A Post Closing Trial Balance Will Show

News Leon

Mar 14, 2025 · 6 min read

Table of Contents

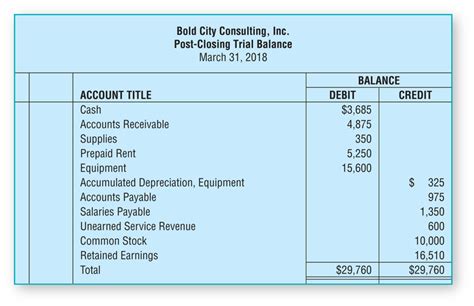

A Post-Closing Trial Balance: What It Shows and Why It Matters

A post-closing trial balance is a crucial step in the accounting cycle, offering a final check on the accuracy of your financial records. Understanding what it shows and its significance is vital for maintaining accurate financial statements and ensuring the smooth operation of your business. This comprehensive guide will delve into the intricacies of the post-closing trial balance, explaining its purpose, composition, and interpretation, and highlighting its importance in financial reporting.

Understanding the Post-Closing Trial Balance

The post-closing trial balance is a report prepared after all closing entries have been made. Unlike the trial balance prepared before closing entries (the adjusted trial balance), it only includes permanent accounts. These are accounts that carry their balances over from one accounting period to the next, unlike temporary accounts which are closed at the end of each period. Let's break this down further:

Permanent Accounts vs. Temporary Accounts

-

Permanent Accounts (Real Accounts): These accounts reflect the ongoing financial position of the business. They include assets (cash, accounts receivable, inventory, equipment), liabilities (accounts payable, loans payable), and equity (owner's equity, retained earnings). These accounts are not closed at the end of the accounting period.

-

Temporary Accounts (Nominal Accounts): These accounts track the financial performance of the business over a specific period. They include revenue accounts (sales revenue, service revenue), expense accounts (rent expense, salaries expense), and dividends. These accounts are closed at the end of the accounting period by transferring their balances to retained earnings.

The Purpose of the Post-Closing Trial Balance

The primary purpose of the post-closing trial balance is to verify that the closing entries were accurately recorded and that the general ledger is in balance. This means that the total debits must equal the total credits. A balanced post-closing trial balance provides assurance that the accounting equation (Assets = Liabilities + Equity) remains intact. It acts as a final checkpoint before preparing the financial statements for the next accounting period.

What a Post-Closing Trial Balance Shows

A post-closing trial balance will only display the balances of the permanent accounts. All temporary accounts will have zero balances after the closing entries. This means you will see:

- Assets: A list of all assets with their respective debit balances.

- Liabilities: A list of all liabilities with their respective credit balances.

- Equity: The balance of the owner's equity (or retained earnings) account, usually a credit balance.

Crucially, it will not show:

- Revenue Accounts: These will have a zero balance.

- Expense Accounts: These will also have a zero balance.

- Dividend Accounts: These will show a zero balance.

This stark difference from the adjusted trial balance is key to understanding its purpose – it's a clean slate for the next accounting period.

Preparing a Post-Closing Trial Balance

The process of preparing a post-closing trial balance is straightforward:

-

Complete the Closing Entries: First, ensure that all closing entries have been correctly posted to the general ledger. This involves transferring the balances of temporary accounts (revenues, expenses, and dividends) to the retained earnings account.

-

Prepare the Trial Balance Worksheet: Create a worksheet with three columns: Account Name, Debit, and Credit.

-

List the Permanent Accounts: List all permanent accounts (assets, liabilities, and equity) in the Account Name column.

-

Enter Account Balances: Enter the updated balances of each permanent account in the Debit or Credit column, as appropriate. Remember, asset and expense accounts usually have debit balances, while liability, owner's equity, and revenue accounts usually have credit balances.

-

Verify the Balance: Finally, add up the total debits and total credits. If the total debits equal the total credits, the post-closing trial balance is balanced, signifying that the closing entries were correctly processed and the accounting equation remains in balance. This indicates the ledger is ready for the next accounting period. If there is an imbalance, a thorough review of the closing entries and general ledger is necessary to identify and correct the error.

Interpreting the Post-Closing Trial Balance

The interpretation of a post-closing trial balance is relatively simple. The primary objective is to ensure that the total debits equal the total credits. This indicates:

- Accuracy of Closing Entries: A balanced post-closing trial balance provides strong evidence that the closing entries were correctly prepared and posted.

- Accuracy of the General Ledger: It suggests that the general ledger is free of significant errors related to the closing process.

- Foundation for the Next Accounting Period: A balanced post-closing trial balance provides a clean starting point for the next accounting period, enabling accurate financial reporting.

A non-balanced post-closing trial balance, on the other hand, signifies a problem that requires immediate investigation. Common causes include:

- Errors in Closing Entries: A common mistake is an incorrect calculation or posting of the closing entries.

- Errors in the General Ledger: Errors in posting transactions throughout the accounting period can also lead to an imbalance.

- Mathematical Errors: Simple mathematical errors during the preparation of the post-closing trial balance itself can also cause an imbalance.

The Importance of the Post-Closing Trial Balance

The post-closing trial balance plays a pivotal role in several key aspects of accounting:

-

Accurate Financial Reporting: The accuracy of the post-closing trial balance is fundamental to the reliability of subsequent financial statements, such as the balance sheet. Errors here directly impact the accuracy of these statements, potentially misleading stakeholders.

-

Auditing and Compliance: External auditors often use the post-closing trial balance as a starting point in their audits. A balanced and accurately prepared post-closing trial balance simplifies the audit process and reduces the risk of audit qualifications.

-

Decision-Making: Accurate financial information is crucial for informed business decisions. The post-closing trial balance provides a clear picture of the company's financial position at the end of the accounting period, enabling better decision-making.

-

Maintaining Financial Integrity: The meticulous preparation of the post-closing trial balance demonstrates a commitment to maintaining the integrity of the financial records, enhancing the credibility and trustworthiness of the business.

Troubleshooting Imbalances in the Post-Closing Trial Balance

If the post-closing trial balance is not balanced, a systematic approach is crucial to identifying the error. Here's a step-by-step troubleshooting guide:

-

Re-check the Closing Entries: Carefully review each closing entry to ensure accuracy in calculation and posting. Look for any transposition errors (e.g., writing 123 as 132), omissions, or incorrect account selections.

-

Examine the General Ledger: Scrutinize the general ledger accounts to identify any discrepancies. Check for any missed postings, incorrect posting amounts, or erroneous debit/credit entries.

-

Reconcile the Trial Balance: Recalculate the debit and credit totals to eliminate mathematical errors in the trial balance preparation.

-

Seek External Assistance: If the error remains unidentified, seeking assistance from a qualified accountant is advisable. An experienced professional can offer expertise in identifying subtle errors and resolving complex accounting issues.

-

Use Accounting Software: Accounting software often includes error detection features that can help to identify imbalances and pinpoint the source of errors.

Conclusion

The post-closing trial balance is more than just a final accounting step; it's a crucial verification process that ensures the accuracy and integrity of your financial records. It serves as a cornerstone for accurate financial reporting, smooth audits, and informed decision-making. While seemingly a simple process, its importance in maintaining a healthy financial picture cannot be overstated. Understanding its purpose, preparation, and interpretation is paramount for any business striving for financial accuracy and transparency. A well-prepared post-closing trial balance reflects a commitment to financial integrity and forms a strong foundation for future accounting periods.

Latest Posts

Related Post

Thank you for visiting our website which covers about A Post Closing Trial Balance Will Show . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.