The Demand Curve For A Monopolist Is

News Leon

Mar 30, 2025 · 6 min read

Table of Contents

The Demand Curve for a Monopolist: A Comprehensive Guide

The demand curve for a monopolist differs significantly from that of a firm operating in a perfectly competitive market. Understanding this difference is crucial for grasping the unique challenges and opportunities faced by monopolies. This article delves deep into the characteristics of a monopolist's demand curve, exploring its implications for pricing strategies, output decisions, and overall market dynamics.

The Defining Characteristic: The Firm is the Industry

The most fundamental difference lies in the market structure itself. In a perfectly competitive market, numerous firms offer identical products, each too small to influence the market price. Consequently, a perfectly competitive firm faces a perfectly elastic demand curve, meaning it can sell any quantity at the prevailing market price but nothing above it. The firm is a price taker.

A monopolist, however, is the sole producer of a unique good or service with no close substitutes. This grants them significant market power. They are price makers, meaning they can influence the market price by adjusting their output. This crucial distinction shapes the monopolist's demand curve.

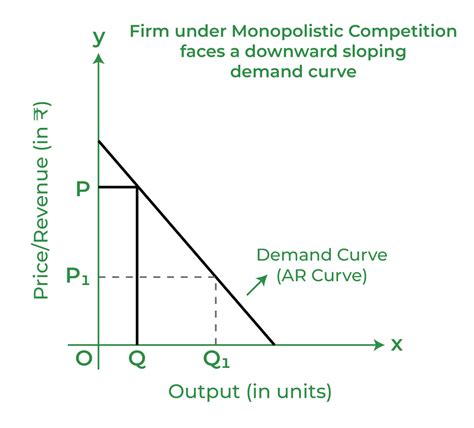

The Monopolist's Demand Curve: Downward Sloping

Unlike the perfectly elastic demand curve faced by perfectly competitive firms, a monopolist confronts a downward-sloping demand curve. This signifies the inverse relationship between price and quantity demanded: to sell more, the monopolist must lower its price. This is a direct consequence of their market dominance. There's no other supplier to compete with, forcing consumers to pay a higher price for lower quantities or receive a lower price for higher quantities.

Why the Downward Slope?

The downward slope stems from several factors:

-

Diminishing Marginal Utility: As consumers consume more of a good, the additional satisfaction they derive from each extra unit decreases. To induce consumers to buy more, the monopolist needs to offer a lower price.

-

Income Effect: Lower prices increase consumers' purchasing power, allowing them to buy more.

-

Substitution Effect: While there are no close substitutes in a pure monopoly, consumers might shift to alternative goods or services if the monopolist's price becomes excessively high.

Relationship between the Demand Curve and Marginal Revenue

For a perfectly competitive firm, price and marginal revenue (MR) are identical. Each extra unit sold brings in revenue equal to the market price. This is not the case for a monopolist. Because the monopolist faces a downward-sloping demand curve, they must lower the price on all units sold to sell an additional unit. This leads to a crucial difference: marginal revenue is always less than the price.

Calculating Marginal Revenue for a Monopolist

To illustrate, consider a simple linear demand function: P = 10 – Q, where P is the price and Q is the quantity. Total revenue (TR) is given by TR = P × Q = (10 – Q)Q = 10Q – Q². Marginal revenue (MR) is the derivative of total revenue with respect to quantity: MR = dTR/dQ = 10 – 2Q. Notice that MR is always below the demand curve (P = 10 – Q).

This relationship highlights the inherent trade-off faced by the monopolist. Increasing sales requires reducing the price not only on the additional unit but also on all previously sold units. This price reduction diminishes the revenue gained from each additional unit sold, resulting in MR < P.

Implications for Pricing and Output Decisions

The downward-sloping demand curve and the associated relationship between price and marginal revenue have profound implications for a monopolist's pricing and output decisions. A monopolist will never operate on the inelastic portion of its demand curve. This is because in the inelastic region, an increase in price leads to a proportionally smaller decrease in quantity demanded. Therefore, increasing price would lead to higher total revenue. The monopolist will always operate in the elastic region where reducing the price increases total revenue.

The profit-maximizing output for a monopolist occurs where marginal revenue equals marginal cost (MR = MC). This is identical to the profit-maximizing rule for a perfectly competitive firm. However, the monopolist then charges the price corresponding to that quantity on the demand curve, resulting in a higher price and lower quantity compared to a perfectly competitive market. This leads to deadweight loss, a reduction in overall economic efficiency.

Price Discrimination

The ability to control price and quantity gives a monopolist the potential to engage in price discrimination. This involves charging different prices to different consumers based on their willingness to pay. There are three degrees of price discrimination:

-

First-degree (perfect) price discrimination: The monopolist charges each consumer their maximum willingness to pay. This extracts all consumer surplus, maximizing the monopolist's profit.

-

Second-degree price discrimination: The monopolist charges different prices based on the quantity consumed. Examples include bulk discounts or tiered pricing plans.

-

Third-degree price discrimination: The monopolist divides the market into distinct segments and charges different prices in each segment. Examples include student discounts or senior citizen discounts.

Factors Affecting the Monopolist's Demand Curve

The shape and position of a monopolist's demand curve aren't fixed. Several factors can shift the curve:

-

Changes in Consumer Income: An increase in consumer income may shift the demand curve to the right, while a decrease shifts it to the left.

-

Changes in Consumer Tastes: Increased preference for the monopolist's product shifts the demand curve to the right.

-

Prices of Related Goods: The prices of substitutes and complements can influence demand. A rise in the price of a substitute increases demand for the monopolist's product, shifting the curve to the right.

-

Government Policies: Taxes, subsidies, and regulations can affect the monopolist's costs and prices, indirectly influencing the demand curve.

The Role of Elasticity

The price elasticity of demand plays a critical role in a monopolist's pricing decisions. A more elastic demand curve implies that a small price change leads to a significant quantity change. In this case, the monopolist will be more cautious about price increases to avoid large reductions in sales. A less elastic demand curve implies that price changes have a smaller impact on quantity demanded, giving the monopolist more pricing power.

The Monopolist's Long-Run Perspective

In the long run, a monopolist can adjust its production capacity to maximize profits. This differs from a perfectly competitive firm, which is constrained by its existing capacity. This ability to adjust capacity allows the monopolist to further exploit their market power and influence the shape and position of their demand curve.

Challenges and Regulation

Monopolies often face criticism due to their potential for restricting output, raising prices, and stifling innovation. Governments frequently intervene through regulations such as antitrust laws to limit the harmful effects of monopolies.

Conclusion

The demand curve for a monopolist is a critical element in understanding their market behavior. Its downward slope, the divergence between price and marginal revenue, and the implications for pricing and output decisions all distinguish the monopolist from firms in competitive markets. Understanding this unique demand curve is fundamental for analyzing the economic consequences of monopolies and the rationale behind government regulation. By recognizing the complexities of a monopolist's demand curve, we can better evaluate their impact on consumers, producers, and the overall economy. The monopolist's ability to manipulate price and quantity creates a dynamic market environment with implications for efficiency, innovation, and public policy. Careful consideration of these implications is essential for developing effective economic strategies and regulations.

Latest Posts

Latest Posts

-

Do Lysosomes Have A Double Membrane

Apr 01, 2025

-

Which Of The Following Is True Of B Cells

Apr 01, 2025

-

How Many Parents Are Involved In Asexual Reproduction

Apr 01, 2025

-

What Is The Order Of The Breakdown Products Of Hemoglobin

Apr 01, 2025

-

What Muscle Subdivides The Ventral Body Cavity

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Demand Curve For A Monopolist Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.