An Auditor Assesses The Risk Of Material Misstatement Because It

News Leon

Apr 07, 2025 · 7 min read

Table of Contents

An Auditor Assesses the Risk of Material Misstatement Because It… Impacts Everything

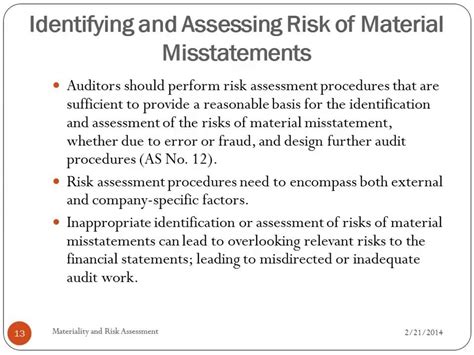

Auditing is a critical process ensuring financial statements accurately reflect a company's financial position. A cornerstone of this process is the assessment of the risk of material misstatement (ROMM). Auditors don't simply check numbers; they delve into the very fabric of an organization's operations and controls to understand where things could go wrong. This comprehensive assessment is crucial because the risk of material misstatement impacts virtually every aspect of the audit, influencing the scope, procedures, and ultimately, the auditor's opinion.

Understanding Material Misstatement

Before diving into why auditors assess ROMM, let's define what a material misstatement is. A material misstatement is an error or omission in the financial statements significant enough to influence the decisions of a reasonable user. This isn't a fixed percentage; it's a judgment call based on the specific circumstances of the company and the users of its financial statements. A small error in a massive corporation might be immaterial, while a tiny error in a small business could be significant.

Several factors influence the materiality threshold. Consider the nature of the misstatement. A fraud is inherently more material than an unintentional error, even if the monetary amounts are similar. The magnitude of the misstatement is also crucial. A larger amount is more likely to be material than a smaller one. Finally, the cumulative effect of several smaller misstatements can also reach materiality, even if each individual misstatement is insignificant on its own.

The Interplay Between Materiality and Risk

The concept of materiality is directly linked to the risk of material misstatement. The higher the risk of material misstatement, the more likely it is that a material misstatement will occur. This understanding forms the basis of the auditor's approach to the audit. Auditors aren't just looking for errors; they are actively trying to understand and mitigate the risks that could lead to material misstatements.

Why Auditors Assess the Risk of Material Misstatement

The assessment of ROMM is fundamental to the audit process for several compelling reasons:

1. Efficient Resource Allocation: Auditing is a resource-intensive process. By assessing ROMM, auditors can focus their efforts on areas with the highest risk of material misstatement. This allows for efficient resource allocation, ensuring that the audit is both thorough and cost-effective. Instead of casting a wide net across all accounts, auditors can prioritize their attention to areas identified as high-risk, resulting in a more targeted and impactful audit.

2. Tailored Audit Procedures: The ROMM assessment dictates the nature, timing, and extent of audit procedures. For high-risk areas, auditors will employ more extensive and rigorous procedures, potentially involving more detailed testing and increased sample sizes. Conversely, lower-risk areas may require less extensive testing. This tailored approach ensures that audit resources are allocated effectively, focusing on the areas that need the most attention.

3. Enhanced Audit Quality: A thorough ROMM assessment contributes to higher-quality audits. By proactively identifying and addressing potential risks, auditors can reduce the likelihood of missing significant errors or omissions. This contributes to greater assurance about the reliability of the financial statements. A focused approach, driven by a comprehensive risk assessment, ultimately increases the confidence of stakeholders in the audited financial statements.

4. Compliance with Auditing Standards: Auditing standards worldwide require auditors to assess ROMM. This is a crucial component of complying with these standards and ensuring the audit is performed in accordance with professional best practices. Failing to adequately assess ROMM can lead to criticism and potential legal issues. The audit process is subject to rigorous standards, and the ROMM assessment is at the core of demonstrating compliance.

5. Informed Audit Opinion: The ROMM assessment directly impacts the auditor's final opinion on the financial statements. If the auditor identifies a significant risk of material misstatement that hasn't been adequately addressed by management, it may lead to a qualified or adverse opinion. This opinion communicates to users of the financial statements the level of assurance that the auditor is providing.

The Process of Assessing ROMM

The assessment of ROMM is a multifaceted process involving several key steps:

1. Understanding the Entity and its Environment: This involves gaining a thorough understanding of the client's business, industry, regulatory environment, and internal controls. This lays the groundwork for identifying potential risks. Auditors must understand the nuances of the company's business model and the economic forces affecting it.

2. Identifying Risks of Material Misstatement: Based on the understanding of the entity and its environment, auditors identify potential risks of material misstatement. This could include risks related to revenue recognition, inventory valuation, or financial instruments. They may consider the inherent risks – risks arising from the nature of the business – and the control risks – risks stemming from weaknesses in internal controls.

3. Assessing the Risk of Material Misstatement: After identifying potential risks, auditors assess the likelihood and potential impact of these risks. This involves a judgment call, considering both qualitative and quantitative factors. A well-defined risk assessment considers various scenarios and potential interactions between risks.

4. Responding to the Assessed Risks: The auditor's response to the assessed risks will shape the audit strategy and procedures. This involves adjusting the nature, timing, and extent of the audit procedures in response to the identified risks. For instance, if a high risk is identified, the auditor might increase the sample size of tests or perform more detailed substantive procedures.

5. Documenting the ROMM Assessment: All aspects of the ROMM assessment are documented in the audit working papers. This is critical for demonstrating compliance with auditing standards and providing an audit trail for future reference. This documentation serves as an essential record of the auditor's judgment and the rationale behind the audit approach.

Key Factors Influencing ROMM

Numerous factors can influence the risk of material misstatement. These include:

- Industry-Specific Risks: Certain industries are inherently riskier than others. For example, companies in the technology sector may face higher risks related to intellectual property or rapid technological change.

- Complexity of the Business: Complex business models and transactions increase the risk of errors or omissions. A highly interconnected and intricate business structure will inevitably increase the complexity of the audit process.

- Changes in the Business Environment: Significant changes in the business environment, such as economic downturns or regulatory changes, can increase the risk of material misstatement. Adapting to dynamic market conditions often presents numerous operational challenges.

- Internal Controls: The effectiveness of a company's internal controls is a critical factor in assessing ROMM. Strong internal controls reduce the risk of material misstatement, while weak controls increase the risk.

- Management Override of Controls: Even with strong internal controls, management can override them, creating a significant risk of material misstatement. The possibility of management bias or intentional manipulation needs to be carefully considered.

- Technological Changes: The increased reliance on technology can introduce new risks related to data security and system reliability. Auditing systems and networks require expertise and caution.

- Fraud Risk: The possibility of fraudulent financial reporting is a significant risk that must be considered. This requires a deeper dive into the company’s ethical culture and risk tolerance.

The Importance of Communication in ROMM Assessment

Effective communication is vital throughout the ROMM assessment process. The auditor needs to communicate with management to obtain a thorough understanding of the company's business and operations. They must also discuss the assessed risks and the planned audit procedures with management to ensure alignment and collaboration. Open communication helps to ensure the audit process is efficient and effective.

Conclusion

The assessment of the risk of material misstatement is a cornerstone of the audit process. It's not merely a technical exercise; it's a critical judgmental process that drives the audit's scope, procedures, and ultimately, the auditor's opinion. By comprehensively assessing ROMM, auditors contribute to the reliability and credibility of financial statements, protecting stakeholders and fostering trust in the capital markets. The meticulous nature of ROMM assessment ensures the integrity of financial reporting, a cornerstone of sound economic activity. A thorough ROMM assessment is not just a box to be checked; it's the backbone of a successful and reliable audit. It underscores the auditor's commitment to providing high-quality, objective assurance. Ultimately, understanding and managing the risk of material misstatement benefits all stakeholders by promoting financial transparency and accountability.

Latest Posts

Latest Posts

-

Which Of The Following Compounds Is Not An Enzyme

Apr 11, 2025

-

Graphite Is A Conductor Or Insulator

Apr 11, 2025

-

Which Is True Regarding Ionic Compounds

Apr 11, 2025

-

Which Is The Largest Satellite Of Solar System

Apr 11, 2025

-

Is Blood A Type Of Epithelial Tissue

Apr 11, 2025

Related Post

Thank you for visiting our website which covers about An Auditor Assesses The Risk Of Material Misstatement Because It . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.