC): This indicates productive efficiency, where output is produced at the lowest possible cost.

- Price equals marginal cost (MC): This indicates allocative efficiency, where resources are allocated to produce the goods and services society most values.

- No incentive for entry or exit: The absence of economic profits or losses eliminates the incentive for firms to enter or exit the market.

The Process Leading to Long-Run Equilibrium

The market adjusts to reach the long-run equilibrium through a dynamic process involving entry and exit:

-

Positive economic profits: If firms are making positive economic profits, new firms enter the market, increasing supply and lowering the price. This continues until profits are driven down to zero.

-

Economic losses: If firms are making economic losses, existing firms exit the market, decreasing supply and raising the price. This continues until losses are eliminated and normal profits are restored.

-

Stable equilibrium: The long-run equilibrium is stable because any deviation from zero economic profits triggers a process of entry or exit that returns the market to this equilibrium point.

Implications of Long-Run Perfectly Competitive Equilibrium

The achievement of long-run equilibrium in a perfectly competitive market has significant implications for both consumers and society:

-

Consumer surplus maximization: Consumers benefit from the lowest possible price, maximizing consumer surplus. The efficient allocation of resources ensures that the goods and services most valued by consumers are produced.

-

Productive efficiency: Firms produce at the minimum point of their ATC curves, ensuring that goods and services are produced at the lowest possible cost. This eliminates any wasteful production practices.

-

Allocative efficiency: The equality of price and marginal cost ensures that resources are allocated optimally. Society gets the right mix of goods and services, based on consumer demand and production costs.

-

Technological progress: Although the basic model doesn't explicitly account for it, long-run equilibrium can foster technological progress. Firms constantly seek ways to reduce costs and gain a competitive advantage, which leads to innovation.

Deviations from the Perfect Competition Model

It's crucial to remember that the perfectly competitive model is a simplification. Real-world markets rarely perfectly adhere to its assumptions. Deviations can occur due to:

-

Barriers to entry: Patents, high start-up costs, or government regulations can prevent new firms from easily entering the market, hindering the adjustment to long-run equilibrium.

-

Imperfect information: If buyers or sellers don't have complete information about prices and qualities, the market may not reach efficient outcomes.

-

Product differentiation: If products are not perfectly homogeneous, firms may have some degree of market power, influencing the price.

Conclusion: The Long Run Perfectly Competitive Equilibrium – A Theoretical Ideal with Practical Relevance

The long-run perfectly competitive equilibrium, while a theoretical construct, offers valuable insights into market dynamics. Understanding this equilibrium helps us appreciate the forces driving efficiency, the role of entry and exit, and the potential benefits of competition. While real-world markets rarely perfectly meet the conditions of perfect competition, the model serves as a powerful benchmark for assessing the efficiency and performance of different market structures. The concept of long-run equilibrium reminds us of the dynamic interplay between supply and demand, and how these forces, given enough time and flexibility, can push markets towards a state of optimal resource allocation and production efficiency. By understanding these principles, economists, policymakers, and business leaders alike can better analyze and manage the complex realities of modern markets.

Latest Posts

Latest Posts

-

Which Compound Has The Strongest Hydrogen Bonding Between Its Molecules

Apr 02, 2025

-

First I Threw Away The Outside And Cooked The Inside

Apr 02, 2025

-

Label The Parts Of The Nucleotide

Apr 02, 2025

-

Hyposecretion Of The Thyroid Gland In Adulthood

Apr 02, 2025

-

At What Temperature Do The Celsius And Fahrenheit Scales Coincide

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about The Long Run Perfectly Competitive Equilibrium . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.