Inventory Is Classified On The Balance Sheet As A

News Leon

Mar 26, 2025 · 7 min read

Table of Contents

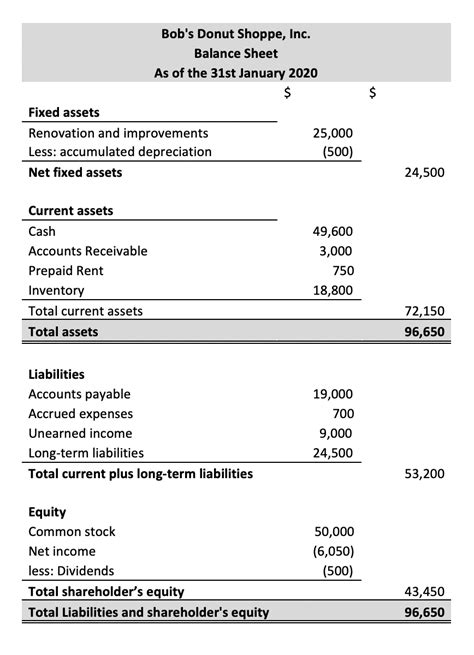

Inventory is Classified on the Balance Sheet as a Current Asset

Inventory is a crucial component of a company's balance sheet, representing goods held for sale in the ordinary course of business. Understanding how inventory is classified and reported is vital for accurate financial statement analysis and effective business management. This comprehensive guide delves into the classification of inventory on the balance sheet, exploring its nature, valuation methods, and the implications for financial reporting.

The Nature of Inventory

Before diving into the balance sheet classification, it's essential to understand what constitutes inventory. Inventory includes:

-

Finished Goods: These are products that are ready for sale and distribution to customers. They represent the culmination of the production process and are the company's primary revenue generators. Examples include clothing in a retail store, cars at a dealership, or finished electronics ready for shipment.

-

Work in Process (WIP): This category encompasses partially completed goods that are still undergoing the production process. WIP inventory represents the value of materials, labor, and overhead costs incurred but not yet realized in finished goods. Think of a partially assembled car on the factory floor or a piece of clothing halfway through the manufacturing process.

-

Raw Materials: These are the basic inputs used in the production process. They are the unprocessed components that will eventually become finished goods. Examples include cotton for clothing, steel for car manufacturing, or silicon for electronics.

The specific composition of inventory varies significantly depending on the nature of the business. A manufacturing company will have a much more complex inventory structure compared to a retail company, which primarily deals with finished goods.

Inventory Classification on the Balance Sheet

On the balance sheet, inventory is consistently classified as a current asset. Current assets are assets that are expected to be converted into cash or used up within one year or the company's operating cycle, whichever is longer. The operating cycle is the time it takes to convert raw materials into cash from sales. Since inventory is held for sale or use in the production of goods for sale, it inherently falls under this definition. Its liquidation is anticipated within a relatively short timeframe, aligning it perfectly with the criteria for current asset classification.

Valuation of Inventory

The valuation of inventory significantly impacts the balance sheet figures and subsequent financial ratios. Several methods exist for determining the value of inventory:

1. First-In, First-Out (FIFO):

FIFO assumes that the oldest inventory items are sold first. This means that the cost of goods sold (COGS) reflects the cost of the oldest inventory, while the ending inventory value reflects the cost of the most recent purchases. During periods of inflation, FIFO results in a higher net income and higher ending inventory value compared to other methods.

Advantages of FIFO:

- Matches current costs with revenues: More accurately reflects the current market value of goods sold.

- Simple to understand and implement: Relatively straightforward accounting process.

- Higher net income during inflation: Leads to a more favorable financial picture.

Disadvantages of FIFO:

- Higher tax liability during inflation: The higher net income leads to a higher tax burden.

- May not reflect actual physical flow of goods: The assumption may not always align with the reality of inventory movement.

2. Last-In, First-Out (LIFO):

LIFO assumes that the newest inventory items are sold first. This means the cost of goods sold reflects the cost of the most recent purchases, while ending inventory reflects the cost of the oldest inventory. During periods of inflation, LIFO results in a lower net income and lower ending inventory value. LIFO is allowed under U.S. GAAP but is prohibited under IFRS.

Advantages of LIFO:

- Lower tax liability during inflation: The lower net income leads to a lower tax burden.

- Reduces the impact of price increases on net income: Provides a more conservative financial picture.

Disadvantages of LIFO:

- Lower net income during inflation: May present a less favorable financial picture.

- May not reflect actual physical flow of goods: Similar to FIFO, the assumption may not align with reality.

- Not permitted under IFRS: Limits its applicability internationally.

3. Weighted-Average Cost:

This method calculates the average cost of all inventory items available for sale during the period. The average cost is then used to determine both the cost of goods sold and the ending inventory value. This method smooths out fluctuations in costs compared to FIFO and LIFO.

Advantages of Weighted-Average Cost:

- Simple to calculate: Relatively straightforward accounting process.

- Smooths out price fluctuations: Provides a more stable picture of inventory costs.

Disadvantages of Weighted-Average Cost:

- May not accurately reflect current market prices: The average cost may not be representative of the actual cost of goods sold.

The Importance of Accurate Inventory Valuation

Accurate inventory valuation is crucial for several reasons:

-

Financial Statement Reliability: Inventory valuation directly impacts the cost of goods sold, gross profit, net income, and ending inventory figures on the balance sheet and income statement. Inaccurate valuation can distort the overall financial picture of the company.

-

Tax Implications: The choice of inventory valuation method influences the company's tax liability. Methods that result in lower net income during inflationary periods may reduce the tax burden.

-

Inventory Management: Accurate valuation helps businesses track inventory levels, identify slow-moving items, and optimize inventory management strategies.

-

Creditworthiness: Accurate inventory figures are essential for securing loans and attracting investors. Lenders and investors rely on reliable financial statements to assess the company's financial health and creditworthiness.

Inventory Turnover Ratio

The inventory turnover ratio is a key financial ratio used to assess the efficiency of a company's inventory management. It measures how many times a company sells and replaces its inventory during a specific period. The formula for calculating the inventory turnover ratio is:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

A high inventory turnover ratio generally indicates efficient inventory management, while a low ratio may suggest slow-moving inventory, potential obsolescence, or overstocking. Analyzing the inventory turnover ratio in conjunction with other financial ratios provides a more comprehensive understanding of a company's operational efficiency and financial health.

Impact of Inventory on Working Capital

Inventory is a significant component of a company's working capital, which is the difference between current assets and current liabilities. High inventory levels can tie up significant amounts of capital, potentially limiting a company's ability to invest in other areas of the business. Efficient inventory management is therefore crucial for optimizing working capital and maximizing the use of available resources.

Potential for Inventory Write-Downs

If the market value of inventory falls below its historical cost, the company may need to write down the inventory to its net realizable value (NRV). NRV is the estimated selling price less any costs of completion, disposal, and transportation. Inventory write-downs reduce the value of inventory on the balance sheet and impact the company's net income.

Disclosure Requirements

Companies are required to disclose detailed information about their inventory valuation methods, inventory turnover ratios, and any significant inventory write-downs in their financial statements. This information helps investors and analysts understand the company's inventory management practices and the potential risks associated with inventory. Transparency in inventory reporting fosters trust and confidence in the financial information presented.

Conclusion

The classification of inventory as a current asset on the balance sheet is a fundamental accounting principle. Understanding its nature, valuation methods, and the importance of accurate valuation is essential for accurate financial reporting and effective business management. By employing appropriate inventory valuation methods, monitoring inventory turnover ratios, and maintaining transparent disclosures, companies can optimize their inventory management practices and improve their overall financial performance. The effective management of inventory is not simply an accounting task but a critical element of overall business strategy, directly impacting profitability, liquidity, and long-term sustainability.

Latest Posts

Latest Posts

-

Largest Foramen In The Human Skeleton

Mar 29, 2025

-

In Humans The Diploid Number Of Chromosomes Is

Mar 29, 2025

-

How Many Nephrons Are Contained In Each Kidney

Mar 29, 2025

-

Who Wrote The Mahabharata And Ramayana

Mar 29, 2025

-

How Many Vacuoles Are In An Animal Cell

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Inventory Is Classified On The Balance Sheet As A . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.